Asian Paints

Working at Asian Paints

Company Summary

Overall Rating

3% above

Highly rated for

Salary, Skill development, Job security

Work Policy

Top Employees Benefits

Rate your company

🤫 100% anonymous

How was your last interview experience?

About Asian Paints

The company has come a long way since its small beginnings in 1942. It was set up as a partnership firm by four friends who were willing to take on the world's biggest, most famous paint companies operating in India at that time. Over the course of 25 years, Asian Paints became a corporate force and India's leading paints company. Driven by its strong consumer-focus and innovative spirit, the company has been the market leader in paints since 1967. Asian Paints manufactures a wide range of paints for decorative and industrial use and also offers water proofing, adhesives and services under its portfolio. The company is also present in the Home Decor segment and offers Modular kitchens and wardrobes, Bath fittings and sanitaryware, Decorative lightings, uPVC windows and doors, wall coverings, Furniture, Fabric & Furnishings and Rugs.

Asian Paints Ratings

Overall Rating

Category Ratings

Salary

Skill development

Job security

Company culture

Work satisfaction

Work-life balance

Promotions

Work Policy at Asian Paints

Asian Paints Reviews

Top mentions in Asian Paints Reviews

Compare Asian Paints with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 4.0/5 based on 7.4k reviews | 3.7/5 based on 3.1k reviews | 4.1/5 based on 1.3k reviews | 3.8/5 based on 2k reviews |

Highly Rated for | Salary Skill development Job security |  No highly rated category | Salary Company culture Work-life balance | Job security |

Critically Rated for |  No critically rated category | Promotions Work-life balance Company culture |  No critically rated category | Promotions |

Primary Work Policy | Work from office 70% employees reported | Work from office 66% employees reported | Hybrid 57% employees reported | Work from office 71% employees reported |

Rating by Women Employees | 4.0 Good rated by 405 women | 3.4 Average rated by 47 women | 3.8 Good rated by 117 women | 2.9 Poor rated by 44 women |

Rating by Men Employees | 4.0 Good rated by 6.6k men | 3.7 Good rated by 2.9k men | 4.1 Good rated by 1.1k men | 3.8 Good rated by 1.9k men |

Job security | 3.8 Good | 3.7 Good | 3.8 Good | 3.8 Good |

Asian Paints Salaries

Direct Sales Representative

Teritory Sales Officer

Territory Sales Executive

ECA

Sales Executive

Executive Production

Senior Sales Executive

Project Sales Officer

Production Officer

Team Lead

Asian Paints Interview Questions

Interview questions by designation

Top Asian Paints interview questions and answers

Asian Paints Jobs

Asian Paints News

Top 14 Indian Paint Brands in 2025

- The Indian paint industry is valued at approximately 50,000 crore rupees and is one of the fastest-growing industries in Asia, offering products like distemper, oil paint, acrylic paint, and more.

- Some of the top Indian paint brands in 2025 include Asian Paints, Indigo Paints, Kansai Nerolac Paints, Dulux Paints, British Paints, Berger Paint, and more.

- Asian Paints, founded in 1942, is the largest company in India and the third-largest in Asia, known for its revenue of Rs. 34,488 crores and extensive global presence.

- Indigo Paints, established in 2000, has become a strong competitor with innovative products like Interior and Exterior Emulsions, Distempers, Primers, and more.

- Kansai Nerolac Paint Ltd, founded in 1920, offers a range of products like Decorative paints, coatings, industrial (re)finishing products, and more for various sectors.

- Dulux Paints, a pioneer since 1931, is renowned for decorative coatings and a network of 75 warehouses, making it a leading choice for wall paint solutions.

- British Paints, established in 1947, is known for its tailored painting solutions and industrial, marine, and architectural coatings, offering cost-effective products.

- Berger Paints India Limited, the second-largest paint company, operates 16 manufacturing plants across India and is recognized for quality paints and rapid growth.

- The top Indian paint brands also include Jenson & Nicholson Paints, Grauer & Weil India, Akzo Nobel India Ltd, Sirca Paints India Ltd, Nippon Paints, Shalimar Paints, Snowcem Paints Limited, and Sheenlac Paints.

- These companies offer a diverse range of paint products, catering to various sectors, including household, industrial, automotive, and decorative needs, ensuring exceptional quality.

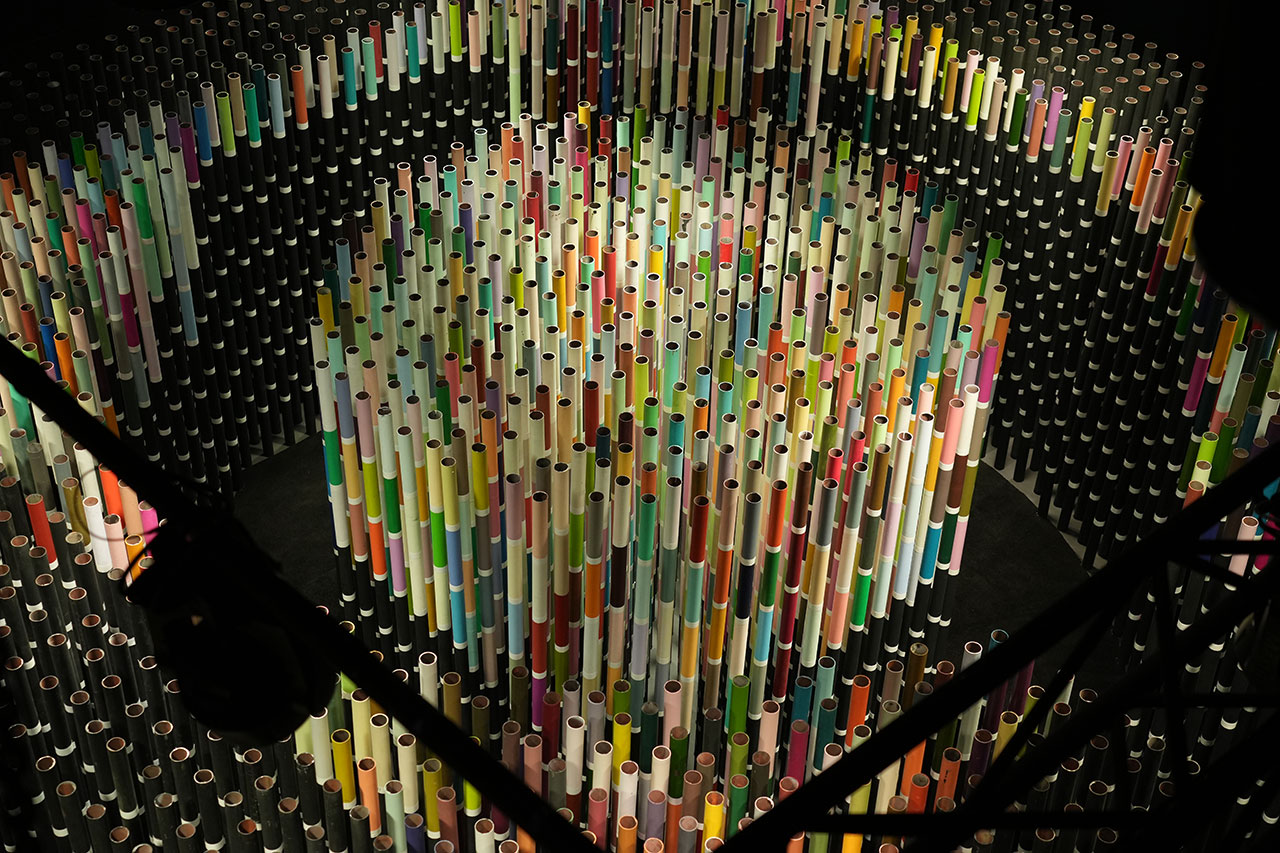

Chromacosm Celebrates the Largest Color System in the World

- Architect Suchi Reddy and Asian Paints presented Chromacosm, the largest architectural color system with over 5,300 unique shades.

- The installation takes the viewer on a journey through gradients and color combinations, inspired by ancient Tantric paintings and the science of light and absorption.

- The Chromacosm library blends India's rich traditions with technological innovation and allows extensive exploration of color families and combinations.

- Suchi Reddy is a renowned architect and designer known for her sense of space delineation and neuroaesthetics.

Promoter pledge holdings in BSE-500 stocks decline to 0.84% in the December 2024: Kotak

- Promoter pledge holdings in BSE-500 stocks decline to 0.84% in the December 2024: Kotak

- Sun Pharma Advanced Research and UPL featured among companies with released pledged holdings to repay debts

- Nifty 50 constituents Apollo Hospitals, Asian Paints, IndusInd Bank, and JSW Steel had over 5% of pledged promoter holdings

- Highest pledged holdings in overall holdings found in Medplus Health Services, Chalet Hotels, and GMR Airports

Indian stock market update: Sensex & Nifty decline, global market influences & sectoral performance

- The Indian stock market declined as weak US markets and tariff threats dented investor sentiment.

- The BSE Sensex fell by 424 points to settle at 75,311, while NSE Nifty lost 117 points to close at 22,796.

- Top gainers in the Sensex pack were Tata Steel, Larsen and Toubro, HCL Technologies, Asian paints, and HDFC Bank.

- Most sectoral indices closed in red, except the Metal index, which registered gains of around 1 percent.

Asian Paints Loses Market Share Due To Stiff Competition, Sluggish Environment — Anand Rathi Retains 'Sell'

- Asian Paints loses market share due to stiff competition and sluggish environment.

- Birla Opus gained significant market share, a large part of which was lost by Asian Paints.

- Anand Rathi retains 'Sell' ratings on Asian Paints, Berger Paints, and a Hold rating on Kansai Nerolac Paints.

- Anand Rathi's analysis shows Asian Paints experiencing the most market-share loss and margin erosion among paint players.

Berger Paints Q3 Results Review — Dolat Capital Upgrades The Stock To 'Buy', Sees 20% Upside

- Berger Paints' Q3 revenue grew by 3.2% YoY to Rs 29.8 billion on a consolidated basis.

- Despite muted consumer sentiments, Berger Paints' standalone volume grew by 7.4% and revenue grew by 0.4%.

- On a four-year CAGR basis, Berger Paints recorded a revenue/volume growth of 16.7%/15.6% outperforming Asian Paints, Kansai Nerolac, and Indigo Paints.

- Dolat Capital has upgraded the stock of Berger Paints to 'Buy' and sees a 20% upside.

Binding bids for AkzoIndia in 3-4 months, sources say; CMD says sale process to be concluded in about 9 months

- Binding bids for AkzoIndia are expected to be placed in another three-to-four months.

- The sale process of AkzoNobel India's decorative and industrial coatings business may be concluded in 6-9 months.

- The top two paint companies in India, Asian Paints and Berger, occupy nearly 75% of the market.

- The valuation process for the powder coatings business is expected to be completed by the end of February.

Earnings Commentary Indicates Urban Consumption Losing Steam, Near Term Reversal Unlikely

- Management commentaries by fast-moving consumer goods companies indicate that headwinds to growth will continue in the near term. Urban consumption has shown signs of a slowdown amid tightening credit, rising costs, and stagnant wage growth.

- Numbers for the October-December 2024 quarter indicate weak demand period, as mentioned by Amit Syngle, CEO of Asian Paints.

- While urban consumption is under stress, rural demand is expected to be better, along with a pickup in industrial demand.

- Delayed and contracted winters, along with a slowdown in consumption, have presented a challenging operating environment for companies like Dabur India.

Markets end lower as Asian Paints, consumer stocks drag; broader indices show resilience

- The BSE Sensex and NSE Nifty50 ended lower, dragged down by Asian Paints and consumer stocks.

- Consumer stocks, including Asian Paints, Titan, Nestlé India, Britannia, and Tata Consumer, experienced significant declines.

- Metal and energy stocks, such as Hindalco, ITC Hotels, ONGC, Apollo Hospitals, and BPCL, showed strength.

- Despite the weakness in benchmark indices, the broader market exhibited resilience, with the Nifty Midcap Select and Nifty Next 50 both recording gains.

Asian Paints shares end 3% lower as Q3 results disappoint brokerages

- Asian Paints shares declined 3.36% on the BSE and 3.40% on the NSE.

- Q3 performance fell below consensus estimates due to downtrading, muted demand, and adverse product mix.

- Brokerages have cut target prices and varied in their outlook on the stock.

- Nuvama Institutional Equities maintains a buy rating, while Elara Capital has assigned a sell rating.

Asian Paints Subsidiaries

Sleek International

The White Teak Company

Weatherseal

Asian Paints Berger

Compare Asian Paints with

Contribute & help others!

Companies Similar to Asian Paints

Asian Paints FAQs

Reviews

Interviews

Salaries

Users/Month