Varun Beverages

Working at Varun Beverages

Company Summary

Overall Rating

3% above

Highly rated for

Job security, Salary

Work Policy

Top Employees Benefits

Rate your company

🤫 100% anonymous

How was your last interview experience?

About Varun Beverages

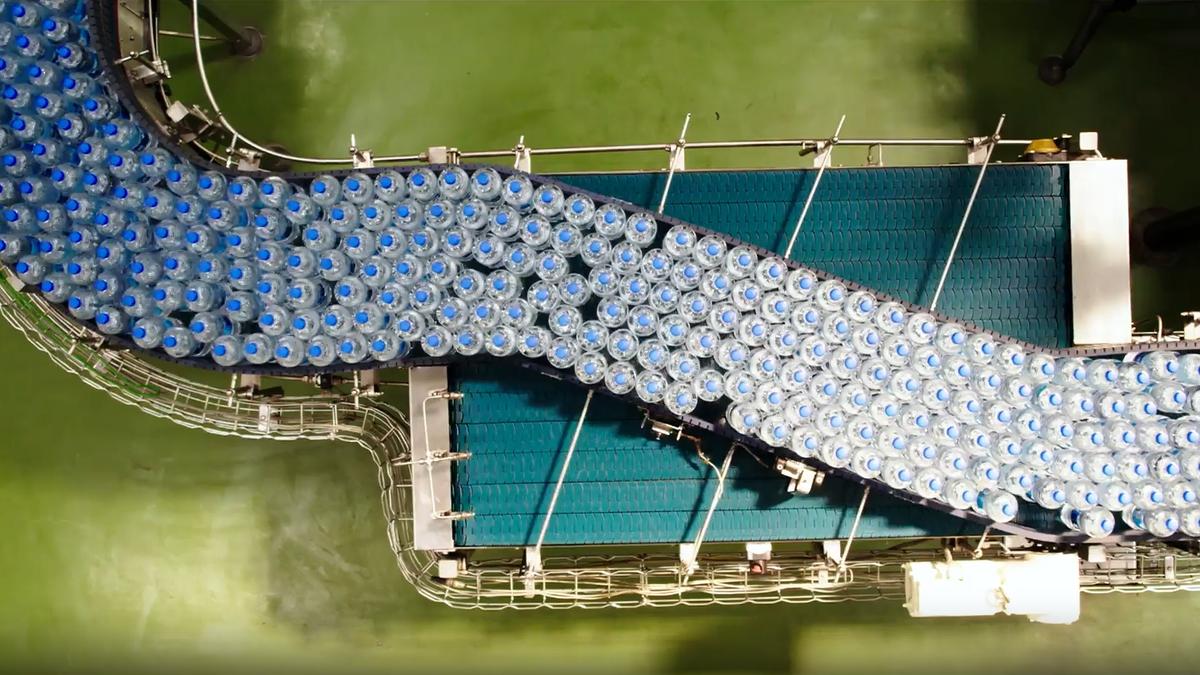

Varun Beverages Limited (VBL) is one of the top FMCG players in the Indian Market. We are on track towards strengthening our position in the global beverage industry with our presence in 14 countries in the Indian sub-continent and Africa - where we are responsible for producing popular brands like Pepsi, Mirinda, 7up, Mountain Dew, Slice, Aquafina, Sting, Tropicana, Gatorade, and many more and making them readily available at outlets near you. We are committed towards delivering a refreshing beverage experience to our consumers.

VBL in India is the second-largest franchisee partner for PepsiCo (outside US) and is powered by #HungryForMore spirit of 10,000+ employees who contribute to making the VBL family stronger and bigger every-day. Life@VBL is about endless opportunities and maximizing learnings every-day. We take immense pride in our employees’ commitment, ownership, and spirit of #OneTeamOneDream.

We are equally committed to ESG principles; focusing on environmental stewardship and actively participating in community initiatives demonstrate our dedication to giving back to the environment and society. Our robust governance framework ensures accountability and sustainability in everything we do.

Varun Beverages Ratings

Overall Rating

Category Ratings

Job security

Salary

Company culture

Work-life balance

Skill development

Work satisfaction

Promotions

Work Policy at Varun Beverages

Varun Beverages Reviews

Top mentions in Varun Beverages Reviews

Compare Varun Beverages with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 4.0/5 based on 3.6k reviews | 4.0/5 based on 2.6k reviews  | 4.1/5 based on 1.9k reviews | 4.1/5 based on 940 reviews |

Highly Rated for | Job security Salary | Skill development Work-life balance Salary | Work-life balance Job security Salary | Skill development Company culture Work-life balance |

Critically Rated for |  No critically rated category |  No critically rated category |  No critically rated category |  No critically rated category |

Primary Work Policy | Work from office 75% employees reported | Hybrid 59% employees reported | Work from office 70% employees reported | Work from office 56% employees reported |

Rating by Women Employees | 3.7 Good rated by 159 women | 3.9 Good rated by 380 women | 3.8 Good rated by 25 women | 3.5 Good rated by 92 women |

Rating by Men Employees | 4.0 Good rated by 3.3k men | 4.1 Good rated by 2k men | 4.1 Good rated by 1.8k men | 4.2 Good rated by 733 men |

Job security | 3.9 Good | 3.8 Good | 3.9 Good | 3.9 Good |

Varun Beverages Salaries

Customer Executive

Sales Executive

Senior Customer Executive

Quality Executive

Executive Production

Area Sales Manager

Deputy Manager

MIS Executive

PRE Sales Representative

Marketing Executive

Varun Beverages Interview Questions

Interview questions by designation

Top Varun Beverages interview questions and answers

Varun Beverages Jobs

Varun Beverages News

Varun Beverages stock in focus as brokerages see upside potential

- Varun Beverages stock traded flat at ₹476.45 on the NSE.

- Technical analysis suggests support near 460 and resistance at 486.

- CLSA upgrades Varun Beverages to high conviction outperform list.

- VBL records 36% increase in net profit for December quarter 2024.

Six Stocks In News At Noon: SBI, Varun Beverages, Titan, Inox Green

- Shares of Inox Green rose after Crisil Ratings Ltd. revised its outlook on the company’s long-term bank facilities from stable to positive.

- SBI shares rose over 3% as Citi gave it a double upgrade and raised the target price from Rs 720 to Rs 830.

- Varun Beverages saw its share price rise over 3% as CLSA upgraded the stock's rating to 'high conviction outperform' and raised the target price to Rs 802.

- Titan shares fell over 2% compared to a decline in the benchmark Nifty 50.

Varun Beverages Share Price Rises After Rating Upgrade From CLSA

- Varun Beverages' share price rose 3.25% to Rs 471.80 apiece after CLSA upgraded the stock's rating to 'high conviction outperform' and increased the target price.

- Concerns over increased competition and investors' concern around slowing urban consumption in India have impacted Varun Beverages' stock; however, CLSA believes the growth and profitability outlook remain robust.

- Varun Beverages' capital expenditure may ease going forward, but it will still be higher than FMCG firms.

- Out of 26 analysts tracking the company, 23 maintain a 'buy' rating, and three recommend a 'hold'. The average 12-month analysts' consensus price target implies an upside of 45.4%.

Varun Beverages Extends Acquisition Deadline Of PepsiCo's Ghana Bottler To March 31

- Varun Beverages, PepsiCo's largest franchise bottler, has extended the deadline for completion of the acquisition of Ghana-based SBC Beverages to March 31.

- On Nov. 13, 2024, Varun Beverages Ltd. had entered into a share purchase agreement for the purchase of 100% shares of SBC Beverages Ghana at $15.06 million.

- The transaction was originally estimated to be completed by the end of February 2025.

- In regulatory updates, VBL has announced that the consummation of the transaction is extended to March 31, 2025 instead of the previous deadline of Feb. 28, 2025.

Tax Sops Fail To Cheer Consumer Stocks' As Rs 6-Lakh Crore Rout Deepens

- Indian consumer stocks have failed to rally despite tax benefits, as the benchmark index Nifty FMCG extends its longest losing streak ever.

- Consumer companies have seen a decline of over Rs 6-lakh crore in market capitalization since September last year.

- Rising input costs, weak rural demand, intense competition, and a shift to health-conscious products are factors contributing to the underperformance of consumer stocks.

- Companies such as ITC Ltd., Varun Beverages Ltd., and United Spirits Ltd. have been among the worst performers.

MSCI Rejig: Hyundai India Only Addition In February Review; IndusInd Bank, Zomato Weights To Rise

- Hyundai Motor India, IndusInd Bank, Zomato, Varun Beverages, and Mankind Pharma will have increased weightage in the February MSCI review.

- India's weight in MSCI Global Standard Indexes will rise to 19% from the current 18.8% after the quarterly rejig.

- HDFC Bank holds the highest weightage among Indian stocks in MSCI indexes, followed by Reliance Industries, ICICI Bank, Infosys, and Bharti Airtel.

- MSCI added 19 Indian small-cap stocks and removed an equal number from its indices.

Varun Beverages Gets Bullish Outlook From Brokerages After Strong Q4 Performance

- Varun Beverages reported a 40.3% YoY increase in net profit for the fourth quarter, reaching Rs 185 crore.

- Brokerages remain optimistic about Varun Beverages' future prospects, citing its strong distribution network, capacity expansion, and growth potential in both domestic and international markets.

- Emkay reiterated its "Buy" rating on Varun Beverages with a target price of Rs 800, highlighting the company's enhanced capacity and light balance sheet as key drivers for future growth.

- Motilal Oswal also maintained a "Buy" rating on the stock with a target price of Rs 680, emphasizing volume growth and expanding international markets as major contributors to its strong Q4 performance.

Varun Beverages Q4 Results Review: Motilal Oswal Reiterates 'Buy' On The Stock — Here's Why

- Varun Beverages reported a revenue growth of 38% YoY in Q4 CY24, led by volume growth of 38% YoY, which was majorly driven by the volume addition from South Africa and the Democratic Republic of Congo.

- Motilal Oswal reiterates Buy rating on the stock with a target price of Rs 680

Stock Recommendations Today: Swiggy, Nykaa, Eicher Motor, Varun Beverages On Brokerages' Radar

- Citi has initiated a 'buy' rating for Swiggy, amid improved gameplay and its long-term growth outlook in food delivery and quick commerce.

- Bernstein maintained a cautious outlook on India, with low-volume stocks as their preference.

- In their note they also said that the auto sector could present potential opportunities.

- BofA has maintained an 'underperform' rating on Nykaa, with a target price of Rs 150.

- Citi has maintained a 'sell' rating on Nykaa, raising the target price to Rs 160 from Rs 155.

- Morgan Stanley maintained an 'overweight' rating on Nykaa, with a target price of Rs 200.

- Citi has maintained a 'buy' rating on Eicher and increased the target price to Rs 6,050 from Rs 5,350 per share.

- Bernstein does not see a clear inflection point yet, to add more risk to portfolios.

- Citi has maintained a 'buy' rating on Varun Beverages.

- Jefferies has maintained a 'buy' rating on Indian Hotels, with a target price of Rs 1,000.

Buy, Sell Or Hold: Tejas Networks, HUDCO, ONGC, Linde India — Ask Profit

- Tejas Networks, HUDCO, KPI Green Energy, ONGC were among the stocks analyzed by experts.

- Tejas Networks: Positive view for long-term investment, with strong fundamentals.

- HUDCO: Hold for two to three years with a positive outlook for the housing sector.

- KPI Green Energy: Avoid due to low expectations and small market capitalization.

- ONGC: Avoid due to performance tied to crude oil prices, consider refinery or marketing segments.

- Varun Beverages: Hold with good support levels and potential to reach higher prices.

- Linde India: Good long-term stock due to involvement in gas supply and being a leader in the industry.

Compare Varun Beverages with

Contribute & help others!

Companies Similar to Varun Beverages

Varun Beverages FAQs

Reviews

Interviews

Salaries

Users/Month