Add office photos

Engaged Employer

InCred Finance

3.8

based on 337 Reviews

Top Rated Tech Startup - 2024

Company Overview

Associated Companies

Company Locations

Working at InCred Finance

Company Summary

InCred Finance is a leading financial services company offering a diverse range of solutions, including Personal Loan, Education Loan, and MSME Loan.

Overall Rating

3.8/5

based on 337 reviews

5% below

industry average

Critically rated for

Promotions

Work Policy

Work from office

81% employees reported

Monday to Saturday

37% employees reported

Flexible timing

67% employees reported

No travel

48% employees reported

View detailed work policy

Top Employees Benefits

Health insurance

12 employees reported

Job/Soft skill training

9 employees reported

Cafeteria

6 employees reported

Office cab/shuttle

2 employees reported

View all benefits

Rate your company

🤫 100% anonymous

How was your last interview experience?

Share interview

About InCred Finance

Founded in2016 (9 yrs old)

India Employee Count1k-5k

Global Employee Count1k-5k

India HeadquartersMumbai, Maharashtra, India

Office Locations

Websiteincred.com

Primary Industry

Other Industries

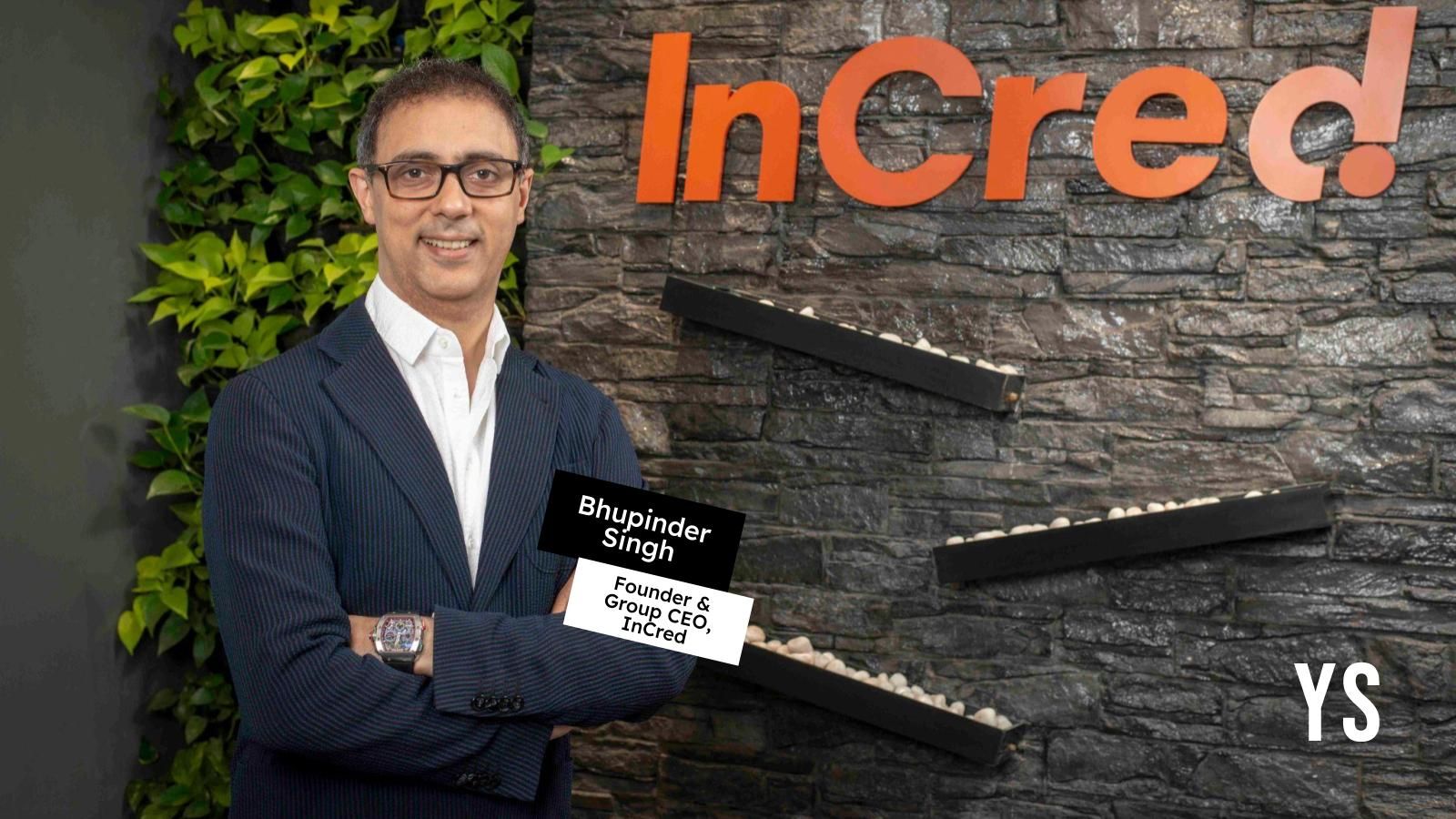

InCred Finance, the lending arm of the InCred Group, was established in 2016 by Bhupinder Singh. InCred Finance is a new-age, tech and risk-analytics-focused lending institution, offering a diversified portfolio that includes Personal Loan, Education Loan and MSME Loan. The company’s lending approach is built on the twin pillars of domain expertise and risk analytics, supported by a cutting-edge technological architecture that underpins all its operations and processes. The company turned unicorn in late 2023 and has a loan book of over Rs. 10,000 Cr.

For more information, visit www.incred.com

Mission: To be relentless in inculcating and nurturing a culture of continuous innovation and execution excellence by combining cutting edge technology, data science and deep financial domain expertise and delivering the best suited profitable product in the most dignified experience for every customer

Vision: To create a trustworthy, transparent and highest integrity financial institution that positively advances the socio-economic well-being of lower middle class to middle class Indian households while protecting the interests of all stakeholders.

AmbitionBox Best Places to Work in India Awards

Best of the best, rated by employees

InCred Finance won India’s Largest Employee Choice Awards in Tech Startups Companies Category.

#8 Top Rated Tech Startups

Share

InCred Finance Ratings

based on 337 reviews

Overall Rating

3.8/5

How AmbitionBox ratings work?

5

159

4

83

3

38

2

14

1

43

Category Ratings

3.7

Work-life balance

3.6

Company culture

3.6

Job security

3.6

Salary

3.5

Skill development

3.5

Work satisfaction

3.1

Promotions

InCred Finance is rated 3.8 out of 5 stars on AmbitionBox, based on 337 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at InCred Finance

based on 307 reviews

3.9

Rated by 48 Women

Rated 3.9 for Job security and 3.8 for Salary

3.8

Rated by 259 Men

Rated 3.8 for Work-life balance and 3.7 for Company culture

Work Policy at InCred Finance

based on 73 reviews in last 6 months

Work from office

81%

Hybrid

16%

Permanent work from home

3%

InCred Finance Reviews

Top mentions in InCred Finance Reviews

+ 5 more

Compare InCred Finance with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.8/5 based on 337 reviews  | 4.0/5 based on 38.3k reviews  | 3.9/5 based on 39.8k reviews  | 4.0/5 based on 6.7k reviews |

Highly Rated for |  No highly rated category | Job security Skill development Company culture | Job security Skill development | Salary Skill development Job security |

Critically Rated for | Promotions |  No critically rated category | Promotions |  No critically rated category |

Primary Work Policy | Work from office 81% employees reported | Work from office 91% employees reported | Work from office 84% employees reported | Work from office 78% employees reported |

Rating by Women Employees | 3.9 Good rated by 48 women | 3.9 Good rated by 10.1k women | 3.7 Good rated by 8.3k women | 3.9 Good rated by 596 women |

Rating by Men Employees | 3.8 Good rated by 259 men | 4.0 Good rated by 26.4k men | 3.9 Good rated by 29.5k men | 4.0 Good rated by 5.7k men |

Job security | 3.6 Good | 4.1 Good | 4.0 Good | 3.9 Good |

View more

InCred Finance Salaries

InCred Finance salaries have received with an average score of 3.6 out of 5 by 337 employees.

Sales Manager

(109 salaries)

Unlock

₹2.8 L/yr - ₹8.5 L/yr

Assistant Sales Manager

(89 salaries)

Unlock

₹3.2 L/yr - ₹5.8 L/yr

Credit Manager

(69 salaries)

Unlock

₹3 L/yr - ₹10.9 L/yr

Credit Officer

(58 salaries)

Unlock

₹2 L/yr - ₹4.5 L/yr

Software Engineer

(52 salaries)

Unlock

₹7 L/yr - ₹25 L/yr

Area Sales Manager

(51 salaries)

Unlock

₹4.6 L/yr - ₹13.8 L/yr

Assistant Credit Manager

(44 salaries)

Unlock

₹3.6 L/yr - ₹6 L/yr

Collections Manager

(30 salaries)

Unlock

₹3.8 L/yr - ₹8 L/yr

Chief Manager

(27 salaries)

Unlock

₹7 L/yr - ₹24.5 L/yr

Senior Software Engineer

(27 salaries)

Unlock

₹12.5 L/yr - ₹30.5 L/yr

InCred Finance Interview Questions

Interview questions by designation

Top InCred Finance interview questions and answers

Get interview-ready with top interview questions

InCred Finance Jobs

Popular Designations InCred Finance Hires for

Popular Skills InCred Finance Hires for

Current Openings

InCred Finance News

View all

InCred Finance buys TruCap’s gold loan business for Rs 330 crore

- InCred Finance has acquired TruCap Finance's gold loan division for around Rs 330 crore.

- The acquisition includes the transfer of the 'Dhanvarsha' trademarks and logos.

- InCred Finance will gain control over 115 gold loan branches and a customer base of over 40,000.

- TruCap aims to use the proceeds from the sale to reduce debt and focus on its green energy finance and MSME business loans.

ISN | 26 Feb, 2025

InCred Finance To Acquire TruCap's Gold Loan Business

- InCred Finance is set to acquire TruCap Finance Ltd.'s gold loan business for about Rs 330 crore.

- The deal includes a nationwide network of 115 branches, a customer base exceeding 40,000, a team of over 550 employees, and assets under management of over Rs 650 crore.

- The acquisition will provide InCred Finance a head start in the gold loans business, accelerating its go-to-market timeline by 24-36 months.

- The transaction is expected to be completed by April 30, 2025, subject to necessary approvals and adjustments.

Bloomberg Quint | 26 Feb, 2025

InCred Finance acquires TruCap’s gold loan business to expand secured lending portfolio

- InCred Finance has acquired TruCap Finance Limited's gold loan business.

- The acquisition includes TruCap's 115-branch network, a customer base of over 40,000, and assets under management (AUM) exceeding Rs 650 crore.

- The deal is expected to accelerate InCred Finance's expansion into secured lending by up to three years.

- The integrated gold loan business will be led by Saurabh Jhalaria, a founding team member of InCred Finance.

Yourstory | 26 Feb, 2025

InCred Finance to acquire gold loans biz of TruCap Finance via slump sale

- InCred Finance is set to acquire the gold loans business of TruCap Finance through a slump sale.

- The acquisition will bring a nationwide network of 115 branches, over 40,000 customers, more than 550 employees, and an AUM of over ₹650+ crore to InCred Finance.

- The proposed acquisition is subject to the execution of long form documents, obtaining necessary approvals, and fulfilling all conditions precedent to closing.

- This acquisition will provide InCred Finance with a head-start in the gold loans business, helping accelerate its go-to-market timeline by 24-36 months.

HinduBusinessLine | 26 Feb, 2025

InCred Finance Acquires TruCap’s Gold Loan Business For Rs 330 Cr

- InCred Finance is acquiring TruCap Finance’s gold loan division in a deal valued at around Rs 330 Cr.

- The acquisition includes the transfer of 'Dhanvarsha' trademarks and logos, covering 115 branches, a customer base of over 40,000, a team of 550+ employees, and assets under management of over Rs 650 Cr.

- TruCap aims to reduce debt and improve net worth, focusing on green energy finance and MSME business loans.

- After the acquisition, InCred Finance's gold loan division will be led by Saurabh Jhalaria, the current head of MSME and Education Loans.

VIE Stories | 26 Feb, 2025

InCred Finance To Acquire TruCap’s Gold Loan Business For INR 330 Cr

- InCred Finance is acquiring TruCap Finance's gold loan division, including trademarks and logos, for INR 330 Cr.

- The deal includes 115 branches, a customer base of over 40,000, and assets under management (AUM) of over INR 650 Cr.

- TruCap aims to reduce debt and focus on green energy finance and MSME business loans.

- InCred Finance plans to diversify its lending portfolio and expand its branch network.

Inc42 | 26 Feb, 2025

Stock Recommendations Today: SBI, IndiGo, Federal Bank And M&M On Brokerages' Radar

- Stock recommendations for SBI, IndiGo, Federal Bank, and M&M were highlighted by various brokerages.

- Analysts from Nomura, Morgan Stanley, and Jefferies provided insights on India GDP, Federal Bank, NBFCs, and market strategy.

- Notable recommendations include Morgan Stanley maintaining 'underweight' rating on Federal Bank with a target price of Rs 170.

- Nomura predicts GDP growth of 5.8% in the third fiscal quarter and expects RBI to cut rates by 75 basis points.

- Morgan Stanley highlighted RBI's proposal on foreclosure charges for loans, potentially impacting industry profitability.

- Jefferies suggested a short-term bounce in Nifty 50 and recommended stocks like Adani Ports, Mahindra & Mahindra, and others for growth.

- Citi maintained a 'buy' rating for IndiGo, anticipating improved demand and raised target price to Rs 5,200.

- Incred downgraded SBI to 'hold' from 'add' with a reduced target price, citing lower return ratios and impact of repo rate cuts.

- Jefferies maintained a 'buy' rating on M&M, foreseeing limited impact from Tesla's entry and encouraging electric vehicle orders.

- The market outlook is optimistic on certain stocks despite challenges, emphasizing growth potential and varying industry impacts.

Bloomberg Quint | 24 Feb, 2025

Indian startups raised over $177 million from Feb 17 to Feb 22, 2025; Lightstorm tops the list

- Between February 17 and February 22, 2025, 16 Indian startups raised over $177.3 million in funding.

- High-value deals included Lightstorm raising $80.7 million and Waterfield Advisors raising $18 million.

- Top sectors attracting investments were Cloud & Data Center Infrastructure, AI-powered visual merchandising, Food, and Enterprise AI.

- Several mergers and acquisitions took place including Atlys acquiring Artionis, PayRange acquiring Turns, Yuma Energy acquiring Grinntech, and InCred Group acquiring Arrow Capital.

ISN | 23 Feb, 2025

Wealth management space getting spicy with M&As

- Several mergers and acquisitions (M&As) are taking place in the wealth management space.

- Last week, Choice Equity Broking acquired Arete Capital Services, increasing its wealth management AUM nearly sixfold.

- InCred Group acquired Arrow Capital (DIFC) Ltd, expanding its global wealth management services.

- Consolidation in the wealth management industry is driven by increased competition, rise in costs, and the potential growth of ultra high net worth individuals in India.

HinduBusinessLine | 21 Feb, 2025

Shreyas Iyer Joins InCred as Brand Ambassador

- InCred, a modern financial services group, partners with cricketer Shreyas Iyer as brand ambassador.

- The partnership aims to promote financial accessibility and transparency in India.

- InCred recently appointed Gaurav Maheshwari as Chief Financial Officer of its MSME lending arm.

- InCred reported significant growth in assets under management and loan book size.

VIE Stories | 20 Feb, 2025

Powered by

InCred Finance Offices

Compare InCred Finance with

Kotak Mahindra Bank

3.8

Axis Bank

3.8

Tata Capital

4.1

Aditya Birla Capital

3.9

Reliance Capital

3.7

Sammaan Capital Limited

3.7

Edelweiss

3.9

Home Credit Finance

4.1

Kogta Financial India Limited

4.7

Hero FinCorp

4.0

BA Continuum

4.1

Hinduja Leyland Finance

4.0

PNB Housing Finance

3.8

Bajaj Housing Finance

3.7

Kotak Mahindra Prime

4.0

Shubham Housing Development Finance

3.9

Kinara Capital

4.4

Vistaar Finance

4.1

Tata Capital Housing Finance

4.1

Electronica Finance

4.0

Contribute & help others!

You can choose to be anonymous

Write a review

Share interview

Contribute salary

Add office photos

Companies Similar to InCred Finance

Bajaj Finance

Financial Services, NBFC

4.0

• 6.7k reviews

HDFC Bank

Financial Services, Media & Entertainment / Publishing, Banking, Insurance, NBFC

3.9

• 39.8k reviews

ICICI Bank

Financial Services, Banking

4.0

• 38.3k reviews

Kotak Mahindra Bank

Financial Services, Banking

3.8

• 16.9k reviews

Axis Bank

Financial Services, Banking

3.8

• 25.6k reviews

Tata Capital

Financial Services, NBFC

4.1

• 2.6k reviews

Aditya Birla Capital

Financial Services, NBFC

3.9

• 1.7k reviews

Reliance Capital

Financial Services

3.7

• 390 reviews

Sammaan Capital Limited

Financial Services, NBFC

3.7

• 2.3k reviews

Edelweiss

Financial Services

3.9

• 1.1k reviews

4.1

• 4.3k reviews

Kogta Financial India Limited

Financial Services, NBFC

4.7

• 3k reviews

InCred Finance FAQs

When was InCred Finance founded?

InCred Finance was founded in 2016. The company has been operating for 9 years primarily in the NBFC sector.

Where is the InCred Finance headquarters located?

InCred Finance is headquartered in Mumbai, Maharashtra. It operates in 2 cities such as Mumbai, Bangalore / Bengaluru. To explore all the office locations, visit InCred Finance locations.

How many employees does InCred Finance have in India?

InCred Finance currently has more than 2,000+ employees in India. BFSI, Investments & Trading department appears to have the highest employee count in InCred Finance based on the number of reviews submitted on AmbitionBox.

Does InCred Finance have good work-life balance?

InCred Finance has a Work-Life Balance Rating of 3.7 out of 5 based on 300+ employee reviews on AmbitionBox. 72% employees rated InCred Finance 4 or above, while 28% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read InCred Finance work-life balance reviews for more details

Is InCred Finance good for career growth?

Career growth at InCred Finance is rated as moderate, with a promotions and appraisal rating of 3.1. 28% employees rated InCred Finance 3 or below, while 72% employees rated it 4 or above on promotions/appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading InCred Finance promotions/appraisals reviews for more detailed insights.

What are the cons of working in InCred Finance?

Working at InCred Finance does have some drawbacks that potential employees should consider. The company is poorly rated for promotions / appraisal, based on 300+ employee reviews on AmbitionBox.

Recently Viewed

PHOTOS

Medanta the Medicity

4 office photos

REVIEWS

Faircent.com

No Reviews

COMPANY BENEFITS

InCred Finance

No Benefits

LIST OF COMPANIES

Axio

Overview

COMPANY BENEFITS

Aye Finance

No Benefits

REVIEWS

Rubique

No Reviews

REVIEWS

CoinTribe

No Reviews

REVIEWS

HAPPY

No Reviews

LIST OF COMPANIES

Happy Loans

Overview

LIST OF COMPANIES

RupeeRedee

Overview

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app