Add office photos

Engaged Employer

Polycab Wires

4.0

based on 1.4k Reviews

Video summary

Company Overview

Company Locations

Working at Polycab Wires

Company Summary

Polycab India Limited is a leader in Wire & Cables. The brand also has a wide range of switches, lighting, fans, and other electrical solutions for homes and commercial applications.

Overall Rating

4.0/5

based on 1.4k reviews

3% above

industry average

Highly rated for

Salary, Work-life balance, Skill development

Work Policy

Work from office

69% employees reported

Monday to Saturday

78% employees reported

Strict timing

59% employees reported

Within city

43% employees reported

View detailed work policy

Top Employees Benefits

Health insurance

52 employees reported

Job/Soft skill training

49 employees reported

Office cab/shuttle

19 employees reported

Cafeteria

14 employees reported

View all benefits

About Polycab Wires

Founded in1996 (29 yrs old)

India Employee Count1k-5k

Global Employee Count1k-5k

India HeadquartersMumbai, Maharashtra, India

Office Locations

--

Websitepolycab.com

Primary Industry

Other Industries

View in video summary

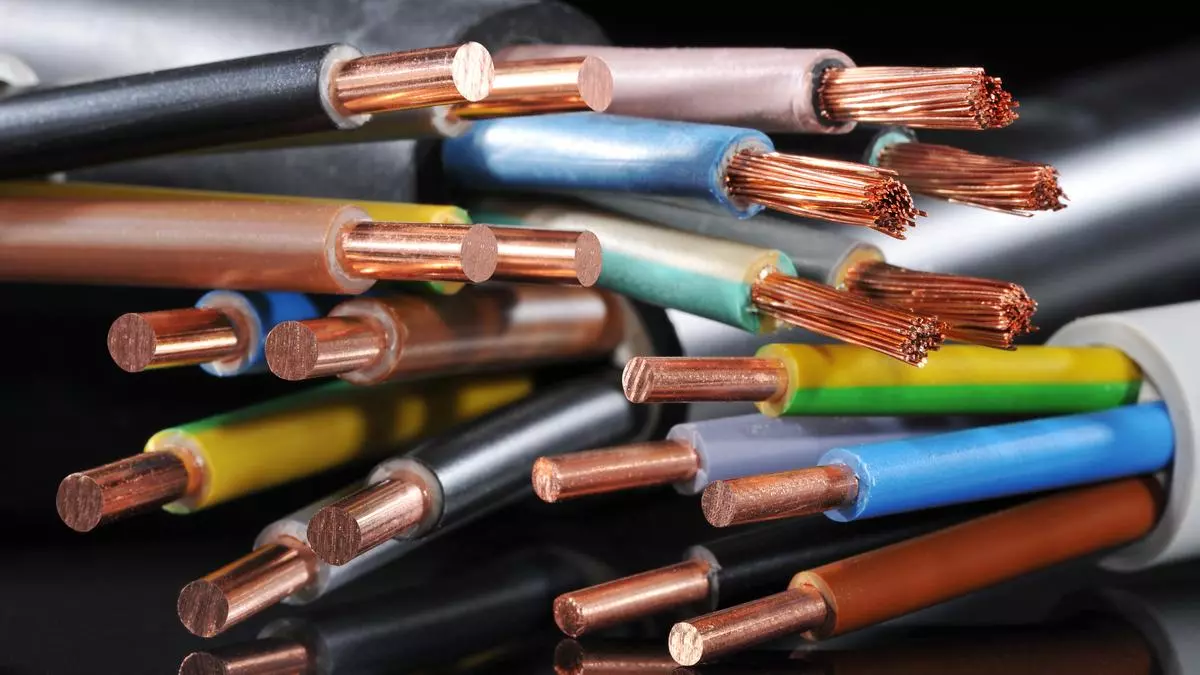

Polycab is engaged in the business of manufacturing and selling wires and cables and fast moving electrical goods ‘FMEG’ under the ‘POLYCAB’ brand. Apart from wires and cables, we manufacture and sell FMEG products such as electric fans, LED lighting and luminaires, switches and switchgear, solar products and conduits & accessories.

Our promoters collectively have more than four decades of experience among them. Our Company was incorporated as ‘Polycab Wires Private Limited’ on January 10, 1996 at Mumbai as a private limited company under the Companies Act, 1956.

We manufacture and sell a diverse range of wires and cables and our key products in the wires and cables segment are power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, flexible/single multi core cables, communication cables and others including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables and green wires.

In 2009, we diversified into the engineering, procurement and construction ‘EPC’ business, which includes the design, engineering, supply, execution and commissioning of power distribution and rural electrification projects. In 2014, we diversified into the FMEG segment and our key FMEG products are switches and switchgear and conduits & accessories.

Our promoters collectively have more than four decades of experience among them. Our Company was incorporated as ‘Polycab Wires Private Limited’ on January 10, 1996 at Mumbai as a private limited company under the Companies Act, 1956.

We manufacture and sell a diverse range of wires and cables and our key products in the wires and cables segment are power cables, control cables, instrumentation cables, solar cables, building wires, flexible cables, flexible/single multi core cables, communication cables and others including welding cables, submersible flat and round cables, rubber cables, overhead conductors, railway signaling cables, specialty cables and green wires.

In 2009, we diversified into the engineering, procurement and construction ‘EPC’ business, which includes the design, engineering, supply, execution and commissioning of power distribution and rural electrification projects. In 2014, we diversified into the FMEG segment and our key FMEG products are switches and switchgear and conduits & accessories.

Mission: We will demonstrate commitment by focussing on company objectives and the needs of our customers.

Vision: to innovate continuously and provide greater value to all

Polycab Wires Ratings

based on 1.4k reviews

Overall Rating

4.0/5

How AmbitionBox ratings work?

5

698

4

314

3

177

2

72

1

122

Category Ratings

3.8

Salary

3.8

Work-life balance

3.8

Skill development

3.7

Company culture

3.7

Job security

3.6

Promotions

3.6

Work satisfaction

Polycab Wires is rated 4.0 out of 5 stars on AmbitionBox, based on 1.4k company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at Polycab Wires

based on 1.3k reviews

4.2

Rated by 69 Women

Rated 4.0 for Company culture and 3.9 for Work-life balance

4.0

Rated by 1.3k Men

Rated 3.8 for Work-life balance and 3.8 for Salary

Work Policy at Polycab Wires

based on 221 reviews in last 6 months

Work from office

69%

Hybrid

27%

Permanent work from home

4%

Polycab Wires Reviews

Top mentions in Polycab Wires Reviews

+ 5 more

Compare Polycab Wires with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 4.0/5 based on 1.4k reviews | 4.0/5 based on 3.4k reviews | 3.8/5 based on 634 reviews | 4.2/5 based on 750 reviews |

Highly Rated for | Skill development Work-life balance Salary | Work-life balance Salary | Job security | Salary Work-life balance Job security |

Critically Rated for | No critically rated category | No critically rated category | Promotions Salary | No critically rated category |

Primary Work Policy | Work from office 69% employees reported | Work from office 73% employees reported | Work from office 83% employees reported | Work from office 85% employees reported |

Rating by Women Employees | 4.2 Good rated by 69 women | 3.6 Good rated by 139 women | 2.8 Poor rated by 9 women | 3.9 Good rated by 15 women |

Rating by Men Employees | 4.0 Good rated by 1.3k men | 4.0 Good rated by 3.1k men | 3.8 Good rated by 600 men | 4.2 Good rated by 701 men |

Job security | 3.7 Good | 3.7 Good | 3.8 Good | 3.9 Good |

View more

Polycab Wires Salaries

Polycab Wires salaries have received with an average score of 3.8 out of 5 by 1.4k employees.

Deputy Manager

(237 salaries)

Unlock

₹4.2 L/yr - ₹15 L/yr

Executive Engineer

(171 salaries)

Unlock

₹3.1 L/yr - ₹6.6 L/yr

Sales Executive

(116 salaries)

Unlock

₹1.8 L/yr - ₹5.2 L/yr

Sales Representative

(109 salaries)

Unlock

₹2.1 L/yr - ₹4.5 L/yr

Senior Engineer

(92 salaries)

Unlock

₹3 L/yr - ₹7.5 L/yr

Chief Manager

(81 salaries)

Unlock

₹9.4 L/yr - ₹29 L/yr

Territory Sales Incharge

(75 salaries)

Unlock

₹3.8 L/yr - ₹8.5 L/yr

Production Engineer

(69 salaries)

Unlock

₹1.6 L/yr - ₹4.9 L/yr

Business Development Manager

(62 salaries)

Unlock

₹4 L/yr - ₹13.5 L/yr

Sales Manager

(55 salaries)

Unlock

₹6.6 L/yr - ₹18 L/yr

Polycab Wires Interview Questions

Interview questions by designation

Top Polycab Wires interview questions and answers

Get interview-ready with top interview questions

Polycab Wires Jobs

Popular Designations Polycab Wires Hires for

Popular Skills Polycab Wires Hires for

Current Openings

Polycab Wires News

View all

Why Polycab, Amber Enterprises, Voltas, Crompton Are Jefferies' Picks In Small, Mid-Caps

- Jefferies prefers Polycab India Ltd., Amber Enterprises India Ltd., Voltas Ltd., and Crompton Greaves Consumer Electricals Ltd. in India's small and midcap space.

- Polycab India Ltd. has a 'buy' rating with a target price of Rs 6,485, which implies a 29.18% upside from Monday's closing price.

- Amber Enterprises India Ltd. has a 'buy' rating from Jefferies with Rs 8,845 as target price, implying a 36.1% upside from Monday's closing price.

- Crompton Greaves Consumer Electricals Ltd. has a 'buy' rating with a target price Rs 480 apiece, implying a 36.13% upside from Monday's closing price.

Bloomberg Quint | 18 Mar, 2025

Stock Market Live Updates 13 March 2025: Stock to buy today: Divi’s Laboratories (₹5,665.55) – BUY

- Stock market updates on 13 March 2025: Positive news includes companies like BEML, NTPC Green, Carysil, Unimech Aerospace, Atishay Ltd, Nahar Industrial, Premier Explosives, Azad Engineering, Infosys, Polycab, NACL Industries, Waaree Renewable, Swelect Energy, Jubilant Pharmova, and Yatra Online.

- Neutral news involves companies like Bajaj Electricals Ltd, Jamna Auto, Beta Drugs, Dynamic Services, Medplus Health, Panasonic Carbon, Shantai Industries, DCAL, Manali Petrochemicals, NHPC, IndusInd Bank, Ola Electric, Zydus Lifesciences, Jaiprakash Associates, Satin Creditcare, Banking Stocks, ICICI Sec, and MTNL.

- Negative news includes Rattan India Power and D.S. Kulkarni Developers facing challenges.

- Divi's Laboratories is recommended for buying with potential growth and support at 200-DMA.

- Notable companies mentioned in the article are BEML, NTPC Green, Infosys, Jubilant Pharmova, and Divi's Laboratories.

- Economic calendar highlights and pre/post-market stock movements for various companies, including Futu Holdings Limited, Wheaton Precious Metals Corp, DocuSign, Inc, and Ulta Beauty, Inc, are also provided.

HinduBusinessLine | 13 Mar, 2025

Stock Market Highlights 5 March 2025: Sensex, Nifty reverse declining trend; settle 1% higher on rally in utilities, power stocks

- Indian stock market witnessed a positive trend with Sensex and Nifty closing higher amidst a rally in utilities and power stocks despite US stock indices facing declines.

- The BSE Sensex surged by 740.30 points to close at 73,730.23, breaking a 10-day losing streak, while the Nifty displayed signs of value buying and followed global market trends.

- Technical analysis revealed strong resistance at 22,250 for Nifty50 stocks supported by an accumulation of put contracts at 21,500.

- The derivatives market showed a bearish tilt as call writers dominated put sellers, with notable resistance at 22,500-call strike and support at 21,500-put strike.

- Forex trading saw the Rupee gain against the US dollar due to trade tariff uncertainties, crude oil price decline, and dollar weakness amidst global market turmoil triggered by US President Trump's trade policies.

- Several companies announced strategic partnerships and new orders including Refex introducing 1,000 electric four-wheelers in major cities and Marine Electricals partnering with Danfoss India for marine electrification.

- IRFC achieved Navratna status and was ranked as the third-largest government NBFC in India, while silver prices rose on MCX with a positive outlook driven by fresh positions.

- Stock price movements were observed across various sectors with companies like HBL Engineering securing orders, and L&T announcing major residential construction projects in key cities.

- Key broking firms issued positive outlook on stocks like Mahindra & Mahindra Finance, Polycab, and SBI Cards, while market analysts highlighted impactful events in the global market alongside domestic developments.

- The US President's actions related to energy policies, OPEC+ decisions, SEBI's proposed trading limits, and NSE's contract expiry changes were noted to impact market sentiments and future trends.

- Overall, the market exhibited a mix of positive and negative factors influencing investor sentiment, with a focus on earnings, partnerships, regulatory changes, and economic indicators affecting the trading environment.

HinduBusinessLine | 5 Mar, 2025

Polycab Stock To See 52% Upside As Strong Demand Expected In Q4: Morgan Stanley

- Polycab India Ltd. expects strong demand in Q4 driven by government and private sector investments, along with US import tariffs on competitor countries.

- Morgan Stanley maintains an 'overweight' rating on Polycab stock with a target price of Rs 7,395 and an upside of 52%.

- Polycab's EBIT margins are expected to remain in the 12-14% range in the near term and 11-13% in the long run.

- Low inventory levels and inflationary copper prices contribute to Polycab's positive outlook.

Bloomberg Quint | 5 Mar, 2025

Polycab, KEI Industries, Havells May Face Tough Times Ahead, Say Brokerages

- The cables and wires sector, including companies such as Polycab, Havells, V-Guard, and KEI Industries, is expected to face challenging times ahead.

- Analysts predict slower growth and margin erosion for these companies, despite their historical strong performance.

- Investec has downgraded its valuation for Havells and V-Guard, while Jefferies has cut the target price for Polycab and KEI Industries.

- UltraTech Cements Ltd., a major player in the cement sector, plans to enter the cables and wires market, which adds to the competitive pressure.

Bloomberg Quint | 3 Mar, 2025

Polycab, RR Kabel, Finolex, KEI Industries, Havells: How UltraTech short circuited cable stocks

- The announcement of UltraTech Cement's entry into the cables and wires space caused a significant decline in the market value of cable stocks.

- Investors reacted negatively due to overall market weakness, high valuations of the sector, and learnings from the paints industry experience.

- Wire stocks have high price-to-earnings ratios despite a 21% correction in the past year, which made the negative news more impactful.

- Havells India, with its diversified portfolio, is better positioned to absorb the competition in the cable and wires segment.

HinduBusinessLine | 1 Mar, 2025

Cable Stocks Erode Rs 30,000 Crore In Market Cap On UltraTech's Foray Into The Sector

- UltraTech Cement Ltd.'s announcement of its entry into the wires and cables segment caused a market cap erosion of around Rs 30,000 crore for listed wires and cable players.

- Stocks like KEI Industries Ltd., Polycab India Ltd., and RR Kabel Ltd. witnessed significant declines following UltraTech's announcement.

- The negative stock reactions may also be linked to the Aditya Birla Group's foray into the paints sector with Birla Opus, impacting valuations across companies.

- UltraTech plans a capital expenditure of Rs 1,800 crore for its market entry, aiming to establish a plant in Bharuch, Gujarat by December 2026.

- With a current market size of Rs 80,000 crore, UltraTech targets addressing the building wire market first, which is around Rs 25,000 crore.

- Ambit estimates UltraTech could generate annual revenue of Rs 5,000–7,000 crore and EBITDA of Rs 400–800 crore from the cable venture in three–five years.

- The entry poses financial strain for UltraTech amidst existing investments; stock prices of cable companies, including Polycab and KEI, may see de-rating.

- Analysts foresee challenges in building a dedicated distribution network for the wires and cables business, impacting UltraTech's leverage and market positioning.

- Concerns arise about UltraTech's strategy to integrate building solutions with cements, paints, wires, and cables; potential overlaps and operational challenges are discussed.

- Expectations of revenue potential, competitive landscape shifts, and market reactions suggest a period of adjustment and valuation corrections for the cable industry.

Bloomberg Quint | 27 Feb, 2025

Polycab, KEI Industries, RR Kabel, Havells and Finolex Cables crash on UltraTech’s entry into cables & wires space

- UltraTech's entry into the cables and wires space resulted in a crash in the stock prices of Polycab, KEI Industries, RR Kabel, Havells, and Finolex Cables.

- Analysts anticipate a de-rating in valuation multiples for other players in the space. However, KEI, Polycab, and Havells are expected to remain bullish.

- Nuvama Institutional Equities states that UltraTech's entry is unlikely to impact the FY25-28 earnings of cables and wires players.

- ICICI Securities predicts a potential contraction in margins for players due to aggressive pricing by UltraTech.

HinduBusinessLine | 27 Feb, 2025

KEI Industries, Polycab, Havells Share Prices Go Haywire After UltraTech's Cables Entry Plan

- Shares of Polycab India, KEI Industries, R R Kabel, and Havells India saw a sharp decline after UltraTech Cements announced plans to enter the cables and wires business.

- The entry of UltraTech is expected to create healthy competition among organized players, according to Macquarie.

- KEI Industries shares fell by 20%, Polycab shares fell by 15%, and Havells shares fell by 9.41% on the NSE.

- Analysts have mixed recommendations for these stocks, with some suggesting a 'buy' and others recommending a 'hold' or 'sell'.

Bloomberg Quint | 27 Feb, 2025

UltraTech Will No Longer Be Just A Cement Company

- UltraTech Cement Ltd, India's largest cement company, is venturing into the cables and wires industry with a planned investment of Rs 1800 crore over the next two years.

- The company aims to set up a plant in Bharuch, Gujarat, with the plant expected to be functional by December 2026.

- The move is part of UltraTech's strategy to expand its presence in the construction value chain and cater to the increasing demand for cables and wires in various sectors.

- Financially, the venture holds significant revenue potential, with estimated Ebitda margins and revenue projections contributing to the company's overall growth.

- With this investment, UltraTech plans to diversify its portfolio beyond cement, although some analysts express concerns about the impact on the company's positioning as a pure play cement maker.

- According to Citi Research, investing in the wires business might offer better returns compared to cables due to the expected gross block multiples in the respective segments.

- UltraTech's entry into the cables and wires industry is expected to shake up the market, with potential implications for the top players in the industry like Polycab India, KEI Industries, and others.

- The industry dynamics could see shifts in Ebitda margins and the emergence of a competitive landscape, similar to what occurred in the paint industry when new players entered the market.

- The move signifies UltraTech's strategic diversification and expansion plans, signaling a departure from its traditional cement-focused business model.

- Overall, UltraTech's foray into the cables and wires sector represents a significant strategic move with both growth opportunities and potential challenges in the evolving market environment.

Bloomberg Quint | 26 Feb, 2025

Powered by

Compare Polycab Wires with

Bajaj Electricals

4.0

V-Guard Industries

4.4

Crompton Greaves Consumer Electricals

3.8

Panasonic Life Solutions India

4.0

Siemens

4.1

Schneider Electric

4.1

CG Power and Industrial Solutions

3.9

C&S Electric

4.0

Medha Servo Drives

4.2

RR kabel

4.1

Raychem RPG

3.9

Amber Enterprises India

3.9

Okaya Power

3.7

HBL Power Systems

4.0

Voltech

3.5

Hpl Electric & Power

3.5

Legrand

3.7

Bharat Bijlee

4.3

Landis+Gyr

3.6

Mettler-Toledo

3.6

Contribute & help others!

You can choose to be anonymous

Companies Similar to Polycab Wires

Finolex Cables

Plastics / Rubber, Electrical Equipment

3.8

• 634 reviews

KEI Industries

Manufacturing, Electronics, Electrical Equipment

4.2

• 750 reviews

Havells

Manufacturing, Electronics, Electrical Equipment

4.0

• 3.4k reviews

Bajaj Electricals

Industrial Machinery, Manufacturing, Electronics, Education & Training, Consumer Electronics & Appliances

4.0

• 2.2k reviews

V-Guard Industries

Financial Services, Consumer Electronics & Appliances, Electronics Manufacturing

4.4

• 1.5k reviews

Crompton Greaves Consumer Electricals

Consumer Electronics & Appliances

3.8

• 714 reviews

Panasonic Life Solutions India

Industrial Machinery, Manufacturing, Consumer Electronics & Appliances, Electronics Manufacturing, Emerging Technologies, Auto Components

4.0

• 1.7k reviews

Siemens

Urban Transport, Semiconductors, Electronics Manufacturing, Software Product, Electrical Equipment, Industrial Automation

4.1

• 4.8k reviews

Schneider Electric

Architecture & Interior Design, Industrial Automation

4.1

• 3.9k reviews

CG Power and Industrial Solutions

Consumer goods, Manufacturing, Education & Training, Electrical Equipment

3.9

• 1.3k reviews

C&S Electric

Manufacturing, Electronics, Engineering & Construction, Electrical Equipment

4.0

• 806 reviews

Medha Servo Drives

Manufacturing, Roads/Railways, Electronics, Electrical Equipment

4.2

• 735 reviews

Polycab Wires FAQs

When was Polycab Wires founded?

Polycab Wires was founded in 1996. The company has been operating for 29 years primarily in the Electrical Equipment sector.

Where is the Polycab Wires headquarters located?

Polycab Wires is headquartered in Mumbai, Maharashtra.

How many employees does Polycab Wires have in India?

Polycab Wires currently has more than 4,800+ employees in India. Sales & Business Development department appears to have the highest employee count in Polycab Wires based on the number of reviews submitted on AmbitionBox.

Does Polycab Wires have good work-life balance?

Polycab Wires has a Work-Life Balance Rating of 3.8 out of 5 based on 1,300+ employee reviews on AmbitionBox. 73% employees rated Polycab Wires 4 or above, while 27% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read Polycab Wires work-life balance reviews for more details

Is Polycab Wires good for career growth?

Career growth at Polycab Wires is rated fairly well, with a promotions and appraisal rating of 3.6. 73% employees rated Polycab Wires 4 or above, while 27% employees rated it 3 or below on promotions/appraisal. Though the sentiment is mixed for career growth, majority employees have rated it positively. We recommend reading Polycab Wires promotions/appraisals reviews for more detailed insights.

What are the pros of working in Polycab Wires?

Working at Polycab Wires offers several advantages that make it an appealing place for employees. The company is highly rated for salary & benefits, skill development and work life balance, based on 1,300+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app