Varun Beverages

Working at Varun Beverages

Company Summary

Overall Rating

3% above

Highly rated for

Job security, Salary

Work Policy

Top Employees Benefits

About Varun Beverages

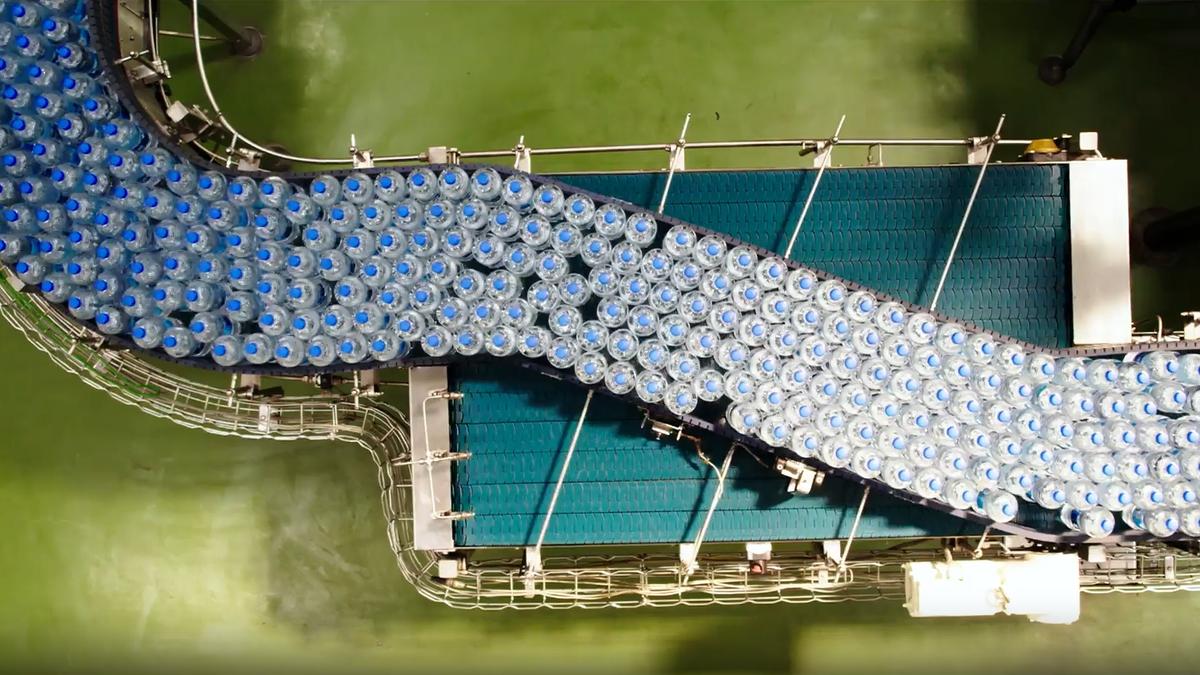

Varun Beverages Limited (VBL) is one of the top FMCG players in the Indian Market. We are on track towards strengthening our position in the global beverage industry with our presence in 14 countries in the Indian sub-continent and Africa - where we are responsible for producing popular brands like Pepsi, Mirinda, 7up, Mountain Dew, Slice, Aquafina, Sting, Tropicana, Gatorade, and many more and making them readily available at outlets near you. We are committed towards delivering a refreshing beverage experience to our consumers.

VBL in India is the second-largest franchisee partner for PepsiCo (outside US) and is powered by #HungryForMore spirit of 10,000+ employees who contribute to making the VBL family stronger and bigger every-day. Life@VBL is about endless opportunities and maximizing learnings every-day. We take immense pride in our employees’ commitment, ownership, and spirit of #OneTeamOneDream.

We are equally committed to ESG principles; focusing on environmental stewardship and actively participating in community initiatives demonstrate our dedication to giving back to the environment and society. Our robust governance framework ensures accountability and sustainability in everything we do.

Varun Beverages Ratings

Overall Rating

Category Ratings

Job security

Salary

Company culture

Work-life balance

Skill development

Work satisfaction

Promotions

Work Policy at Varun Beverages

Varun Beverages Reviews

Top mentions in Varun Beverages Reviews

Compare Varun Beverages with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 4.0/5 based on 3.7k reviews | 4.0/5 based on 2k reviews | 3.4/5 based on 1.2k reviews | 4.1/5 based on 2.8k reviews |

Highly Rated for | Job security Salary | Work-life balance Job security Salary | No highly rated category | Skill development Salary Job security |

Critically Rated for | No critically rated category | No critically rated category | Promotions Job security Work satisfaction | No critically rated category |

Primary Work Policy | Work from office 73% employees reported | Work from office 71% employees reported | Hybrid 60% employees reported | Work from office 71% employees reported |

Rating by Women Employees | 3.7 Good rated by 166 women | 3.9 Good rated by 26 women | 3.3 Average rated by 230 women | 3.7 Good rated by 304 women |

Rating by Men Employees | 4.0 Good rated by 3.4k men | 4.0 Good rated by 1.9k men | 3.4 Average rated by 941 men | 4.2 Good rated by 2.3k men |

Job security | 3.9 Good | 3.9 Good | 3.0 Average | 3.9 Good |

Varun Beverages Salaries

Customer Executive

Senior Customer Executive

Area Sales Manager

Sales Executive

Quality Executive

Executive Production

Deputy Manager

MIS Executive

PRE Sales Representative

Shipping Assistant

Varun Beverages Interview Questions

Interview questions by designation

Top Varun Beverages interview questions and answers

Varun Beverages Jobs

Varun Beverages News

Corporate Actions This Week — RailTel, Varun Beverages, United Spirits And More

- A host of companies, including RailTel Corp. of India, United Spirits Ltd., and Varun Beverages Ltd., are set to issue dividends to their stakeholders.

- MSTC has declared a final dividend of Rs 4.5 per equity share for 2024–25, with the record date set for April 02.

- RailTel Corp. of India has declared an interim dividend of Re 1 per share for the financial year ending March 31, with the record date set for April 02.

- United Spirits has announced its fourth interim dividend of Rs 4 per share for 2024–25, with the record date set for April 03.

Consumer Sector Q4 Results Preview — Margin Pressure To Sustain Gauges DRChoksey; Varun Beverages Its Top Pick

- Mixed consumption trends in Q4 FY25E amid inflationary pressures, says DRChoksey

- The brokerage expects the Ebitda margin to decline on a YoY basis due to rising raw material prices and inflationary pressures

- Net profit is forecasted to remain flat YoY due to negative operating leverage and gross margin pressures

- Varun Beverages is recommended as the top pick by the brokerage

Stock Market Today: All You Need To Know Before Going Into Trade On March 26

- Benchmark indices gained for the seventh straight session on Tuesday, with NSE Nifty 50 rising by 0.04% to 23,668.65 and BSE Sensex ending 0.04% higher.

- Asian stocks, including Nikkei, Kospi, Australia's S&P/ASX 200, and Hang Seng, saw modest gains amid market uncertainties.

- US futures were up, with S&P 500, Dow Jones Industrial Average gaining 0.7% each and Nasdaq 100 up 0.1%.

- Foreign portfolio investors were net buyers for the fourth session, while domestic institutional investors turned net sellers.

- The rupee closed 12 paise lower at 85.76 per US dollar, breaking an eight-day winning streak.

- Stocks to watch include Infosys, PRAJ Industries, Varun Beverages, Arvind Smartspaces, and more, with significant developments reported.

- Companies like Waaree Energies, TVS Motor, Indegene, and others announced various acquisitions, investments, and operational updates.

- Market movements included bulk/block deals, trading tweaks, upcoming company meetings, F&O cues, and a currency update.

- The rupee opened stronger but closed lower against the US dollar, impacted by global sentiments and crude oil price fluctuations.

- Research reports on cement and banking sectors, along with specific stock recommendations, were highlighted for investors.

'Buy' Varun Beverages Maintains Motilal Oswal Factoring In Strong Fundamentals, Potential For Future Growth

- Varun Beverages is expected to maintain its growth momentum driven by strong fundamentals and potential for future growth.

- Motilal Oswal forecasts a 18%16%/27% revenue/Ebitda/PAT CAGR from CY24-26 and reiterates a Buy rating for the stock.

- Varun Beverages had a transformative year in CY24 with strong growth, global expansion, and sustainability commitments.

- The company aims to strengthen its presence in Africa, diversify revenue by expanding into snacks, invest in new greenfield facilities, and focus on new product launches.

Buy, Sell Or Hold: Trent, Kaynes Tech, M&M, CDSL, Tejas Networks, Tata Motors — Ask Profit

- Analysts shared insights on the share prices of Trent, Kaynes Tech, M&M, CDSL, Tejas Networks, Tata Motors, Varun Beverages, and NTPC.

- Trent: Hold the stock for now with a potential upside.

- Kaynes Tech: Hold the stock for some time, enter at the right price.

- M&M: A favourable stock in the auto sector and large cap space, recommended to buy.

- CDSL: Wait for corrective action, buy in parts, potential upside in next three to five months.

- Tejas Networks: Hold the stock, expect some more upmove in the near future.

- Tata Motors: Buy the stock, demerger plan slated for October 2025.

- Varun Beverages: Hold the stock, potential for growth in the upcoming time.

- NTPC: Continue to hold the stock, expect further increase.

Varun Beverages stock in focus as brokerages see upside potential

- Varun Beverages stock traded flat at ₹476.45 on the NSE.

- Technical analysis suggests support near 460 and resistance at 486.

- CLSA upgrades Varun Beverages to high conviction outperform list.

- VBL records 36% increase in net profit for December quarter 2024.

Six Stocks In News At Noon: SBI, Varun Beverages, Titan, Inox Green

- Shares of Inox Green rose after Crisil Ratings Ltd. revised its outlook on the company’s long-term bank facilities from stable to positive.

- SBI shares rose over 3% as Citi gave it a double upgrade and raised the target price from Rs 720 to Rs 830.

- Varun Beverages saw its share price rise over 3% as CLSA upgraded the stock's rating to 'high conviction outperform' and raised the target price to Rs 802.

- Titan shares fell over 2% compared to a decline in the benchmark Nifty 50.

Varun Beverages Share Price Rises After Rating Upgrade From CLSA

- Varun Beverages' share price rose 3.25% to Rs 471.80 apiece after CLSA upgraded the stock's rating to 'high conviction outperform' and increased the target price.

- Concerns over increased competition and investors' concern around slowing urban consumption in India have impacted Varun Beverages' stock; however, CLSA believes the growth and profitability outlook remain robust.

- Varun Beverages' capital expenditure may ease going forward, but it will still be higher than FMCG firms.

- Out of 26 analysts tracking the company, 23 maintain a 'buy' rating, and three recommend a 'hold'. The average 12-month analysts' consensus price target implies an upside of 45.4%.

Varun Beverages Extends Acquisition Deadline Of PepsiCo's Ghana Bottler To March 31

- Varun Beverages, PepsiCo's largest franchise bottler, has extended the deadline for completion of the acquisition of Ghana-based SBC Beverages to March 31.

- On Nov. 13, 2024, Varun Beverages Ltd. had entered into a share purchase agreement for the purchase of 100% shares of SBC Beverages Ghana at $15.06 million.

- The transaction was originally estimated to be completed by the end of February 2025.

- In regulatory updates, VBL has announced that the consummation of the transaction is extended to March 31, 2025 instead of the previous deadline of Feb. 28, 2025.

Tax Sops Fail To Cheer Consumer Stocks' As Rs 6-Lakh Crore Rout Deepens

- Indian consumer stocks have failed to rally despite tax benefits, as the benchmark index Nifty FMCG extends its longest losing streak ever.

- Consumer companies have seen a decline of over Rs 6-lakh crore in market capitalization since September last year.

- Rising input costs, weak rural demand, intense competition, and a shift to health-conscious products are factors contributing to the underperformance of consumer stocks.

- Companies such as ITC Ltd., Varun Beverages Ltd., and United Spirits Ltd. have been among the worst performers.

Compare Varun Beverages with

Contribute & help others!

Companies Similar to Varun Beverages

Varun Beverages FAQs

Reviews

Interviews

Salaries

Users/Month