UBS![]()

Working at UBS

Company Summary

Overall Rating

3% above

Highly rated for

Work-life balance, Company culture

Critically rated for

Promotions

Work Policy

Top Employees Benefits

About UBS

UBS works with individuals, families, institutions, and corporations around the world to help answer some of life's questions – whether through award winning wealth management advisory, investment banking and asset management expertise, or private and corporate banking services in Switzerland. We're a team of more than 66,000 colleagues, collaborating across all major financial centers in 50 countries. We strive for excellence in everything we do, and this has awarded us recognition across our businesses. We offer a collaborative, international and diverse working environment that rewards passion, commitment and success – and are regularly recognized as an attractive employer.

UBS Ratings

Overall Rating

Category Ratings

Work-life balance

Company culture

Salary

Job security

Skill development

Work satisfaction

Promotions

Work Policy at UBS

UBS Reviews

Top mentions in UBS Reviews

Compare UBS with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.9/5 based on 3.1k reviews | 3.8/5 based on 7.1k reviews | 3.9/5 based on 6.7k reviews | 3.9/5 based on 5.3k reviews  |

Highly Rated for | Work-life balance Company culture | Work-life balance Job security | Job security Skill development Salary | Job security Work-life balance Company culture |

Critically Rated for | Promotions | Promotions Skill development | Promotions | Promotions |

Primary Work Policy | Hybrid 91% employees reported | Hybrid 85% employees reported | Hybrid 50% employees reported | Hybrid 84% employees reported |

Rating by Women Employees | 3.9 Good rated by 899 women | 3.9 Good rated by 2.3k women | 3.9 Good rated by 2.3k women | 3.9 Good rated by 1.7k women |

Rating by Men Employees | 3.9 Good rated by 2k men | 3.8 Good rated by 4.7k men | 4.0 Good rated by 4.1k men | 4.0 Good rated by 3.3k men |

Job security | 3.6 Good | 3.9 Good | 4.0 Good | 4.0 Good |

UBS Salaries

Associate Director

Assistant Vice President

Authorized Officer

Exempt NON Officer

ENO

authorised Officer

Director

Financial Analyst

AVP

Associate Vice President

UBS Interview Questions

UBS Jobs

UBS News

UBS Invests in Icon’s Payment Modernization Efforts

- UBS has made an equity investment in payments technology FinTech company Icon Solutions.

- The investment was announced on June 18 and follows additional funding from existing investors Citi and NatWest.

- UBS views Icon as a crucial partner in modernizing payment platforms with innovative infrastructure solutions.

- The investment solidifies the partnership between UBS and Icon to deliver faster and future-ready payment solutions.

- UBS, along with Citi and NatWest, will utilize Icon's Payments Framework (IPF) for their payments modernization programs.

- IPF allows banks to speed up the development, testing, and deployment of payment processing solutions while controlling costs and timelines.

- Icon's director and co-founder, Tom Kelleher, believes that banks should take the lead in their payments transformation, indicating confidence in IPF.

- PYMNTS highlights the increasing importance for banks to modernize in response to consumer preferences for instant payments and small businesses seeking faster access to funds.

- Research shows a growing preference for instant disbursements, with virtual accounts offering banks a competitive edge in meeting these evolving customer needs.

- Virtual accounts present an opportunity for banks to turn disbursements into customer-centric services that go beyond just transferring money.

New Study Finds U.S. Adds Staggering Number of Millionaires Per Day

- A new study reveals that the United States added over 1,000 millionaires per day in 2024.

- The report, conducted by UBS, shows a total of about 379,000 new millionaires in the U.S. last year, a 1.5% increase.

- The U.S. had around 23.8 million millionaires by the start of 2025, the highest in any country globally.

- UBS attributes the increase to strong markets and a stable dollar but predicts a potential decrease in new millionaires for 2025.

- UBS economist James Mazeau is optimistic about continued wealth creation in the U.S.

- Almost 40% of the world's millionaires reside in the United States.

- Globally, the total number of millionaires increased by 684,000 in 2024.

- The count of billionaires worldwide rose to 2,891, with 813 billionaires living in the U.S.

UBS digital art museum to open in 2026, bringing europe’s largest teamLab show to hamburg

- Hamburg is set to open the UBS Digital Art Museum in 2026, becoming Europe's largest institution dedicated to digital and immersive art.

- The museum, founded by Lars Hinrichs and led by Artistic Director Ulrich Schrauth, is supported by UBS as the naming sponsor and lead partner.

- Located in Hamburg's HafenCity district, the museum will launch with a teamLab exhibition, introducing an interactive art environment spread across 7,000 square meters.

- The museum's inaugural exhibition, teamLab Borderless Hamburg, offers a seamless and immersive ecosystem where digital artworks interact with human presence.

- Lars Hinrichs was inspired to create the museum after visiting teamLab Borderless in Tokyo, aiming to bring this experience to Europe.

- The UBS Digital Art Museum is a private initiative focused on making digital and immersive art accessible and tangible for all visitors.

- Visitors will be encouraged to touch, interact, and even co-create within the museum space, breaking traditional museum norms.

- Beyond the initial exhibition, the museum plans to showcase a variety of digital art, support emerging artists, and promote dialogue on art and technology.

- The museum also aims to be the world's first climate-neutral museum, prioritizing sustainability and fairness in its operations.

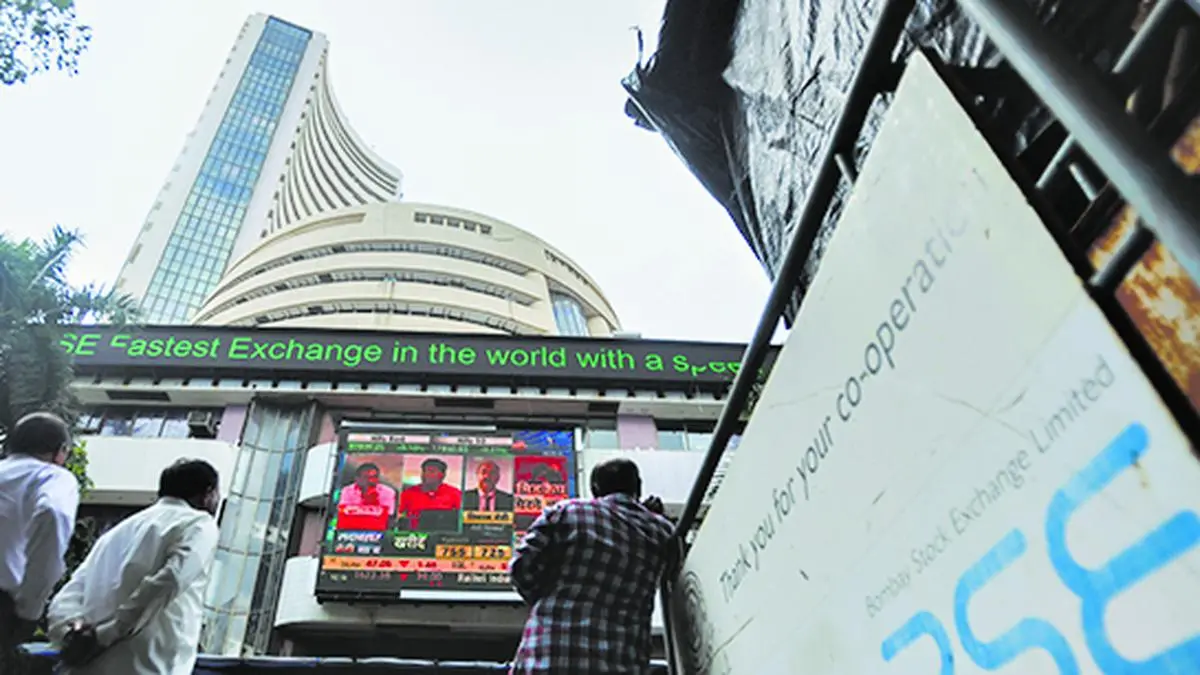

BSE shares fluctuate after F&O expiry shift, tanks 6% in early trade

- BSE shares experienced fluctuations after the F&O expiry shift, plunging 6% in early trading.

- Motilal Oswal downgraded BSE's stock to neutral from buy with a target price of ₹2,300.

- The F&O expiry shift is expected to result in BSE losing market share in premium turnover.

- BSE's market share varied from 8% to 38% across different days of the week.

- Motilal anticipates a market share loss of 350-400 basis points for BSE.

- Motilal also reduced average daily turnover estimates for FY26 and FY27, leading to lower earnings estimates.

- Goldman Sachs predicted BSE could lose 3% market share within index options premium in the short term.

- Jefferies maintained a hold rating on BSE citing 5-10% volume impact in the near future.

- UBS retained a buy call on BSE, expecting a 15% volume impact due to the change in expiry.

- BSE shares traded flat on the NSE at ₹2,661.90 after hitting a low of ₹2,500.

- The stock opened 5% lower in early trading at ₹2,525.

- Published on June 18, 2025.

Equity benchmarks set for muted open as West Asia tensions spur risk aversion

- Equity benchmarks are set for a muted open as tensions in West Asia drive risk aversion.

- Nifty futures indicate the Nifty 50 will open near the previous close.

- Other Asian markets opened lower, with the MSCI Asia ex-Japan index declining by 0.5%.

- Wall Street equities fell, while crude prices rose amid the Israel-Iran conflict entering its sixth day.

- Investor concerns heighten over a broader escalation in the oil-rich Middle East due to the conflict.

- Rising crude prices negatively impact economies like India, where oil imports make up a substantial portion of the bill.

- Tensions in the Middle East, uncertainty around U.S. President Trump's tariffs, and signs of U.S. economic weakness contribute to market instability.

- The Federal Reserve is expected to maintain rates steady with focus on updated economic and rate projections.

- On Tuesday, domestic institutional investors continued buying Indian stocks for the 21st consecutive session.

- Foreign portfolio investors ended a four-session selling streak.

- India's markets regulator approved requests for the NSE and BSE to move equity derivatives contracts' expiry to Tuesdays and Thursdays.

- UBS and Goldman Sachs suggest that this change may lead to decreased volumes and impact BSE's market share gains.

- The exchange rate is $1 to 86.2700 Indian rupees.

- Published on June 18, 2025.

Zurich-based aerial robotics startup Voliro flies high with €19.8 million to deploy their maintenance drones

- Swiss aerial robotics startup Voliro raises €19.8 million in Series A extension to accelerate development of their inspection drones.

- Funding includes participation from noa and a debt facility from UBS, with Cherry Ventures leading the original round.

- Voliro's technology enhances industrial safety, asset maintenance for wind farms, and addresses workforce shortages in inspections.

- Their Voliro T drone features a patented tiltable rotor system for stable contact during inspections.

- The company aims to improve safety, data quality, and efficiency in inspections, offering a versatile and intelligent platform.

- Voliro has a global presence, conducting over 100 contact inspections monthly for customers like Chevron and Holcim.

- Their drones target hard-to-access infrastructure to prevent failures, reduce risks, and lower inspection costs in various industries.

- Traditional manual inspection methods are costly, infrequent, and reactive, leading to corrosion-related failures and accidents.

- Voliro's automation solutions help industries detect issues early, reduce downtime, and attract digital-native technicians.

- The investment will accelerate the development of AI-powered inspection reporting, enhanced autonomy, and modular payloads for Voliro's drones.

Hyundai Motor Gets UBS' 'Buy' Initiation On Capacity Expansion, Premiumisation

- UBS has initiated coverage on Hyundai Motor India Ltd. with a ‘buy’ rating and a price target of Rs 2,350, citing the company's strategic capacity expansion and growth trajectory.

- Hyundai is set for a strong comeback, driven by its new optimisation-led strategy, upcoming plant in Maharashtra to increase production capacity by 30%, and positioning India as a global export hub.

- UBS expects a significant increase in domestic volume growth by 10% between fiscal 2026 and fiscal 2028, along with an 11% annual rise in export volumes.

- Hyundai's success is attributed to its premiumisation and technology adoption, offering upmarket features like sunroofs, GDi engines, DCT gearboxes, and ADAS.

- While Hyundai underperformed in volume growth, it maintained strong revenue and operating profit figures due to its product mix and pricing power, with higher EBIT margins compared to industry peers.

- UBS forecasts a 16% Ebitda CAGR during fiscal 2026–2028, supported by operating leverage and growing export share, despite risks such as overdependence on the Creta and potential launch missteps.

- Hyundai's focus on growth, product innovation, and premium positioning, alongside its pipeline of 26 new models by 2030 and entry into hybrids, justifies a bullish outlook and long-term investment, according to UBS.

Chainlink Connects CCT with SuperchainERC20 on Optimism

- Chainlink’s CCT now supports SuperchainERC20, enabling seamless cross-chain functionality for tokens like ASTR across Optimism’s ecosystem.

- Chainlink Labs joins the Global Synchronizer Foundation to help design institutional-grade interoperable blockchain infrastructure.

- Chainlink’s CCT standard is now compatible with Optimism’s SuperchainERC20, demonstrated through the deployment of Astar Network’s ASTR token on the Soneium Layer-2 network.

- ASTR can now make cross-chain transfers across networks within Optimism’s Superchain ecosystem using Chainlink CCIP’s infrastructure.

- This integration allows ASTR to connect different networks without relying on vulnerable bridges, making cross-chain transfers hassle-free.

- Johann Eid, Chief Business Officer at Chainlink Labs, highlighted how ASTR's adoption of the CCT standard on Soneium paves the way for SuperchainERC20 tokens to become CCT-compatible, enabling secure cross-chain interoperability.

- By combining Chainlink CCIP's speed and security with SuperchainERC20's flexibility, ASTR serves as a strategic bridge between networks.

- Chainlink Labs joining the Global Synchronizer Foundation signifies their commitment to facilitating blockchain applications for large institutions.

- Chainlink's technology has been utilized by significant entities like UBS, MAS (Singapore), and SBI in tokenizing traditional funds into blockchain-based digital assets.

- Chainlink's involvement in the pilot program of Hong Kong’s CBDC with CCIP protocol showcased its ability to bridge permissioned and permissionless blockchains.

- Recently, Chainlink launched CCIP on the Solana network, expanding cross-chain features for Solana developers.

- The integration of ASTR on Soneium serves as a live demonstration of Chainlink and Optimism's collaboration on a real network.

- As of press time, the LINK token is trading at approximately $15.51, showing a 3.52% increase in the last 24 hours and a 10.17% increase over the last 7 days.

RBI Has Limited Room For Further Easing, Says UBS After Sharp Rate Cut, Cash Boost

- RBI reduced the cash reserve ratio to 3% from 4% to provide ample liquidity to support policy transmission.

- UBS Global Research stated that there is limited room for further easing after RBI's sharp rate cut and change in stance to 'neutral' from 'accommodative'.

- RBI projects a real GDP growth of 6.5% for financial year 2026 and CPI inflation to be 3.7% year on year.

- UBS Global Research believes RBI may cut rates by 25 bps in the future if global uncertainty increases.

Apple is the worst-performing Mag 7 stock this year. Here's what analysts and investors say about whether you should buy the dip.

- Apple is the worst-performing Magnificent Seven stock in 2025, down 20%, largely due to global trade and AI challenges.

- Analysts attribute Apple's decline to factors like trade war uncertainties and potential tariffs on foreign-made iPhones.

- President Trump's threats of tariffs have intensified concerns, especially as most iPhones are assembled in China.

- Goldman Sachs sees Apple stock as attractive, with a 'buy' rating and a 27% upside potential.

- UBS maintains a 'neutral' rating on Apple, projecting a 5% upside, even with potential 25% tariffs on iPhones.

- CFRA Research suggests buying Apple stock for long-term investors, citing growth prospects and resilience.

- Main Street Research also advocates buying Apple amidst uncertainties, anticipating improvements in AI and trade issues.

- Wedbush Securities regards Apple as well-equipped to handle tariff challenges, with CEO Tim Cook's strategies applauded.

- Melius Research emphasizes Apple's long-term potential, highlighting initiatives in AI, services, and a sizable device base.

- Clockwise Capital takes a cautious stance, selling off Apple stock due to tariff risks, despite Apple's market strength.

Compare UBS with

Contribute & help others!

Companies Similar to UBS

UBS FAQs

Reviews

Interviews

Salaries

Users