Motilal Oswal Financial Services

About Motilal Oswal Financial Services

Motilal Oswal Financial Services Ltd. (MOFSL) was founded in 1987 as a small sub-broking unit, with just 2 people running the show. Focus on a customer-first attitude, ethical and transparent business practices, respect for professionalism, research-based value investing, and implementation of cutting-edge technology has enabled us to blossom into a 13,000+ member team.

Today, we are a well-diversified financial services firm offering a range of financial products and services such as Private Wealth, Wealth Management, Institutional Broking, Asset Management, Investment Banking, Private Equity, Commodity Broking, Currency Broking, and Home Finance.

We have a diversified client base that includes retail customers (including High Net worth Individuals), mutual funds, foreign institutional investors, financial institutions, and corporate clients. We are headquartered in Mumbai and, have a network spread over 550 cities and towns comprising 2500+ Business Locations operated by our Business Partners, us, and 55,00,000+ customers.

Research is the solid foundation on which MOFSL advice is based. Almost 10% of revenue is invested in equity research, and we hire and train the best resources to become our advisors. At present we have 25+ research analysts researching over 250 companies across 20 sectors.

Motilal Oswal Financial Services Reviews

Motilal Oswal Financial Services Achievements on AmbitionBox

Motilal Oswal Financial Services Videos

Motilal Oswal Financial Services Job Openings

Motilal Oswal Financial Services Office Locations

Motilal Oswal Financial Services Brands and Subsidiaries

Motilal Oswal Securities

Motilal Oswal Financial Services Salaries

Relationship Manager

Equity Advisor

Financial Advisor

Business Development Executive

Area Manager

Territory Manager

Team Lead

Senior Relationship Manager

Equity Dealer

Sales Executive

Motilal Oswal Financial Services Interview Questions

'Be MOre' at Motilal Oswal

Life @Motilal Oswal

The Journey of Motilal Oswal Financial Services Limited.

Motilal Oswal Foundation

Motilal Oswal Financial Services Perks & Benefits

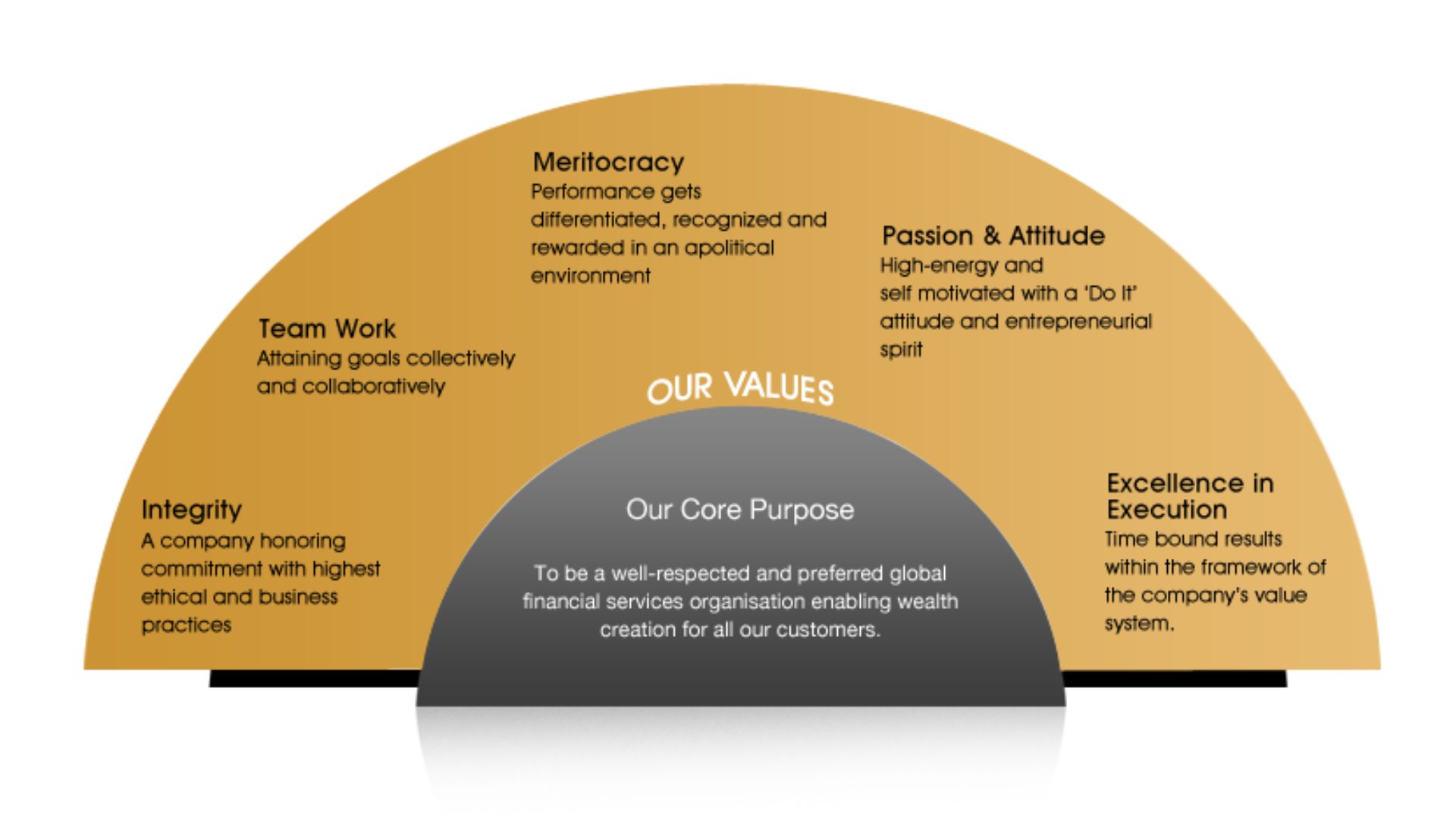

Core Purpose & Values

A little more about Motilal Oswal Financial Services

Connect with us

Motilal Oswal Financial Services FAQs

Reviews

Interviews

Salaries

Users