Add office photos

Employer?

Claim Account for FREE

Hindalco Industries

4.2

based on 3k Reviews

Proud winner of ABECA 2024 - AmbitionBox Employee Choice Awards

Company Overview

Associated Companies

Company Locations

Working at Hindalco Industries

Company Summary

Hindalco Industries operates in the metals sector, focusing on aluminium and copper production, and offers comprehensive recycling and integrated facilities globally.

Overall Rating

4.2/5

based on 3k reviews

8% above

industry average

Highly rated for

Job security, Skill development, Company culture

Work Policy

Work from office

83% employees reported

Monday to Saturday

61% employees reported

Strict timing

51% employees reported

No travel

56% employees reported

View detailed work policy

Top Employees Benefits

Job/Soft skill training

219 employees reported

Health insurance

199 employees reported

Office cab/shuttle

186 employees reported

Office gym

137 employees reported

View all benefits

About Hindalco Industries

Founded in1958 (67 yrs old)

India Employee Count10k-50k

Global Employee Count10k-50k

India HeadquartersMumbai, Maharashtra, India

Office Locations

Websitehindalco.com

Primary Industry

Other Industries

Are you managing Hindalco Industries's employer brand? To edit company information,

claim this page for free

Hindalco Industries Limited is the metals flagship company of the Aditya Birla Group. A US$18 billion metals powerhouse, Hindalco is an industry leader in aluminium and copper. Hindalco’s acquisition of Aleris Corporation in April 2020, through its subsidiary Novelis Inc., has cemented the company's position as the world’s largest flat-rolled products player and recycler of aluminium. Hindalco’s state-of-art copper facility comprises a world-class copper smelter and a fertiliser plant along with a captive jetty. The copper smelter is among Asia's largest custom smelters at a single location. In India, the company’s aluminium units across the country encompass the gamut of operations from bauxite mining, alumina refining, coal mining, captive power plants and aluminium smelting to downstream rolling, extrusions and foils. Today, Hindalco ranks among the global aluminium majors as an integrated producer and a footprint in 9 countries outside India. The Birla Copper unit produces copper cathodes and continuous cast copper rods, along with other by-products, including gold, silver, and DAP fertilisers. It is India’s largest private producer of gold. Hindalco has been accorded Star Trading House status in India. Its aluminium is accepted for delivery under the High-Grade Aluminium Contract on the London Metal Exchange (LME), while its copper quality is also registered on the LME with Grade A accreditation.

Mission: To relentlessly pursue the creation of superior shareholder value, by exceeding customer expectation profitably, unleashing employee potential, while being a responsible corporate citizen, adhering to our values.

Vision: To be a premium metals major, global in size and reach, excelling in everything we do, and creating value for its stakeholders.

Managing your company's employer brand?

Claim this Company Page for FREE

AmbitionBox Best Places to Work in India Awards

Best of the best, rated by employees

Hindalco Industries won India’s Largest Employee Choice Awards in Large Companies Category.

#12 Top Rated Large Company

Share

Hindalco Industries Ratings

based on 3k reviews

Overall Rating

4.2/5

How AmbitionBox ratings work?

5

1.6k

4

881

3

334

2

95

1

120

Category Ratings

4.4

Job security

4.1

Skill development

4.0

Company culture

4.0

Work-life balance

3.9

Work satisfaction

3.7

Salary

3.5

Promotions

Hindalco Industries is rated 4.2 out of 5 stars on AmbitionBox, based on 3k company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at Hindalco Industries

based on 2.8k reviews

4.1

Rated by 186 Women

Rated 4.3 for Job security and 3.9 for Company culture

4.2

Rated by 2.6k Men

Rated 4.4 for Job security and 4.1 for Skill development

Work Policy at Hindalco Industries

based on 426 reviews in last 6 months

Work from office

83%

Hybrid

11%

Permanent work from home

6%

Hindalco Industries Reviews

Top mentions in Hindalco Industries Reviews

+ 5 more

Compare Hindalco Industries with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 4.2/5 based on 3k reviews  | 4.1/5 based on 7.4k reviews  | 3.9/5 based on 5.8k reviews | 3.8/5 based on 433 reviews |

Highly Rated for | Job security Skill development Work-life balance | Job security Skill development Work-life balance | Job security Skill development | Salary |

Critically Rated for |  No critically rated category |  No critically rated category | Promotions | Work-life balance Promotions |

Primary Work Policy | Work from office 83% employees reported | Work from office 71% employees reported | Work from office 86% employees reported | Work from office 86% employees reported |

Rating by Women Employees | 4.1 Good rated by 186 women | 4.0 Good rated by 477 women | 3.8 Good rated by 262 women | 3.5 Good rated by 72 women |

Rating by Men Employees | 4.2 Good rated by 2.6k men | 4.1 Good rated by 6.5k men | 3.9 Good rated by 5.3k men | 3.9 Good rated by 338 men |

Job security | 4.4 Good | 4.1 Good | 4.1 Good | 3.7 Good |

View more

Hindalco Industries Salaries

Hindalco Industries salaries have received with an average score of 3.7 out of 5 by 3k employees.

Junior Engineer

(580 salaries)

Unlock

₹2.5 L/yr - ₹7 L/yr

Assistant Engineer

(468 salaries)

Unlock

₹1.9 L/yr - ₹9.2 L/yr

Deputy Manager

(279 salaries)

Unlock

₹8.6 L/yr - ₹19.8 L/yr

Deputy Engineer

(201 salaries)

Unlock

₹5.1 L/yr - ₹10.5 L/yr

Senior Engineer

(144 salaries)

Unlock

₹5 L/yr - ₹15 L/yr

Assistant General Manager

(142 salaries)

Unlock

₹12.5 L/yr - ₹39 L/yr

Assistant Officer

(126 salaries)

Unlock

₹3.5 L/yr - ₹8 L/yr

Supervisor

(110 salaries)

Unlock

₹1 L/yr - ₹4.5 L/yr

Deputy Officer

(92 salaries)

Unlock

₹5 L/yr - ₹11 L/yr

Graduate Engineer Trainee (Get)

(79 salaries)

Unlock

₹5.5 L/yr - ₹8 L/yr

Hindalco Industries Interview Questions

Interview questions by designation

Top Hindalco Industries interview questions and answers

Get interview-ready with top interview questions

Hindalco Industries Jobs

Popular Designations Hindalco Industries Hires for

Popular Skills Hindalco Industries Hires for

Current Openings

Hindalco Industries News

View all

Crafting a green future: India’s strategy for aluminium exports to Europe

- The EU's Carbon Border Adjustment Mechanism (CBAM) will impose a carbon tariff on high-emission imports like aluminium, affecting India's producers reliant on carbon-heavy methods.

- India, a major aluminium producer, faces the challenge of modernizing production to align with global sustainability standards amid CBAM's imminent implementation in 2026.

- India's production methods are carbon-intensive, with 80% of emissions attributed to coal-based electricity, highlighting the need to shift to low-carbon production like hydropower.

- Compared to China's dominance in global aluminium production, India has the potential to position itself as a leading green aluminium supplier to Europe by transitioning faster to low-carbon production.

- CBAM presents opportunities for aluminium producers to gain a competitive edge in Europe by reducing carbon intensity, but failure to modernize could lead to trade disadvantages.

- India-EU bilateral trade could benefit the aluminium industry, especially if a Free Trade Agreement with sustainability incentives is established to boost competitiveness.

- To excel in sustainable aluminium exports, India must take bold policy, trade, and technology steps, including incentives for green aluminium, energy transition, and workforce upskilling.

- Leading players like Vedanta Aluminium and Hindalco Industries are already making strides towards low-carbon production by introducing green brands and increasing renewable energy usage.

- India needs to advance renewable energy adoption in aluminium smelting, strengthen trade agreements, and develop a skilled workforce to compete globally in the green aluminium market.

- The choices India makes now will determine its position in the low-carbon economy, with early action and innovation crucial for securing a leading role in sustainable trade.

- Seizing the moment to emerge as a top supplier of low-carbon aluminium in Europe is not just an environmental responsibility for India but also an economic opportunity for shaping the future of sustainable trade.

HinduBusinessLine | 2 Mar, 2025

Nalco To Vedanta: Why Aluminium Stocks Are Losing Their Sheen This Week

- Shares of Nalco, Vedanta, and Hindalco have experienced significant losses in the past two trading sessions.

- One of the reasons for the decline is the fall in aluminium future prices.

- Avendus Spark downgraded Hindalco Industries to a 'sell' rating, contributing to the weakness in the stocks.

- The Nifty Metal index has fallen over 3.5% since Monday.

Bloomberg Quint | 25 Feb, 2025

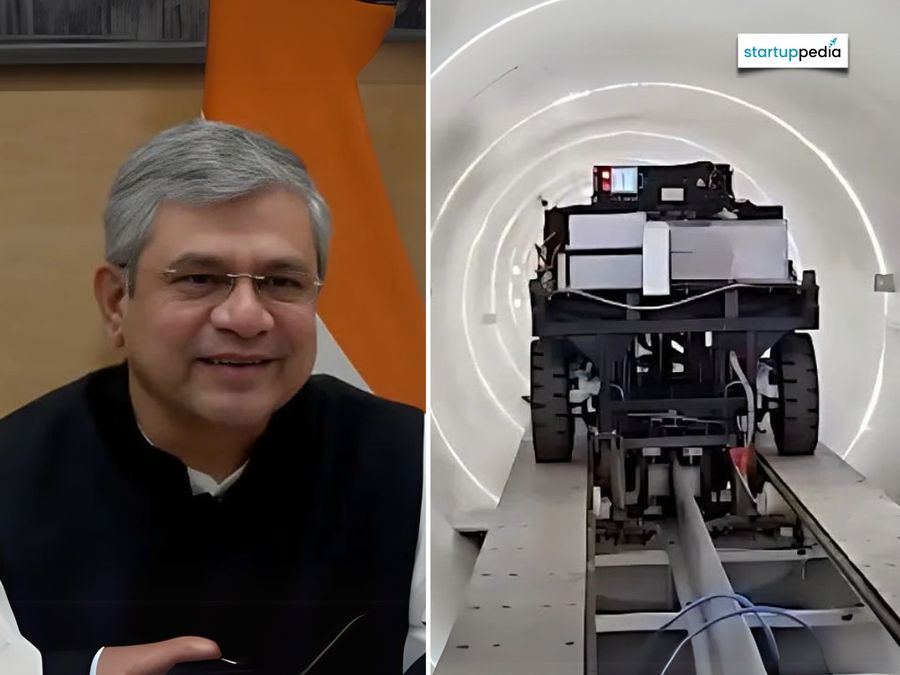

Delhi To Jaipur In 30 Minutes? India's First Hyperloop To Operate At 1,000 Km/Hr, IIT Madras Unveils 422 Meter Test Track

- The Indian Institute of Technology (IIT) Madras has unveiled India's first 422-meter-long hyperloop test track.

- The hyperloop system will transport passengers in pods through low-pressure tubes at speeds exceeding 1,000 km/h, potentially reducing travel time between Delhi and Jaipur to less than 30 minutes.

- Bigshot construction companies such as Larsen & Toubro (L&T) Construction, ArcelorMittal, and Hindalco Industries have contributed to establishing the test track.

- There are plans to create a hyperloop corridor between Chennai and Bengaluru, potentially covering the 350 km distance in just 15 minutes.

Startup Pedia | 25 Feb, 2025

Top gainers & top losers mid-day February 25, 2025: M&M, Bharti Airtel, Bajaj Finance, Adani Enterprises lead gains

- Top gainers mid-day February 25, 2025: M&M, Bharti Airtel, Bajaj Finance, Adani Enterprises lead gains.

- Mahindra & Mahindra stock rose by 3.28% to ₹2,798.

- Bharti Airtel recorded a 2.20% increase to ₹1,636.55.

- Hindalco and Dr. Reddy's Laboratories declined by 3.05% and 2.35% respectively.

HinduBusinessLine | 25 Feb, 2025

Markets open mixed amid global trade tensions, FII selling pressure

- Today's market opened mixed following a sharp sell-off on Monday, with IT and digital indices seeing significant declines.

- The market's bearish sentiment continues amid oversold conditions, fair largecap valuations, and high short positions.

- FII selling pressure remains a concern, reaching ₹43,200 crore in February, leading to foreign outflows.

- Auto and financial stocks led early gains today, with Mahindra & Mahindra as the top performer.

- Metal stocks faced pressure, with Hindalco leading the losers, as cautious sentiment prevails in the market.

- Global uncertainties, including Trump's tariffs and trade disruptions, contribute to market caution.

- Technical analysts highlight critical support zones, emphasizing weak sentiment below specific market levels.

- Nifty approaching a potential fifth consecutive monthly decline, with analysts expecting a bounce after prolonged losses.

- Traders are advised caution given bearish market indicators, with key support and resistance levels identified.

- Market volatility is set to rise with the F&O expiry, while derivative data suggests a bearish sentiment and strong resistance levels.

HinduBusinessLine | 25 Feb, 2025

Hindalco to invest ₹15,000 crore in MP to expand aluminium smelting capacity

- Hindalco plans to invest ₹15,000 crore in Madhya Pradesh to expand aluminium smelting capacity.

- The investment aims to enhance Hindalco's presence and boost the local economy.

- Global trade policies, including tariffs, have a neutral to positive impact on Hindalco's operations.

- The Madhya Pradesh government welcomes the investment as a major step towards strengthening the state's position as a key hub for aluminium production and industrial development.

HinduBusinessLine | 24 Feb, 2025

Sensex drops 425 points as auto stocks skid on EV import duty cut reports, foreign fund outflows

- Equity benchmarks ended lower on Friday, dragged down by automobile stocks following reports of potential cuts in electric vehicle import duties, while continued foreign investor selling and global trade concerns further dampened sentiment.

- Mahindra & Mahindra led the losses, tumbling 6.20 per cent following media reports that the government may slash import duties on electric vehicles from 110 per cent to 15 per cent as Tesla prepares to enter the Indian market.

- Metal stocks bucked the trend, with Hindalco rising 2.09 per cent and Tata Steel gaining 1.85 per cent.

- Foreign institutional investors (FIIs) remained net sellers, offloading ₹33,527.55 crores worth of Indian equities in February so far.

HinduBusinessLine | 21 Feb, 2025

Nifty 50 Top Gainers And Losers On Feb. 21: From Tata Steel, Hindalco To Eicher Motors, BPCL

- The NSE Nifty 50 ended 117.25 points or 0.51% lower at 22,795.90, while the BSE Sensex closed 424.90 points or 0.56% lower at 75,311.06.

- The only sector to end the day in the green was Nifty Metal. The NSE Nifty Auto is the worst performing sector.

- The top gainer for the day was Hindalco Ltd, which gained 2.31% during trade. Tata Steel Ltd. was the next biggest gainer, rising 1.99%. SBI Life Ltd. and Eicher Motors Ltd. shares advanced 1.36% and 1.32%, respectively.

- The top losers were Mahindra and Mahindra Ltd., Adani Ports and Special Economic Zones Ltd., and BPCL Ltd., which declined by 6.15%, 2.66%, and 2.51% respectively.

Bloomberg Quint | 21 Feb, 2025

Hindalco, NALCO, Coal India, JSW Steel, Among Systematix' Top Stock Picks In Metals, Mining After Q3 Results

- Brokerage firm Systematix Institutional Equities has identified Hindalco, NALCO, Coal India, and JSW Steel as the top stock picks in the metals and mining sector after reviewing the Q3 results.

- Jindal Saw, NALCO, Hindalco, Coal India, and JSW Steel are the pecking order of top picks under Systematix's coverage.

- NMDC, MOIL, and Coal India saw better offtake in Q3, supplying key raw materials for the steel and power sectors.

- Systematix also mentioned that these companies performed well during the quarter.

Bloomberg Quint | 19 Feb, 2025

Hindalco Q3 Results Review: Systematix Maintains 'Buy' On The Stock, Lowers Target Price — Here's Why

- Systematix Institutional Equities maintains Buy rating on Hindalco Industries Ltd. stock with a revised target price of Rs 735/share.

- Hindalco Q3 FY25 consolidated Ebitda of Rs 76.0 billion was 11% below the estimated value of Rs 85 billion.

- Hindalco outlines a capex of Rs 400 billion for India upstream business over three-four years for expansions in alumina refinery, aluminium smelter, and copper smelter.

- Access to NDTV Profit exclusive stories, curated newsletters, and research reports are available for subscribers.

Bloomberg Quint | 17 Feb, 2025

.png?rect=0%2C0%2C457%2C240&w=1200&auto=format%2Ccompress&ogImage=true)

Powered by

Hindalco Industries Subsidiaries

Utkal Alumina International

4.0

• 158 reviews

Ryker Base

4.1

• 8 reviews

Hindalco Almex Aerospace

4.2

• 5 reviews

Report error

Compare Hindalco Industries with

Hindustan Zinc

3.8

Nalco

4.2

Steel Authority Of India

4.1

Aditya Birla Group

4.1

Jindal Steel and Power

3.9

Nalco water

4.0

ArcelorMittal Nippon Steel

4.1

Rungta Mines

4.1

Vedanta Resources

3.8

Adani Enterprises

3.8

Carborundum Universal Limited

3.9

Coal India

4.0

CMR Green Technologies

3.7

Jindal Aluminium

3.8

PC Jewellers

3.9

Ashapura Group Of Industries

4.1

Tribhovandas Bhimji Zaveri

4.1

Jindal Power

4.1

TRL Krosaki Refractories

3.9

Nava Limited

3.8

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Write a review

Share interview

Contribute salary

Add office photos

Companies Similar to Hindalco Industries

Tata Steel

Iron & Steel, Manufacturing, Metals & Mining, Power

4.1

• 7.4k reviews

JSW Steel

Iron & Steel, Metals & Mining, Engineering & Construction

3.9

• 5.8k reviews

Vedanta Limited

Metals & Mining

3.8

• 433 reviews

Hindustan Zinc

Metals & Mining

3.8

• 859 reviews

Nalco

Design, Manufacturing, Metals & Mining

4.2

• 214 reviews

Steel Authority Of India

Iron & Steel

4.1

• 571 reviews

Aditya Birla Group

Financial Services, Building Material, Metals & Mining, Telecom, Chemicals

4.1

• 2k reviews

Jindal Steel and Power

Iron & Steel, Power

3.9

• 3k reviews

Nalco water

Chemicals / Agri Inputs, Power, Waste Management

4.0

• 225 reviews

ArcelorMittal Nippon Steel

Iron & Steel, Metals & Mining

4.1

• 2.6k reviews

Rungta Mines

Iron & Steel, Metals & Mining

4.1

• 892 reviews

Vedanta Resources

Metals & Mining, Oil / Gas / Petro Chemicals, Power

3.8

• 750 reviews

Hindalco Industries FAQs

When was Hindalco Industries founded?

Hindalco Industries was founded in 1958. The company has been operating for 67 years primarily in the Metals & Mining sector.

Where is the Hindalco Industries headquarters located?

Hindalco Industries is headquartered in Mumbai, Maharashtra and has an office in Mumbai

How many employees does Hindalco Industries have in India?

Hindalco Industries currently has more than 21,000+ employees in India. Production, Manufacturing & Engineering department appears to have the highest employee count in Hindalco Industries based on the number of reviews submitted on AmbitionBox.

Does Hindalco Industries have good work-life balance?

Hindalco Industries has a work-life balance rating of 4.0 out of 5 based on 3,000+ employee reviews on AmbitionBox. 82% employees rated Hindalco Industries 4 or above on work-life balance. This rating reflects the company's efforts to help employees maintain a healthy balance between their personal and professional lives. We encourage you to read Hindalco Industries work-life balance reviews for more details

Is Hindalco Industries good for career growth?

Career growth at Hindalco Industries is rated fairly well, with a promotions and appraisal rating of 3.5. 82% employees rated Hindalco Industries 4 or above, while 18% employees rated it 3 or below on promotions/appraisal. Though the sentiment is mixed for career growth, majority employees have rated it positively. We recommend reading Hindalco Industries promotions/appraisals reviews for more detailed insights.

What are the pros of working in Hindalco Industries?

Working at Hindalco Industries offers several advantages that make it an appealing place for employees. The company is highly rated for job security, skill development and company culture, based on 3,000+ employee reviews on AmbitionBox.

Recently Viewed

LIST OF COMPANIES

Fleetguard Filters

Overview

LIST OF COMPANIES

Transsion

Overview

JOBS

Mahindra Susten

No Jobs

SALARIES

Fleetguard Filters

No Salaries

JOBS

Fedbank Financial Services

No Jobs

JOBS

Utkarsh Small Finance Bank

No Jobs

SALARIES

Transsion

No Salaries

JOBS

Equitas Small Finance Bank

No Jobs

JOBS

Hewlett Packard Enterprise

No Jobs

REVIEWS

India Japan Lighting

No Reviews

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

70 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app