Add office photos

Employer?

Claim Account for FREE

Development Bank of the Philippines

5.0

based on 2 Reviews

About Development Bank of the Philippines

Founded in--

India Employee Count--

Global Employee Count--

Headquarters--

Office Locations

--

Websitedbp.ph

Primary Industry

--

Other Industries

--

Are you managing Development Bank of the Philippines's employer brand? To edit company information,

claim this page for free

Managing your company's employer brand?

Claim this Company Page for FREE

Development Bank of the Philippines Ratings

based on 2 reviews

Overall Rating

5.0/5

How AmbitionBox ratings work?

5

2

4

0

3

0

2

0

1

0

Category Ratings

5.0

Company culture

4.9

Work satisfaction

4.0

Job security

4.0

Salary

4.0

Work-life balance

4.0

Skill development

4.0

Promotions

Development Bank of the Philippines is rated 5.0 out of 5 stars on AmbitionBox, based on 2 company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Development Bank of the Philippines Reviews

Compare Development Bank of the Philippines with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 5.0/5 based on 2 reviews | 3.7/5 based on 91.3k reviews | 3.7/5 based on 53.9k reviews | 3.8/5 based on 57.5k reviews |

Highly Rated for | Company culture Work satisfaction Skill development | Job security Work-life balance | Job security | Job security Company culture |

Critically Rated for | No critically rated category | Promotions Salary Work satisfaction | Promotions Salary | Promotions |

Primary Work Policy | - | Work from office 81% employees reported | Hybrid 62% employees reported | Hybrid 74% employees reported |

Rating by Women Employees | - no rating available | 3.7 Good rated by 26.5k women | 3.8 Good rated by 15.5k women | 3.9 Good rated by 21.6k women |

Rating by Men Employees | - no rating available | 3.6 Good rated by 59.6k men | 3.7 Good rated by 36k men | 3.8 Good rated by 33.3k men |

Job security | 4.0 Good | 4.5 Good | 3.8 Good | 3.8 Good |

View more

Development Bank of the Philippines Salaries

Development Bank of the Philippines salaries have received with an average score of 4.0 out of 5 by 2 employees.

Senior Lead Manager

(1 salaries)

Unlock

₹96 L/yr - ₹1.1 Cr/yr

Development Bank of the Philippines News

View all

DBP’s net earnings rise 20% to P7.1 billion

- The Development Bank of the Philippines (DBP) recorded a 20% increase in net profit, reaching P7.1 billion in 2024.

- DBP's net income exceeded its target of P5.5 billion, making it the highest in the past 10 years.

- The growth in net income was driven by a 13% increase in net core earnings, primarily due to increased lending activities.

- DBP's total loans expanded by 5% to P536.8 billion in 2024, with significant funding allocated for infrastructure and logistics, social infrastructure, and community development projects.

Bworldonline | 21 Feb, 2025

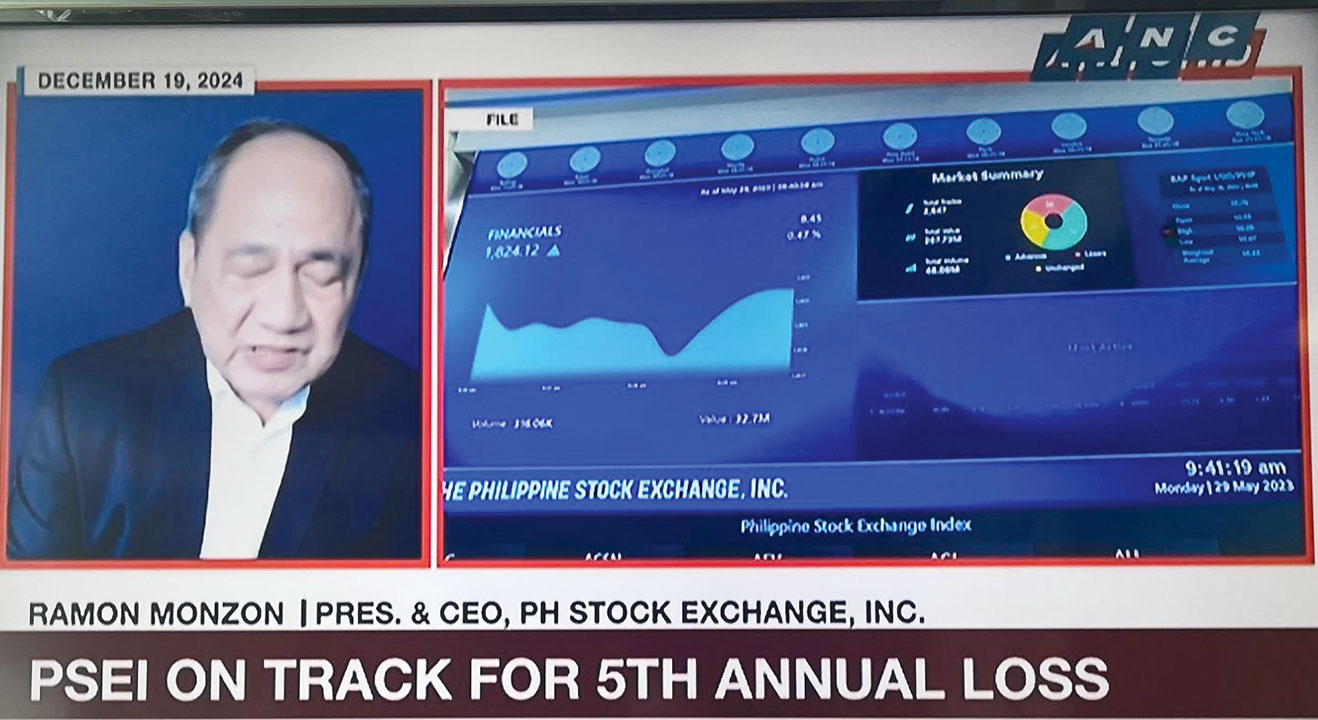

Reviving the Philippine stock market: The OECD Report

- The Philippine stock market is struggling and is currently bed-ridden despite the recovery of other ASEAN stock markets from COVID-19 pandemic.

- The Organization for Economic Co-operation and Development (OECD) has issued a report entitled 'OECD Capital Market Review of the Philippines 2024.'

- The report suggests that the Philippine stock market lacks supply of listed companies instead of demand for stocks.

- To address this, the OECD proposed two strategies: tapping private companies and State-Owned Enterprises (SOEs) for listing.

- The report notes that there are 411 unlisted companies in the Philippines, which are suitable candidates for listing.

- The listing of SOEs through minority stakes could lead to alternate sources of funding outside government funds.

- SOEs as listed enterprises provide the government, as a majority stockholder, with information on the competence and performance of appointed managers.

- Dr. Victor S. Limlingan explains that the OECD report provides the Philippine Stock Exchange with a viable strategy for revival.

- OECD Report suggests that the provision of incentives like the exemption from Bureau of Internal Revenue audits to all listed companies could draw potential candidates for listing.

- The listing of SOEs, especially banks like the Land Bank of the Philippines and the Development Bank of the Philippines, could strengthen the Capital Market.

Bworldonline | 7 Feb, 2025

Bicam report on capital markets reform OKd

- The bicameral conference report on a measure to cut the tax on stock transactions to 0.1% from 0.6% has been ratified by the Senate and House of Representatives.

- The report also included the measure to raise the capital of the Development Bank of the Philippines (DBP).

- The Capital Markets Efficiency Promotions Act aims to promote capital market development, increase capital mobility, and enhance financial inclusion.

- Lowering the stock transaction tax is expected to boost stock market's trading volume to P4.9 trillion by 2029.

Bworldonline | 6 Feb, 2025

DBP bags citations for corporate governance

- Development Bank of the Philippines (DBP) has been recognized for its consistent adherence to good corporate governance principles.

- DBP scored the second highest ranking in the Corporate Governance Scorecard (CGS) ratings of the Governance Commission for GOCCs (GCG).

- DBP received special awards such as the GOCCs for Sustainability Award and Special Recognitions for consistent high scores in CGS ratings.

- DBP aims to continue being a paragon of good corporate governance in the public sector.

Bworldonline | 31 Jan, 2025

House OKs DBP charter on final reading

- The House of Representatives approved a bill on third reading that replaces the charter of Development Bank of the Philippines (DBP).

- The new charter raises DBP's authorized capital stock to P300 billion and allows it to conduct an initial public offering.

- The amended charter aims to strengthen DBP's financial position and give it easier access to capital markets.

- The government plans to retain a 70% stake in DBP and intends to improve the bank before considering partial privatization.

Bworldonline | 28 Jan, 2025

DBP charter changes to support capital position

- Proposed changes to the charter of the Development Bank of the Philippines (DBP) could support its capital position.

- The changes would allow public ownership, contribute to capital restoration, and boost the bank's credit profile.

- Fitch Ratings stated that the proposed amendments are unlikely to impact the bank's issuer default ratings (IDR) but could positively affect its standalone credit profile.

- The amendments include increasing the bank's capital to PHP 300 billion, allowing public listing, and engaging in financial leasing for government projects.

Bworldonline | 20 Jan, 2025

DBP raises P11 billion from dual-tenor bond offer

- The Development Bank of the Philippines (DBP) has raised P11 billion from its offering of dual-tenor fixed rate notes.

- The offering of fixed rate Series 6A and 6B bonds was oversubscribed by five-and-a-half times compared to the initial P2-billion program.

- The Series 6A bonds have a tenor of 1.5 years and were priced at 6.0503% per annum, while the Series 6B bonds mature in three years and carry an annual interest rate of 6.1294%.

- This marks the first time that the state-run bank issued dual-tenor bonds, as part of DBP's effort to diversify funding sources and boost lending.

Bworldonline | 16 Jan, 2025

LANDBANK, DBP looking to issue bonds this year

- Land Bank of the Philippines (LANDBANK) and Development Bank of the Philippines (DBP) are planning to conduct bond offerings this year to raise fresh funds.

- LANDBANK is aiming to tap the domestic debt market in the second quarter and hopes to raise at least P10 billion.

- LANDBANK intends to issue peso-denominated papers with a tenor of at least five years to match its peso-based projects, particularly in renewable and clean energy.

- DBP, on the other hand, is considering issuing bonds with a tenor of at least five years towards the latter part of the year, aiming to raise around P5 to P10 billion.

Bworldonline | 13 Jan, 2025

S&P revises ratings outlook for DBP, PSALM to ‘positive’

- S&P GLOBAL RATINGS has revised its ratings outlook for the Development Bank of the Philippines (DBP) and the Power Sector Assets and Liabilities Management Corp. (PSALM) to “positive” from “stable” to reflect the change in its outlook for the Philippines’ sovereign rating.

- The debt watcher affirmed the Philippines’ investment grade rating and revised its outlook to reflect their positive view of the economy amid improved institutional strength.

- S&P Global affirmed DBP’s “BBB” long-term foreign- and local-currency issuer default ratings on March 21.

- PSALM holds a “BBB+” long-term foreign- and local-currency issuer default rating with the debt watcher.

Bworldonline | 26 Nov, 2024

House body OKs DBP capital hike

- The House of Representatives committee has approved a bill to increase the capital stock of the Development Bank of the Philippines (DBP) from P35 billion to P300 billion.

- The bill aims to update DBP's charter to enhance its capacity in funding infrastructure projects and loans for small businesses.

- Under the bill, the National Government will be required to own 70% of DBP's capital stock at all times.

- The bill also expands DBP's mandate to fund government programs for economic growth and productivity.

Bworldonline | 18 Nov, 2024

Powered by

Compare Development Bank of the Philippines with

Cognizant

3.7

Capgemini

3.7

HDFC Bank

3.9

Infosys

3.6

ICICI Bank

4.0

HCLTech

3.5

Tech Mahindra

3.5

Genpact

3.8

Teleperformance

3.9

Concentrix Corporation

3.8

Axis Bank

3.8

Amazon

4.1

Jio

4.0

iEnergizer

4.6

Reliance Retail

3.9

IBM

4.0

LTIMindtree

3.8

HDB Financial Services

3.9

Larsen & Toubro Limited

4.0

Deloitte

3.8

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to Development Bank of the Philippines

Infosys

Consulting, IT Services & Consulting

3.6

• 40.1k reviews

ICICI Bank

Financial Services, Banking

4.0

• 38.7k reviews

HCLTech

Telecom, Education & Training, Hardware & Networking, Banking, Emerging Technologies, IT Services & Consulting, Software Product

3.5

• 36.8k reviews

Tech Mahindra

BPO/KPO, Consulting, Analytics & KPO, Engineering & Construction, IT Services & Consulting

3.5

• 35.7k reviews

Genpact

Financial Services, EdTech, IT Services & Consulting

3.8

• 32.1k reviews

Teleperformance

BPO, IT Services & Consulting, Software Product

3.9

• 30.2k reviews

Development Bank of the Philippines FAQs

What are the pros of working in Development Bank of the Philippines?

Working at Development Bank of the Philippines offers several advantages that make it an appealing place for employees. The company is highly rated for company culture, work satisfaction and job security, based on 2 employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app