Add office photos

Employer?

Claim Account for FREE

Bessemer Venture Partners

5.0

based on 3 Reviews

About Bessemer Venture Partners

Founded in--

India Employee Count--

Global Employee Count--

Headquarters--

Office Locations

--

Websitebvp.com

Primary Industry

--

Other Industries

--

Are you managing Bessemer Venture Partners's employer brand? To edit company information,

claim this page for free

Managing your company's employer brand?

Claim this Company Page for FREE

Bessemer Venture Partners Ratings

based on 3 reviews

Overall Rating

5.0/5

How AmbitionBox ratings work?

5

3

4

0

3

0

2

0

1

0

Category Ratings

5.0

Salary

5.0

Work-life balance

4.5

Company culture

4.5

Job security

4.5

Promotions

4.5

Work satisfaction

4.2

Skill development

Bessemer Venture Partners is rated 5.0 out of 5 stars on AmbitionBox, based on 3 company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Bessemer Venture Partners Reviews

Compare Bessemer Venture Partners with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 5.0/5 based on 3 reviews | 3.7/5 based on 92.1k reviews | 3.7/5 based on 54.4k reviews | 3.8/5 based on 58.2k reviews |

Highly Rated for | Work-life balance Salary Job security | Job security Work-life balance | Job security | Job security |

Critically Rated for | No critically rated category | Promotions Salary Work satisfaction | Promotions Salary | Promotions |

Primary Work Policy | - | Work from office 81% employees reported | Hybrid 61% employees reported | Hybrid 75% employees reported |

Rating by Women Employees | - no rating available | 3.7 Good rated by 26.7k women | 3.8 Good rated by 15.6k women | 3.8 Good rated by 21.9k women |

Rating by Men Employees | - no rating available | 3.6 Good rated by 60.2k men | 3.7 Good rated by 36.3k men | 3.8 Good rated by 33.7k men |

Job security | 4.5 Good | 4.5 Good | 3.8 Good | 3.8 Good |

View more

Bessemer Venture Partners Salaries

Bessemer Venture Partners salaries have received with an average score of 5.0 out of 5 by 3 employees.

Valuation Analyst

(4 salaries)

Unlock

₹13.5 L/yr - ₹17 L/yr

Senior Analyst

(4 salaries)

Unlock

₹18 L/yr - ₹30 L/yr

Analyst

(2 salaries)

Unlock

₹17.3 L/yr - ₹22.2 L/yr

Data Analyst

(2 salaries)

Unlock

₹7.9 L/yr - ₹10.1 L/yr

Event and Marketing Manager

(2 salaries)

Unlock

₹18 L/yr - ₹23 L/yr

Investment Accounting Analyst

(2 salaries)

Unlock

₹12.5 L/yr - ₹15.9 L/yr

Project Manager

(1 salaries)

Unlock

₹0.9 L/yr - ₹1.2 L/yr

HR Generalist

(1 salaries)

Unlock

₹11.3 L/yr - ₹14.4 L/yr

Tax Analyst

(1 salaries)

Unlock

₹10.4 L/yr - ₹13.2 L/yr

Senior Tax Analyst

(1 salaries)

Unlock

₹13.5 L/yr - ₹17.2 L/yr

Bessemer Venture Partners News

View all

AI’s coming to the classroom: Brisk raises $15M after a quick start in school

- AI edtech startup Brisk raises $15 million in funding to help teachers identify signs of AI-generated work in student writing and offer additional tools through its platform.

- Brisk's platform offers around 40 tools for teachers and students to use, including generative AI and computer vision features to enhance various educational tasks.

- The company aims to build an AI-native edtech stack and plans to expand to more platforms, such as a Microsoft integration in autumn 2025.

- Brisk has shown significant growth, with a five-fold increase in its user base and a 40x revenue growth in 2024, serving over 2,000 schools in 100 countries.

- The funding round is led by Bessemer Venture Partners, with previous backers Owl Ventures, South Park Commons, and Springbank Collective also participating.

- The convergence of technology and education is evident, with AI playing a crucial role in improving learning experiences despite some concerns about data protection and accuracy.

- Brisk focuses on providing assistance through AI tools, like a student writing inspector and Targeted Feedback, emphasizing collaboration and enhancement rather than replacement.

- The company plans to introduce new immersive tools and integrations, including support for image-based work submissions and a podcast feature for audio versions of documents.

- AI's integration into education technology is embraced by educators seeking improved workflows, with Brisk aiming to enhance collaboration and efficiency within the educational environment.

- The trend towards AI adoption in edtech is clear, with educators actively seeking AI solutions that complement their work rather than aiming to replace human involvement entirely.

- Brisk's approach to AI in education reflects a measured use of technology to support teachers and enhance student learning experiences, signaling a shift towards more AI-powered tools in educational settings.

TechCrunch | 26 Mar, 2025

Protectt.ai secures Rs 76 Cr in Series A funding led by Bessemer Venture Partners

- Indian cybersecurity firm Protectt.ai has secured Rs 76 crore in Series A funding round led by Bessemer Venture Partners.

- The funding will be used to accelerate product innovation, improve customer experience, and expand global footprint.

- The company plans to develop AI-driven security solutions and strengthen mobile threat intelligence research capabilities.

- Protectt.ai covers over 300 million smartphones, securing more than 2 billion mobile app sessions per month.

Yourstory | 18 Mar, 2025

Protectt.ai Bags INR 76 Cr To Help Enterprises Protect Apps Against Cyber Fraud

- Mobile app security startup Protectt.ai has raised INR 76 Cr (about $8.7 Mn) in a Series A funding round led by Bessemer Venture Partners.

- Protectt.ai plans to use the funding to enhance its AI-driven mobile security platform, develop new AI security solutions, expand internationally, and hire cybersecurity talent.

- Founded in 2020, Protectt.ai provides mobile threat defence solutions and acts as a compliance hub for mobile app owners, ensuring adherence to regulations from entities such as RBI, SEBI, and NPCI.

- The company claims to cover over 300 Mn smartphones, processes 2 Bn mobile app sessions per month, and prevents 200 Mn cyber threats and fraud attempts.

Inc42 | 18 Mar, 2025

Indian VCs Pile Up On SaaS Deals In Chase For AI Gold

- Indian VCs and startup investors in search of moat against big tech giants are focusing on AI and SaaS investments amidst global shifts.

- The resilience and innovation of India's SaaS sector amidst market disruptions open doors for AI advancements and convergence in enterprise tech.

- AI giants like OpenAI, Anthropic, Google, and Meta, along with newer models like DeepSeek, are shaping the competitive landscape and fueling AI in SaaS investments.

- GenAI models integration into SaaS products attracts significant venture capital interest, driving a surge in deals for Indian startups in enterprise tech.

- Recent SaaS deals in India include investments in companies like Darwinbox, Innovaccer, Spotdraft, Atomicwork, SuperOps, and TrueFoundry, emphasizing AI for growth.

- Bessemer Venture Partners closes a fund focusing on sectors like AI-enabled services, SaaS, fintech, and digital health, reflecting the broader AI investment trend.

- AI integration becoming imperative for businesses like Zomato, reflecting the shift towards AI-first strategies and the importance of AI in shaping SaaS future.

- Transition towards AI-first SaaS is evident in leadership changes at companies like Freshworks and Zoho, with a growing preference for vertical GenAI startups.

- Investors favor specialized AI applications that cater to industry-specific challenges, influencing the evolution of AI-driven SaaS offerings in India.

- AI-powered SaaS solutions witness increased adoption in healthcare, finance, and ecommerce sectors, illustrating their transformative potential across industries.

- Despite challenges like global market dynamics, Indian SaaS startups' focus on profitability, scalability, and innovation will be key to sustaining investor confidence.

Inc42 | 13 Mar, 2025

A microcosm of global industry; Zolve bags $251M boost

- Starlink, in partnership with Bharti Airtel, plans to distribute devices in India through Airtel's retail network.

- Elon Musk's companies, including SpaceX and Tesla, face challenges, with Tesla's shares plunging and Musk's social media platform experiencing outages.

- US President Donald Trump expressed support for Musk amid his business struggles, offering to buy one of his cars.

- MrBeast, known for his YouTube videos, has a lucrative chocolate business called Feastables.

- Guardian Life Insurance Company of America operates a global capability centre in India, focusing on technology innovations for the American market.

- Zolve, a cross-border neobank, raised $251 million in funding to expand its financial services globally.

- Bessemer Venture Partners closed a $350 million India-focused fund, prioritizing investments in emerging sectors such as AI, SaaS, fintech, and cybersecurity.

- Meta is testing its first in-house chip for training AI systems to reduce reliance on external suppliers.

- Nissan CEO Makoto Uchida will step down, with current Chief Planning Officer Ivan Espinosa set to take over.

- Crypto exchange Coinbase registered with India's Financial Intelligence Unit to offer crypto trading services in the country.

Yourstory | 12 Mar, 2025

Exclusive: Innoviti Nets INR 35 Cr From Existing Backers To Fuel Business Growth

- Indian fintech Innoviti Technologies has raised INR 35 Cr ($4 Mn) in a funding round.

- Existing investors including angel investor Ashutosh Joshi and Bessemer Venture Partners participated.

- The funding will be used to support the company's business growth.

- Innoviti Technologies is planning to go public in fiscal year 2025-26.

Inc42 | 7 Mar, 2025

How digital payments company Easebuzz quietly broke into the big league

- Pune-based startup Easebuzz is on track to close FY25 with a net profit of Rs 25 crore, despite modest funding of $4 million.

- The company is projected to end FY25 with a gross revenue of Rs 650 crore and a significant rise in net profit compared to the previous year.

- Easebuzz has benefitted from regulatory restrictions on larger payment aggregators, experiencing substantial business growth and profitability.

- The startup is expected to secure a Rs 350 crore equity infusion round led by Bessemer Venture Partners, elevating its valuation to around Rs 1,700 crore.

- Easebuzz focuses on software services and payments for small businesses, with a noticeable presence in the education sector for fee collections.

- The firm's Saas-cum-payments model helps generate revenue and build reliable systems for SMEs at a low cost, earning 35% of its revenue from Saas currently.

- Easebuzz is expanding its services to large enterprise clients and aims for a sustainable balance sheet, eyeing a public listing by fiscal 2029.

- The startup plans to venture into offline payments and cross-border transactions, aiming to enhance its offerings in the digital payments space.

- Despite competition from industry giants like Razorpay, Cashfree, and Pine Labs, Easebuzz's lean operations and unique business strategy position it for future growth.

- With recognition as a technology service provider by NPCI Bharat BillPay, Easebuzz is looking to centralize fee payments in colleges and universities through the Bharat Connect platform.

Economic Times | 5 Mar, 2025

Anthropic’s $61.5B Valuation Will Accelerate Its AI Development & Global Expansion Ambitions

- Anthropic secures $3.5 billion in Series E funding, reaching a post-money valuation of $61.5 billion.

- Backed by investors like Lightspeed Venture Partners and Bessemer Venture Partners, Anthropic plans to further develop its AI systems.

- Anthropic introduces groundbreaking updates to its AI models, expanding capabilities in coding and problem-solving.

- The funding will support global expansion and research into AI alignment, ensuring ethical and reliable operation.

Eweek | 5 Mar, 2025

[Update] Bessemer-Backed Rupifi To Raise $2 Mn Via Rights Issue

- B2B fintech startup Rupifi is raising $2 Mn through a rights issue.

- The funds will be raised from existing investors, including Bessemer Venture Partners, Ankur Capital, and Quona Capital.

- Rupifi plans to issue 66,427 pre-Series B3 compulsorily convertible preference shares (CCPS) to raise the funds.

- The company offers B2B transaction and payment solutions and has raised previous rounds of funding.

Inc42 | 3 Mar, 2025

![[Update] Bessemer-Backed Rupifi To Raise $2 Mn Via Rights Issue](https://inc42.com/cdn-cgi/image/quality=75/https://asset.inc42.com/2025/03/rupifi-social.jpg)

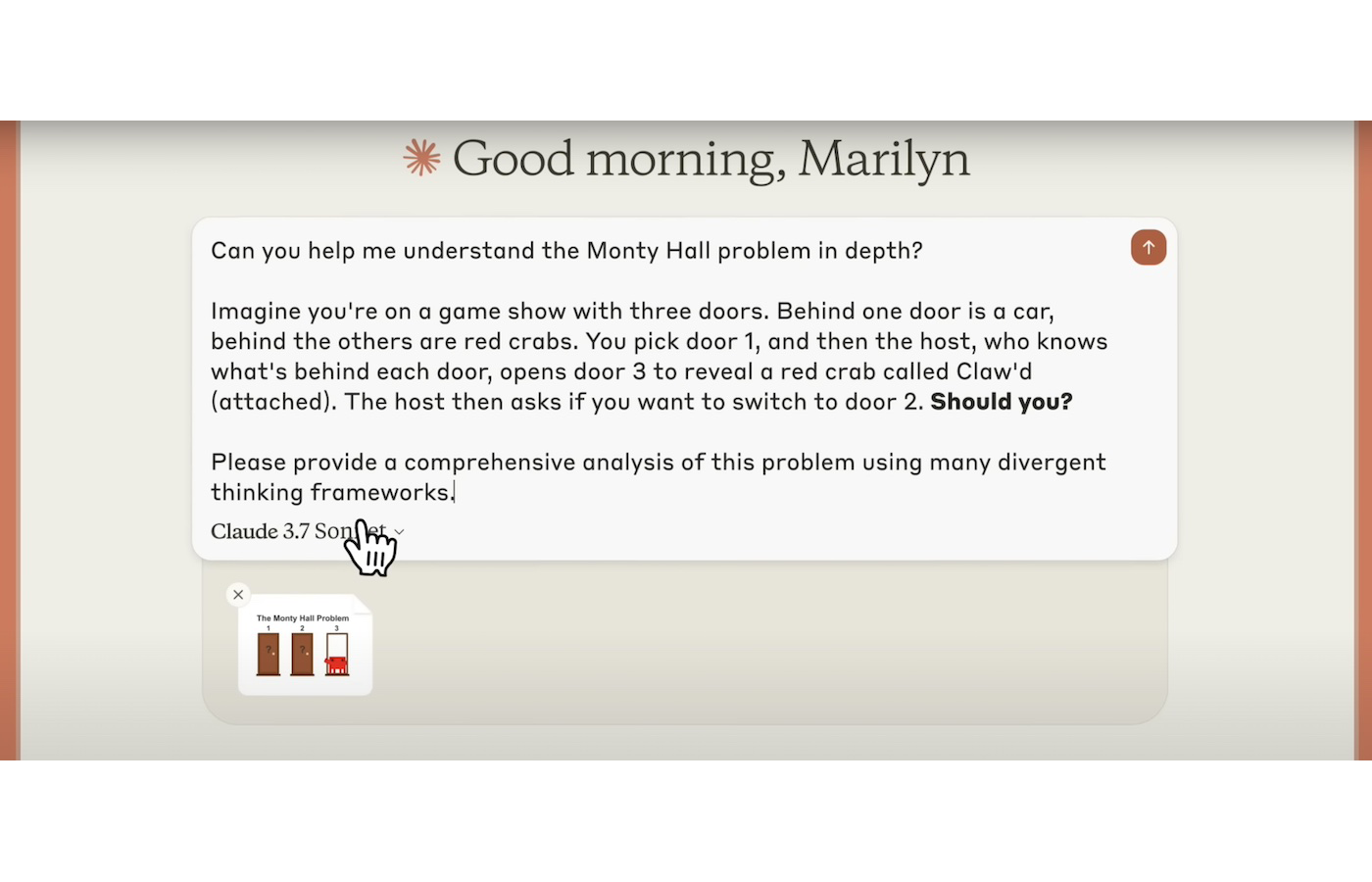

Anthropic Debuts Different Levels of Reasoning for Claude, Announces $3.5 Billion Fundraise

- Anthropic has introduced new features for its AI chatbot, Claude, including hybrid reasoning capabilities.

- Claude 3.7 Sonnet can respond instantly or provide step-by-step thinking visible to the user.

- Anthropic also announced a $3.5 billion fundraise, raising its valuation to $61.5 billion.

- Participants in the funding round include Lightspeed Venture Partners, General Catalyst, and Bessemer Venture Partners.

Pymnts | 25 Feb, 2025

Powered by

Compare Bessemer Venture Partners with

Cognizant

3.7

Capgemini

3.7

HDFC Bank

3.9

Infosys

3.6

ICICI Bank

4.0

HCLTech

3.5

Tech Mahindra

3.5

Genpact

3.8

Teleperformance

3.9

Concentrix Corporation

3.7

Axis Bank

3.7

Amazon

4.0

Jio

4.0

iEnergizer

4.6

Reliance Retail

3.9

IBM

4.0

LTIMindtree

3.7

HDB Financial Services

3.9

Larsen & Toubro Limited

3.9

Deloitte

3.8

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to Bessemer Venture Partners

Infosys

Consulting, IT Services & Consulting

3.6

• 40.5k reviews

ICICI Bank

Financial Services, Banking

4.0

• 39k reviews

HCLTech

Telecom, Education & Training, Hardware & Networking, Banking, Emerging Technologies, IT Services & Consulting, Software Product

3.5

• 37.2k reviews

Tech Mahindra

BPO/KPO, Consulting, Analytics & KPO, Engineering & Construction, IT Services & Consulting

3.5

• 36.1k reviews

Genpact

Financial Services, EdTech, IT Services & Consulting

3.8

• 32.4k reviews

Teleperformance

BPO, IT Services & Consulting, Software Product

3.9

• 30.4k reviews

Bessemer Venture Partners FAQs

What are the pros of working in Bessemer Venture Partners?

Working at Bessemer Venture Partners offers several advantages that make it an appealing place for employees. The company is highly rated for salary & benefits, work life balance and company culture, based on 3 employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app