Add office photos

Employer?

Claim Account for FREE

HSBC Group

3.9

based on 4.9k Reviews

Video summary

Proud winner of ABECA 2024 - AmbitionBox Employee Choice Awards

Company Overview

Associated Companies

Company Locations

Working at HSBC Group

Company Summary

HSBC, one of the largest banking and financial services institutions in the world, serves millions of customers through its four Global Businesses.

Overall Rating

3.9/5

based on 4.9k reviews

3% above

industry average

Highly rated for

Job security, Company culture, Work-life balance

Critically rated for

Promotions

Work Policy

Hybrid

87% employees reported

Monday to Friday

84% employees reported

Flexible timing

65% employees reported

No travel

74% employees reported

View detailed work policy

Top Employees Benefits

Job/Soft skill training

783 employees reported

Office cab/shuttle

750 employees reported

Health insurance

740 employees reported

Cafeteria

672 employees reported

View all benefits

About HSBC Group

Founded in1865 (160 yrs old)

India Employee Count10k-50k

Global Employee Count1 Lakh+

India HeadquartersPune, Maharashtra, India

Office Locations

Websitehsbc.com

Primary Industry

Other Industries

Are you managing HSBC Group's employer brand? To edit company information,

claim this page for free

View in video summary

Opening up a world of opportunity for our customers, investors, ourselves and the planet. We're a financial services organisation that serves more than 40 million customers, ranging from individual savers and investors to some of the world’s biggest companies and governments. Our network covers 63 countries and territories, and we’re here to use our unique expertise, capabilities, breadth and perspectives to open up a world of opportunity for our customers. HSBC is listed on the London, Hong Kong, New York, and Bermuda stock exchanges.

Managing your company's employer brand?

Claim this Company Page for FREE

AmbitionBox Best Places to Work in India Awards

Best of the best, rated by employees

HSBC Group won India’s Largest Employee Choice Awards in Large Companies Category.

#4 Top Rated Banking Company

Share

HSBC Group Ratings

based on 4.9k reviews

Overall Rating

3.9/5

How AmbitionBox ratings work?

5

2.2k

4

1.5k

3

639

2

227

1

326

Category Ratings

4.0

Job security

3.9

Company culture

3.9

Work-life balance

3.7

Skill development

3.6

Work satisfaction

3.5

Salary

3.2

Promotions

HSBC Group is rated 3.9 out of 5 stars on AmbitionBox, based on 4.9k company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at HSBC Group

based on 4.6k reviews

3.8

Rated by 1.6k Women

Rated 4.0 for Job security and 3.8 for Work-life balance

4.0

Rated by 3k Men

Rated 4.0 for Work-life balance and 4.0 for Job security

Work Policy at HSBC Group

based on 643 reviews in last 6 months

Hybrid

87%

Work from office

10%

Permanent work from home

3%

HSBC Group Reviews

Top mentions in HSBC Group Reviews

+ 5 more

Compare HSBC Group with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 3.9/5 based on 4.9k reviews | 3.8/5 based on 6.6k reviews | 3.9/5 based on 6.3k reviews | 3.9/5 based on 4.7k reviews |

Highly Rated for | Job security Work-life balance Company culture | Work-life balance Job security | Job security Skill development Salary | Salary |

Critically Rated for | Promotions | Promotions Skill development | Promotions | No critically rated category |

Primary Work Policy | Hybrid 87% employees reported | Hybrid 84% employees reported | Hybrid 61% employees reported | Work from office 82% employees reported |

Rating by Women Employees | 3.8 Good rated by 1.6k women | 3.9 Good rated by 2.1k women | 3.8 Good rated by 2.2k women | 3.9 Good rated by 173 women |

Rating by Men Employees | 4.0 Good rated by 3k men | 3.8 Good rated by 4.3k men | 4.0 Good rated by 3.8k men | 3.9 Good rated by 4.3k men |

Job security | 4.0 Good | 3.9 Good | 4.0 Good | 3.7 Good |

View more

HSBC Group Salaries

HSBC Group salaries have received with an average score of 3.5 out of 5 by 4.9k employees.

Senior Software Engineer

(1.7k salaries)

Unlock

₹7.6 L/yr - ₹26 L/yr

Assistant Vice President

(1.5k salaries)

Unlock

₹13.8 L/yr - ₹46 L/yr

Software Engineer

(1.4k salaries)

Unlock

₹5 L/yr - ₹14.5 L/yr

Consultant Specialist

(1.2k salaries)

Unlock

₹11 L/yr - ₹35 L/yr

Analyst

(1.2k salaries)

Unlock

₹4.4 L/yr - ₹18 L/yr

Senior Analyst

(1k salaries)

Unlock

₹5.5 L/yr - ₹23 L/yr

Customer Service Executive

(885 salaries)

Unlock

₹1.1 L/yr - ₹7 L/yr

Senior Consultant Specialist

(649 salaries)

Unlock

₹14 L/yr - ₹46.2 L/yr

Associate Vice President

(633 salaries)

Unlock

₹11.4 L/yr - ₹45.6 L/yr

Business Analyst

(452 salaries)

Unlock

₹8 L/yr - ₹30 L/yr

HSBC Group Interview Questions

Interview questions by designation

Top HSBC Group interview questions and answers

Get interview-ready with top interview questions

HSBC Group Jobs

Popular Designations HSBC Group Hires for

Current Openings

HSBC Group News

View all

HSBC lays off mid-senior level employees as part of cost-cutting measures

- HSBC laid off mid-senior level employees as part of cost-cutting measures. The affected employees were at the vice president level and above, and did not receive any bonuses.

- This move is unusual for HSBC, known for treating its employees well. However, given the current economic challenges and the need for cost management, the bank had to prioritize profitability.

- Since Georges Elhedery became CEO, HSBC has been focusing on growth areas to enhance profitability in the investment-banking division.

- In January, HSBC had already indicated lower bonuses and cost reduction efforts. The bank intended to be fair in rewarding employees based on performance.

HRKatha | 28 Mar, 2025

Another big bank has slashed its stock-market outlook amid soaring economic uncertainty

- HSBC has downgraded its rating of US stocks from "overweight" to "neutral" due to the risk of a potential recession and weak economic data.

- The uncertainty around tariffs could continue to challenge the performance of US equities in the short term.

- Manufacturing activity and expectations for future activity have weakened, while job market expectations have also fallen.

- Citi, Goldman Sachs, RBC, and Barclays have also trimmed their price targets for the S&P 500, reflecting more muted expectations for the US market.

Insider | 26 Mar, 2025

HSBC Shifts Investment Banking Focus to Asia, Middle East Amid Global Restructuring

- HSBC Holdings plans to ramp up investment banking efforts in Asia and the Middle East following a strategic retreat from the US and Europe.

- Reallocating $1.5 billion in cost savings towards areas of growth, HSBC aims to strengthen debt and financing capabilities globally and sharpen its presence in Middle Eastern equity capital markets and M&A advisory.

- The bank has undergone a restructuring under CEO Georges Elhedery's leadership, merging commercial and investment banking units, designating standalone businesses in the UK and Hong Kong, and scaling back equity and M&A activities in Western markets.

- HSBC expects to incur $1.8 billion in restructuring charges over the next two years, with most decisions already finalized, and has reduced senior management ranks.

Fintechnews | 26 Mar, 2025

Globalisation may have run its course in current form, says HSBC chair

- Globalisation "may have now run its course" in its current form, according to the chair of HSBC.

- Trade tensions and US tariffs pose a serious potential risk to global growth.

- Geopolitical uncertainties may lead to stronger economic ties between regional groups and trade blocs.

- The balance of economic power has changed, and new opportunities will arise from stronger economic ties between different political groupings.

Guardian | 25 Mar, 2025

JFC taps global banks for US dollar bond issuance

- Jollibee Foods Corp. (JFC) plans to issue US dollar-denominated bonds for growth plans and debt reduction.

- JFC appointed J.P. Morgan Securities Asia and Morgan Stanley Asia as joint global coordinators and bookrunners for the bond offering.

- The company also engaged BPI Capital Corp. and HSBC Singapore branch as joint lead managers and bookrunners.

- Proceeds from the offering will be used for general corporate purposes and/or refinancing existing borrowings.

Bworldonline | 25 Mar, 2025

Shriram Finance, Cholamandalam, Bajaj Finance, SBI Cards Preferred By HSBC Global Research

- HSBC Global Research has preferred Shriram Finance Ltd., Cholamandalam Investment and Finance Co Ltd., Bajaj Finance Ltd., and SBI Cards & Payment Services Ltd.

- HSBC Global Research found balance transfer in floating rate loans to be high and noted the rising competition in some segments, while asset quality remained stable.

- In the housing finance sector, HSBC Global Research expects underperformance in the declining interest rate scenario and reduced rating for Bajaj Housing Finance Ltd.

- HSBC Global Research mentions stable asset quality outlook in the vehicle finance segment, with Shriram Finance Ltd. and Cholamandalam Investment and Finance Co. being key beneficiaries.

Bloomberg Quint | 25 Mar, 2025

HSBC Flash India PMI: Private Sector Closes FY25 Strong As Manufacturing Sales Growth Quickens

- India's private sector ends FY25 on a strong note, with manufacturing sector reporting growth in sales and output.

- HSBC Flash India Composite Output Index stable at 58.6 in March, indicating a sharp rate of expansion.

- HSBC Flash India Manufacturing PMI increases to 57.6 in March, reflecting notable improvement in operating conditions.

- Private sector companies hire extra staff and experience an increase in operating expenses, while business confidence remains positive.

Bloomberg Quint | 24 Mar, 2025

Artificial Intelligence in Banking: Applications, Benefits, and Future Trends

- Artificial Intelligence (AI) is transforming the banking industry through applications like fraud detection, customer service, credit scoring, and risk management.

- AI in banking automates fraud detection by analyzing transaction patterns in real-time and generating alerts for unusual activities.

- Chatbots in banking provide personalized assistance, handle standard queries, execute transactions, and offer financial advice based on customer data.

- AI helps manage risk and credit scoring by analyzing customer data, predictive modeling, and real-time monitoring to adjust risk factors accordingly.

- AI personalization in banking improves customer experience by offering tailored financial services, recommendation engines, and real-time feedback.

- In trading and investment banking, AI offers market analysis, algorithmic trading, and portfolio optimization based on market conditions and risk tolerance.

- AI in banking enhances efficiency, reduces costs, strengthens security and fraud prevention, and boosts customer satisfaction through automation and personalized services.

- However, AI adoption in banking poses challenges such as data security concerns, ethical issues, regulatory compliance, and workforce adaptation to AI integration.

- Leading banks like Commonwealth Bank of Australia, HSBC, and JPMorgan Chase have successfully implemented AI for data analytics, fraud detection, and compliance automation.

- Future trends in AI for banking include generative AI, autonomic systems, and quantum computing, with increasing investment in AI technologies projected in the coming years.

- The future of AI in banking promises faster, more secure, and customized financial services, emphasizing the importance of balancing technological innovation with human insight.

Scand | 21 Mar, 2025

IT Sector Outlook: Analysts Have Chalk And Cheese Views On Tech Stocks After Accenture Results

- Analysts have varying views on the IT sector post the Accenture results, with concerns over US discretionary spending impacting Indian IT companies.

- Accenture raised its forecast for fiscal 2025, signaling a neutral to positive outlook for Indian IT according to HSBC, while Nomura is cautious about US federal contracts.

- Domestic IT sector may face challenges due to limited exposure to US federal contracts, prompting brokerages like CLSA to urge a cautious approach despite stable pricing.

- Despite projected growth, there are concerns about a possible pause in flow business and difficulty in outperforming the market in 2025, particularly in retail.

- Citi advises caution in the sector citing global economic uncertainties, increased competition intensity, and margin pressures, recommending certain tech companies over others.

- Nomura highlights risks for Indian IT companies despite no exposure to US federal contracts, predicting tough times ahead with growth likely to bottom out in 2025.

- CLSA remains optimistic on the Indian IT sector, emphasizing that reductions in US public services won't affect domestic IT companies, expecting currency depreciation to partially offset revenue cuts.

- CLSA maintains an 'outperform' rating on key Indian IT firms, citing progress in the BFSI sector, while continuing to favor Accenture in communication, media, and technology verticals.

Bloomberg Quint | 21 Mar, 2025

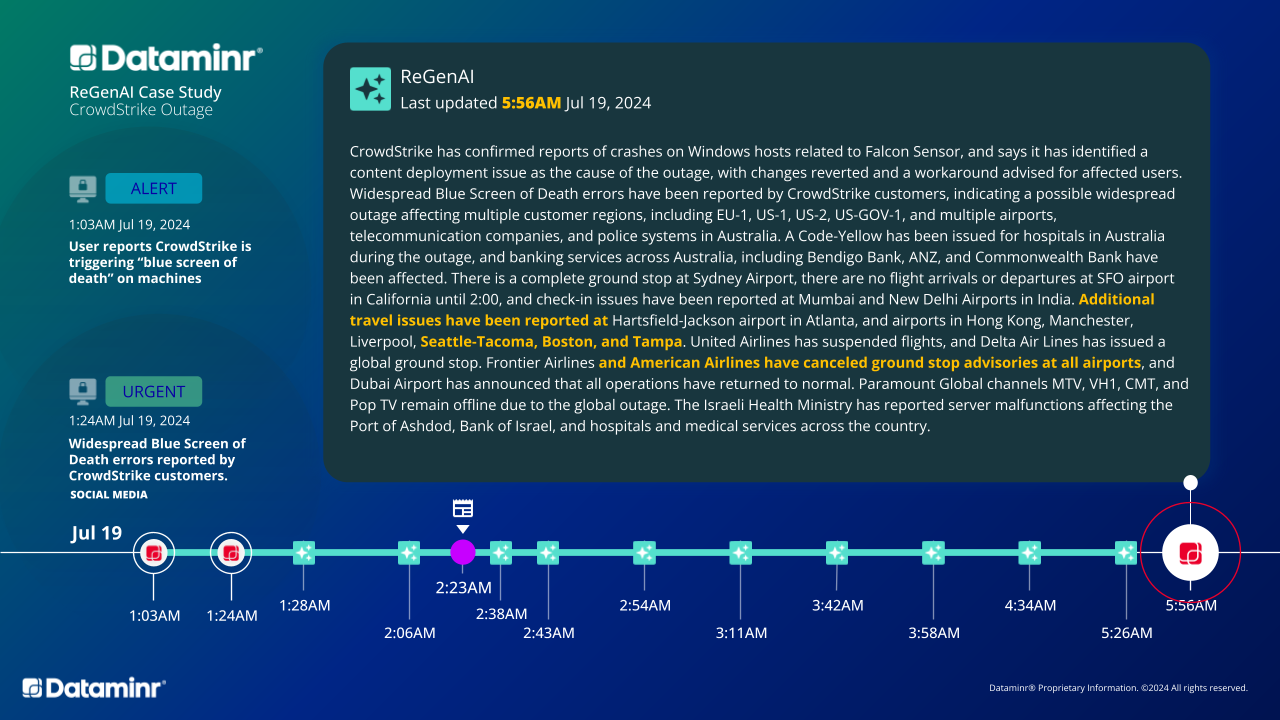

Dataminr raises $85M in funding for its AI platform

- Dataminr, a startup specializing in risk detection, has raised $85 million in debt funding to enhance its technology.

- The financing round includes convertible debt provided by NightDragon and HSBC.

- Dataminr's AI platform processes billions of data points daily, enabling companies to track real-time events.

- The funding will support the development of new AI capabilities, including an AI tool called Context Agents and predictive features.

Siliconangle | 20 Mar, 2025

Powered by

HSBC Group Subsidiaries

HSBC Bank

4.1

• 621 reviews

HSBC Securities and Capital Markets

3.3

• 29 reviews

M&S Bank

5.0

• 1 review

Report error

HSBC Group Offices

Compare HSBC Group with

Citicorp

3.7

BNY

3.9

American Express

4.2

State Street Corporation

3.7

UBS

3.9

Motilal Oswal Financial Services

3.7

HDFC Sales

4.0

IDFC FIRST Bharat

4.4

Aditya Birla Capital

3.9

BNP Paribas

3.8

Morgan Stanley

3.6

Aon

3.8

The Muthoot Group

3.5

RBL FinServe

4.1

Marsh McLennan

4.0

Karvy DigiKonnect

3.0

Bnp Paribas Securities

3.9

Muthoot Pappachan Group

3.9

Capri Global Housing Finance

3.4

Ford Motor Credit Company

4.1

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to HSBC Group

Wells Fargo

Financial Services

3.8

• 6.6k reviews

JPMorgan Chase & Co.

Financial Services

3.9

• 6.3k reviews

Cholamandalam Investment & Finance

Financial Services

3.9

• 4.7k reviews

Citicorp

Financial Services, Banking

3.7

• 4.5k reviews

BNY

Financial Services

3.9

• 4.2k reviews

American Express

Financial Services, Retail, Travel & Tourism / Hospitality

4.2

• 3.2k reviews

State Street Corporation

Financial Services, Internet

3.7

• 2.9k reviews

UBS

Financial Services

3.9

• 2.9k reviews

Motilal Oswal Financial Services

Financial Services

3.7

• 2.8k reviews

HDFC Sales

Financial Services

4.0

• 2.4k reviews

IDFC FIRST Bharat

Financial Services

4.4

• 2.3k reviews

Aditya Birla Capital

Financial Services, NBFC

3.9

• 1.7k reviews

HSBC Group FAQs

When was HSBC Group founded?

HSBC Group was founded in 1865. The company has been operating for 160 years primarily in the Financial Services sector.

Where is the HSBC Group headquarters located?

HSBC Group is headquartered in Pune, Maharashtra. It operates in 7 cities such as Hyderabad / Secunderabad, Bangalore / Bengaluru, Pune, Kolkata, Chennai. To explore all the office locations, visit HSBC Group locations.

How many employees does HSBC Group have in India?

HSBC Group currently has more than 38,000+ employees in India. BFSI, Investments & Trading department appears to have the highest employee count in HSBC Group based on the number of reviews submitted on AmbitionBox.

Does HSBC Group have good work-life balance?

HSBC Group has a Work-Life Balance Rating of 3.9 out of 5 based on 4,800+ employee reviews on AmbitionBox. 76% employees rated HSBC Group 4 or above, while 24% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read HSBC Group work-life balance reviews for more details

Is HSBC Group good for career growth?

Career growth at HSBC Group is rated as moderate, with a promotions and appraisal rating of 3.2. 24% employees rated HSBC Group 3 or below, while 76% employees rated it 4 or above on promotions/appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading HSBC Group promotions/appraisals reviews for more detailed insights.

What are the pros and cons of working in HSBC Group?

Working at HSBC Group comes with several advantages and disadvantages. It is highly rated for job security, company culture and work life balance. However, it is poorly rated for promotions / appraisal, based on 4,800+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app