Add office photos

Employer?

Claim Account for FREE

Sequoia Capital

3.4

based on 6 Reviews

Company Overview

Company Locations

Working at Sequoia Capital

Company Summary

Sequoia Capital operates in the venture capital industry, focusing on identifying and investing in promising startups, supporting innovation and growth.

Overall Rating

3.4/5

based on 6 reviews

11% below

industry average

Highly rated for

Salary, Work-life balance

Critically rated for

Skill development, Job security, Promotions

Work Policy

Monday to Friday

80% employees reported

Flexible timing

80% employees reported

View detailed work policy

About Sequoia Capital

Founded in2000 (25 yrs old)

India Employee Count--

Global Employee Count51-200

India HeadquartersMenlo Park, India

Office Locations

--

Websitesequoiacap.com

Primary Industry

Other Industries

Are you managing Sequoia Capital's employer brand? To edit company information,

claim this page for free

In 2006, Sequoia Capital acquired Westbridge Capital Partners, an Indian venture capital firm. It later was renamed Sequoia Capital India

Managing your company's employer brand?

Claim this Company Page for FREE

Sequoia Capital Ratings

based on 6 reviews

Overall Rating

3.4/5

How AmbitionBox ratings work?

5

3

4

1

3

1

2

0

1

1

Category Ratings

4.7

Salary

4.5

Work-life balance

3.4

Work satisfaction

3.3

Company culture

3.3

Promotions

3.0

Job security

3.0

Skill development

Sequoia Capital is rated 3.4 out of 5 stars on AmbitionBox, based on 6 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Sequoia Capital Reviews

Compare Sequoia Capital with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.4/5 based on 6 reviews | 2.8/5 based on 3 reviews | 3.5/5 based on 3 reviews | 1.8/5 based on 3 reviews |

Highly Rated for | Salary Work-life balance |  No highly rated category | Work-life balance Company culture |  No highly rated category |

Critically Rated for | Skill development Job security Company culture | Job security Work satisfaction Salary | Promotions Salary Job security | Work-life balance Skill development Salary |

Rating by Women Employees | 1.4 Bad rated by 2 women | - no rating available | - no rating available | - no rating available |

Rating by Men Employees | 3.1 Average rated by 2 men | - no rating available | - no rating available | - no rating available |

Job security | 3.0 Average | 1.0 Bad | 3.3 Average | 2.1 Poor |

View more

Sequoia Capital Salaries

Sequoia Capital salaries have received with an average score of 4.7 out of 5 by 6 employees.

Executive Assistant

(4 salaries)

Unlock

₹17.9 L/yr - ₹35 L/yr

Analyst

(4 salaries)

Unlock

₹30 L/yr - ₹50 L/yr

Data Analyst

(4 salaries)

Unlock

₹3.8 L/yr - ₹5.4 L/yr

Senior Associate

(4 salaries)

Unlock

₹15 L/yr - ₹27.5 L/yr

Lead System Engineer

(4 salaries)

Unlock

₹22 L/yr - ₹33.9 L/yr

Finance Manager

(3 salaries)

Unlock

₹14 L/yr - ₹27 L/yr

Senior Engineer

(3 salaries)

Unlock

₹12 L/yr - ₹34 L/yr

Lead Engineer

(3 salaries)

Unlock

₹36 L/yr - ₹60 L/yr

Product Manager

(3 salaries)

Unlock

₹25 L/yr - ₹30 L/yr

Investment Analyst

(3 salaries)

Unlock

₹14 L/yr - ₹40 L/yr

Sequoia Capital News

View all

Sola emerges from stealth with $30M to build the ‘Stripe for security’

- Israeli startup Sola has launched a low/no-code platform for users to design custom cybersecurity apps.

- The platform aims to simplify security and democratize security management.

- Sola has secured $30 million in seed funding from investors like S Capital and former Sequoia VC Mike Moritz.

- Co-founder Guy Flechter emphasizes Sola's goal of changing security mindset like Stripe did for payments.

- Sola's founders bring extensive experience in cybersecurity and aim to offer a new approach to security challenges.

- Sola allows users to create tailored security apps without requiring high technical expertise.

- The platform leverages AI and big data to streamline security processes for organizations.

- Users can create custom security apps and access ready-made apps from Sola's gallery.

- Sola's interface enables natural language interactions and data aggregation from various sources.

- Investor Mike Moritz praises Sola's approach of simplifying front ends while leveraging technological advancements.

TechCrunch | 11 Mar, 2025

Indian HR tech startup raises $140mn in funding

- Darwinbox, an Indian HR tech startup, has raised $140 million in funding.

- The funding round was co-led by KKR and Partners Group.

- Darwinbox's investors include Microsoft, Salesforce, Sequoia, TCV, Peak XV, and Lightspeed.

- The company has expanded internationally and witnessed significant revenue growth over the past years.

HRKatha | 7 Mar, 2025

On Track Records and Why They Matter / $30B Valuation of SSI

- Safe Super Intelligence (SSI), a startup focused on the safe deployment of artificial intelligence, has successfully closed an initial capital raise.

- SSI, backed by a16z, Sequoia Capital, NFGD, and SV Angel, raised more than $1 Billion in financing, with a valuation of $5B.

- In less than a year, SSI secured additional funding, including $500M from Greenoaks Capital, and now has a valuation of $30B.

- The company, co-founded by Ilya Sutskever, has doubled its workforce size to approximately 20 employees and is focused on developing safe, superintelligent AI solutions.

Medium | 7 Mar, 2025

Freed Raises $30M to Combat Clinician Burnout with AI-Powered Documentation

- Freed, an AI-powered clinical documentation provider, has raised $30M in a Series A funding round led by Sequoia Capital. This brings the total funding for Freed to $34M.

- Freed's AI-powered platform addresses the issue of clinician burnout by automating documentation and streamlining workflows. It saves clinicians an average of 2 hours per day, allowing them to focus on patient care.

- The company has introduced new AI-powered features, including tailored notes for different clinical specialties, personalized documentation, AI-generated patient summaries, and seamless integration with existing clinical workflows through EHR integration.

- Since its launch in 2023, Freed has gained over 17,000 paying customers, saving clinicians over 2.5 million cumulative hours of documentation time. It is also experiencing 4x year-over-year revenue growth.

Hitconsultant | 6 Mar, 2025

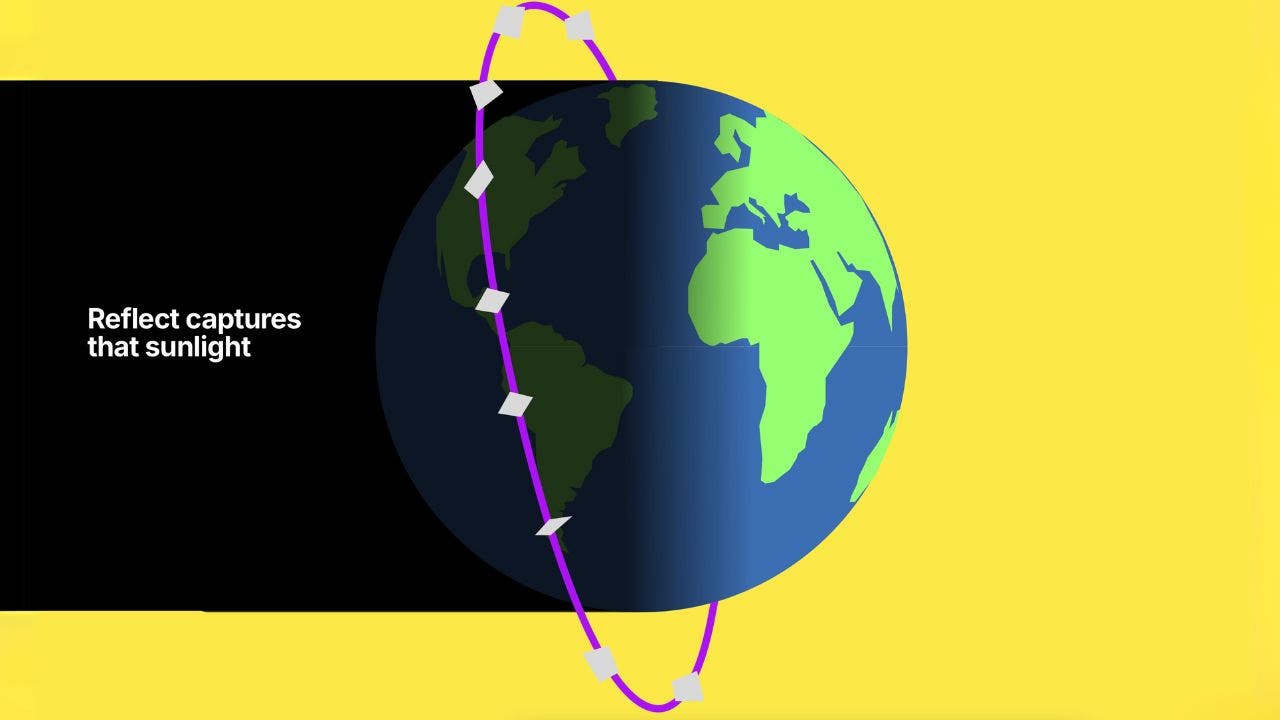

Order sunlight whenever and wherever you want on demand

- Reflect Orbital, a startup, is developing a constellation of mirrors in space that can beam sunlight to Earth at night, extending the operational hours of solar farms.

- The company plans to use satellites positioned in space, equipped with ultra-reflective mirrors, to redirect sunlight to specific locations on Earth.

- Reflect Orbital recently secured a $6.5 million seed round led by Sequoia Capital and aims to deliver its first space-based sunlight service in the fourth quarter of 2025.

- The technology faces challenges such as atmospheric scattering, cloud interference, and precision in directing sunlight, but it holds potential for a more sustainable future in solar power utilization.

Fox News | 4 Mar, 2025

Amsterdam’s AI startup Lemni launches with €3.3M pre-seed funding led by Sequoia

- Amsterdam-based Lemni has launched with €3.3M pre-seed funding led by Sequoia.

- The pre-seed funding round saw participation from other investors as well.

- Lemni aims to provide AI-powered customer experience platforms by setting up custom AI agents for businesses.

- The company offers a unique pricing model to make their products more accessible.

SiliconCanals | 3 Mar, 2025

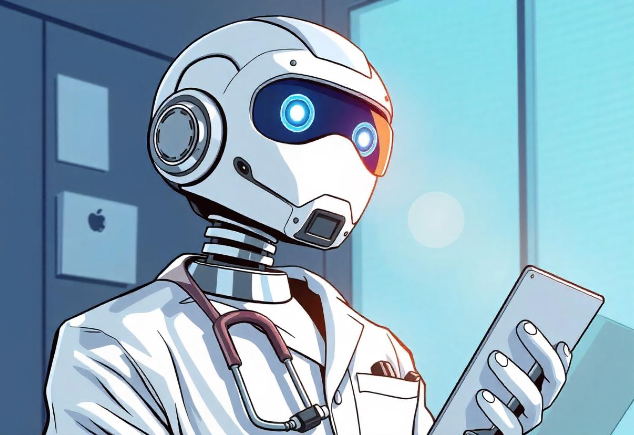

OpenEvidence raises $75M to become the ChatGPT for doctors

- OpenEvidence, a healthcare-focused chatbot startup, has raised $75 million in funding from Sequoia Capital Operations LLC, valuing it at over $1 billion.

- OpenEvidence has created a generative AI chatbot exclusively for doctors to help them make better decisions regarding patient care.

- The chatbot, trained on peer-reviewed medical journals, is already used by approximately 25% of U.S. doctors and provides more accurate responses compared to other chatbots in the market.

- OpenEvidence is free to use and generates revenue solely from advertising, relying on word-of-mouth marketing within the medical community.

Siliconangle | 20 Feb, 2025

AI health-care startup OpenEvidence raises funding from Sequoia at $1 billion valuation

- AI health-care startup OpenEvidence raises $75 million funding from Sequoia at a $1 billion valuation.

- OpenEvidence, founded by Daniel Nadler, has developed a chatbot for doctors to aid in decision-making at the point of care.

- The company is already being used by a quarter of doctors in the U.S. and has partnerships with The New England Journal of Medicine.

- OpenEvidence plans to use the funding to expand, forge strategic content partnerships, and address the physician shortfall and burnout issues.

CNBC | 19 Feb, 2025

Safe Superintelligence, Ilya Sutskever’s AI startup, is reportedly close to raising roughly $1B

- AI startup Safe Superintelligence, founded by Ilya Sutskever, is close to raising over $1 billion at a $30 billion valuation.

- VC firm Greenoaks Capital Partners is leading the deal and committing to invest $500 million.

- This would bring Safe Superintelligence's total raised to approximately $2 billion.

- The startup, founded by former OpenAI scientists, has previously raised funds from Sequoia Capital, Andreessen Horowitz, and DST Global.

TechCrunch | 19 Feb, 2025

xAI’s Grok 3 to be Released Today

- Elon Musk, CEO of xAI, announced the release of the company's latest AI model, Grok 3, which has been trained on 100,000 NVIDIA GPUs.

- xAI is in talks to raise $10 billion in funding, led by Sequoia Capital, Andreessen Horowitz, and Valor Equity Partners, increasing its valuation to $75 billion.

- xAI is also in advanced stages of securing a $5 billion deal with Dell Technologies for servers containing NVIDIA GB200 to handle AI workloads.

- Grok 3 faces competition from other AI models such as Anthropic's hybrid model and GPT 4.5 from OpenAI, as part of the newly released roadmap.

Analyticsindiamag | 17 Feb, 2025

Powered by

Sequoia Capital Offices

Compare Sequoia Capital with

Nexus Venture Partners

3.0

Chiratae Ventures

2.6

India Quotient

4.2

Nomura Holdings

3.8

Adarsh Credit Co-Operative Society

4.0

Muthoot Homefin India

3.9

Belstar Investment and Finance

4.2

Wise Finserv

3.0

Verity Knowledge Solutions

2.8

Link Intime

3.5

Trustline Securities

4.3

STP Investment Services

3.6

Faircent.com

3.2

Goodwill Commodities

3.4

Almajal Alarabi Holding

3.2

Asit C Mehta Investment Interrmediates

2.9

Nesma

4.5

Instant Systems

3.6

Smallcase Technologies

4.3

Credit Agricole CIB

3.2

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Write a review

Share interview

Contribute salary

Add office photos

Companies Similar to Sequoia Capital

Lightspeed Venture Partners

Investment Banking / Venture Capital / Private Equity

1.8

• 3 reviews

Matrix Partners

Investment Banking / Venture Capital / Private Equity

2.8

• 3 reviews

Kalaari Capital

Investment Banking / Venture Capital / Private Equity

3.5

• 3 reviews

3.0

• 1 reviews

Chiratae Ventures

Financial Services, Investment Banking / Venture Capital / Private Equity

2.6

• 2 reviews

4.2

• 2 reviews

Nomura Holdings

Financial Services, Investment Banking / Venture Capital / Private Equity

3.8

• 527 reviews

Adarsh Credit Co-Operative Society

Investment Banking / Venture Capital / Private Equity

4.0

• 340 reviews

Muthoot Homefin India

Investment Banking / Venture Capital / Private Equity

3.9

• 339 reviews

Belstar Investment and Finance

Financial Services, Investment Banking / Venture Capital / Private Equity

4.2

• 225 reviews

Wise Finserv

Financial Services, Investment Banking / Venture Capital / Private Equity

3.0

• 67 reviews

Verity Knowledge Solutions

Advertising / PR / Events, Investment Banking / Venture Capital / Private Equity

2.8

• 124 reviews

Sequoia Capital FAQs

When was Sequoia Capital founded?

Sequoia Capital was founded in 2000. The company has been operating for 25 years primarily in the Investment Banking / Venture Capital / Private Equity sector.

Where is the Sequoia Capital headquarters located?

Sequoia Capital is headquartered in Menlo Park.

Does Sequoia Capital have good work-life balance?

Sequoia Capital has a work-life balance rating of 4.5 out of 5 based on 6 employee reviews on AmbitionBox. 67% employees rated Sequoia Capital 4 or above on work-life balance. This rating reflects the company's efforts to help employees maintain a healthy balance between their personal and professional lives. We encourage you to read Sequoia Capital reviews for more details

Is Sequoia Capital good for career growth?

Career growth at Sequoia Capital is rated as moderate, with a promotions and appraisal rating of 3.3. 33% employees rated Sequoia Capital 3 or below, while 67% employees rated it 4 or above on promotions/appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading Sequoia Capital reviews for more detailed insights.

What are the pros and cons of working in Sequoia Capital?

Working at Sequoia Capital comes with several advantages and disadvantages. It is highly rated for salary & benefits and work life balance. However, it is poorly rated for skill development, job security and promotions / appraisal, based on 6 employee reviews on AmbitionBox.

Recently Viewed

REVIEWS

GE Capital

No Reviews

LIST OF COMPANIES

Matrix Partners

Overview

LIST OF COMPANIES

Kalaari Capital

Overview

SALARIES

SAIF Partners

No Salaries

REVIEWS

CESC

No Reviews

REVIEWS

Ameyo

No Reviews

COMPANY BENEFITS

Bank Muscat

No Benefits

COMPANY BENEFITS

Idea Entity

No Benefits

REVIEWS

CESC

No Reviews

COMPANY BENEFITS

Optum Global Solutions

No Benefits

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app