Add office photos

Employer?

Claim Account for FREE

Kalaari Capital

3.5

based on 3 Reviews

Company Overview

Company Locations

About Kalaari Capital

Founded in2011 (14 yrs old)

India Employee Count11-50

Global Employee Count11-50

India HeadquartersBangalore/Bengaluru, Karnataka, India

Office Locations

--

Websitekalaari.com

Primary Industry

Other Industries

--

Are you managing Kalaari Capital's employer brand? To edit company information,

claim this page for free

Kalaari Capital manages $650M funds with a strong advisory team in Bangalore investing in early-stage, technology-oriented companies in India. We are passionate about investing in entrepreneurs who are poised to be tomorrow's global leaders. We seek companies that are capturing new markets, providing innovative solutions, and creating new wealth for India and beyond.

Managing your company's employer brand?

Claim this Company Page for FREE

Kalaari Capital Ratings

based on 3 reviews

Overall Rating

3.5/5

How AmbitionBox ratings work?

5

0

4

2

3

0

2

0

1

1

Category Ratings

4.3

Work-life balance

4.1

Company culture

3.6

Skill development

3.6

Work satisfaction

3.3

Job security

3.3

Salary

2.8

Promotions

Kalaari Capital is rated 3.5 out of 5 stars on AmbitionBox, based on 3 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Kalaari Capital Reviews

Compare Kalaari Capital with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 3.5/5 based on 3 reviews | 3.4/5 based on 6 reviews | 2.8/5 based on 3 reviews | 3.0/5 based on 1 reviews |

Highly Rated for | Work-life balance Company culture | Salary Work-life balance | No highly rated category | Skill development Work satisfaction |

Critically Rated for | Promotions Salary Job security | Skill development Job security Company culture | Job security Work satisfaction Salary | Work-life balance Job security Company culture |

Rating by Women Employees | - no rating available | 1.4 Bad rated by 2 women | - no rating available | - no rating available |

Rating by Men Employees | - no rating available | 3.1 Average rated by 2 men | - no rating available | - no rating available |

Job security | 3.3 Average | 3.0 Average | 1.0 Bad | 2.0 Poor |

View more

Kalaari Capital Salaries

Kalaari Capital salaries have received with an average score of 3.3 out of 5 by 3 employees.

Investment Analyst

(3 salaries)

Unlock

₹18 L/yr - ₹33 L/yr

HR & Administration Executive

(2 salaries)

Unlock

₹3.4 L/yr - ₹4.3 L/yr

Junior Research Fellow

(2 salaries)

Unlock

₹16.2 L/yr - ₹20.7 L/yr

Senior Manager Information Technology

(2 salaries)

Unlock

₹9 L/yr - ₹11.5 L/yr

Principal

(2 salaries)

Unlock

₹95 L/yr - ₹1.1 Cr/yr

Investment Associate

(1 salaries)

Unlock

₹71.3 L/yr - ₹78.8 L/yr

Assistant Vice President

(1 salaries)

Unlock

₹71.3 L/yr - ₹78.8 L/yr

Front Office Executive

(1 salaries)

Unlock

₹18.9 L/yr - ₹24.2 L/yr

Legal Manager

(1 salaries)

Unlock

₹11.7 L/yr - ₹15 L/yr

Analyst

(1 salaries)

Unlock

₹10.8 L/yr - ₹13.8 L/yr

Kalaari Capital News

View all

Today Startup News 26 February 2025 From The Indian Startup Ecosystem

- Shiju Pappen - The Chatpata AffairFrom cleaning restaurant to INR 8 Cr. revenue. The story of Shiju Pappen begins when Shiju loses his parents at a very young age.

- HiWiPay Raises $2 Mn In Seed Round Led By Unicorn India VenturesCross-border payments platform HiWiPay has raised $2 million in a seed funding round led by Unicorn India Ventures.

- Quick Clean Raises $6Mn Funding Led By Alkemi Growth Capital and Blue Ashva CapitalQuick Clean, which provides professional linen management solutions, has secured Rs 50 crore ($5.7 million) in its Series A funding round led by Alkemi Growth Capital and Blue Ashva Capital.

- Triple Tap Games Raises $1.2 Mn Funding In Pre-Seed RoundTriple Tap Games, a gaming studio, has raised $1.2 million in a pre-seed funding round led by Eximius Ventures and Kalaari Capital.

VIE Stories | 26 Feb, 2025

Mumbai-based gaming studio Triple Tap Games raises $1.2 million in a pre-Seed funding round

- Mumbai-based gaming studio Triple Tap Games has raised $1.2 million in a funding round.

- The funding was led by Eximius Ventures and Kalaari Capital, along with angel investors from the entertainment and gaming community.

- Triple Tap Games aims to create innovative mobile games in the 'relax and unwind' category for a global audience.

- The funding will be used to launch and scale games in the US and Europe.

ISN | 26 Feb, 2025

Triple Tap Games Raises $1.2 Mn Funding In Pre-Seed Round

- Triple Tap Games, a gaming studio, has raised $1.2 million in a pre-seed funding round led by Eximius Ventures and Kalaari Capital.

- The funds will be used to create a collection of innovative mobile games in the ‘relax and unwind’ category, designed for a global audience.

- The company also plans to launch and expand these games in the US and Europe.

- Triple Tap Games, founded by Karan Khairajani, aims to build engaging experiences leveraging AI and cater to a women-centric audience.

VIE Stories | 26 Feb, 2025

Today Startup News 04 February 2025 From The Indian Startup Ecosystem

- Presentations.AI, an AI-powered platform, secures $3 million in seed funding.

- OYO plans to invest Rs 539.57 crore in the UK for hotel expansion, creating 1,000 jobs in the hospitality sector.

- Construction tech startup BuilditIndia raises undisclosed funding from former cricketer Parthiv Patel.

- Priyanka Gill steps down from Kalaari Capital to start her own venture, after joining as a venture partner last year.

VIE Stories | 4 Feb, 2025

Startup news and updates: Daily roundup (February 4, 2025)

- India may have a GPU problem when it comes to its AI ambitions, as major AI powerhouses in the US and China have a far bigger muscle. OYO has plans to invest £50m in the UK over the next three years to expand its premium hotel portfolio and generate 1,000 direct and indirect jobs. Priyanka Gill, Co-founder of The Good Glamm Group, is moving on from her role at Kalaari Capital as a venture partner to launch a lab-grown diamond brand. The Global Private Capital Association (GPCA) has launched its inaugural Southeast Asia Women Investors Directory. Beacon, a super app purpose-built for immigrants to Canada, has introduced India Bill Pay, allowing users to pay Indian bills directly in Canadian dollars. Eli Lilly and Company has appointed Winselow Tucker as the President and General Manager of Lilly India, effective immediately. The partnership between NBFC Aye Finance and AI-powered debt collections platform Credgenics aims to enhance Aye Finance's digital debt resolution processes. New Relic has introduced the industry's first AI monitoring solution for DeepSeek, designed to streamline the development, deployment, and monitoring of generative AI (GenAI) applications while reducing complexity and costs.

- Earlier this month, Union Minister of Electronics and IT Ashwini Vaishnaw announced plans to develop India's own foundational AI model. Kalaari Capital's Priyanka Gill has launched lab-grown diamond brand COLUXE to make fine jewellery an everyday luxury for aspirational consumers. The Global Private Capital Association's inaugural Southeast Asia Women Investors Directory features 365 women investment professionals deploying private capital across various sectors. Eli Lilly expects Winselow Tucker's experience will be pivotal in driving growth and positioning Lilly for long-term success in India. The partnership between Aye Finance and Credgenics aims to enable personalised, insights-driven borrower communication and collection strategies. Beacon's India Bill Pay allows users in Canada to pay Indian bills directly in Canadian dollars.

- India needs to catch up fast in the global GPU race if it wants a place in the AI race. Kalaari Capital's Priyanka Gill will leave her venture partner role to launch lab-grown diamond brand COLUXE. OYO emphasises long-term leasehold and management contracts to pursue the premiumisation of its UK portfolio. The Southeast Asia Women Investors Directory is aimed at increasing the visibility of women investors in the region. Beacon's India Bill Pay aims to offer an independent solution through the company's super app. Lilly India's president and general manager Winselow Tucker will oversee the company's commercial operations in India and lead the Lilly Capability Centre India.

- New Relic has introduced the industry's first AI monitoring solution for DeepSeek, which streamlines the development, deployment, and monitoring of generative AI applications. The partnership between Aye Finance and Credgenics aims to enhance personalised communication and collection strategies. The Global Private Capital Association represents over 300 members managing over $2tn in assets across 130 countries.

Yourstory | 4 Feb, 2025

Priyanka Gill Step Down from Kalaari Capital To Float Her New Venture

- Priyanka Gill, co-founder of The Good Glamm Group, has stepped down from Kalaari Capital to launch her own venture called Coluxe, which will offer lab-grown diamonds.

- Gill aims to tap into the growing demand for affordable synthetic diamonds and plans to start online sales in May, followed by a physical store.

- Lab-grown diamonds are gaining popularity due to their lower price and better quality compared to natural diamonds.

- Gill plans to raise a Series A round after securing early-stage funding for her new venture.

VIE Stories | 4 Feb, 2025

Deconstruct raises Rs 65 Cr from L’Oréal’s VC fund BOLD and others

- D2C skincare brand Deconstruct has raised Rs 65 crore ($7.7 million) in funding.

- The funding comes from L’Oréal’s VC fund BOLD, V3 Ventures, DSG Consumer Partners, Kalaari Capital, and Beenext.

- The funds will be used for product innovation, reinforcing leadership in existing segments, and expanding into quick commerce and retail.

- Deconstruct saw significant growth in FY25, achieving an annualized net revenue of Rs 200 crore.

Entrackr | 22 Jan, 2025

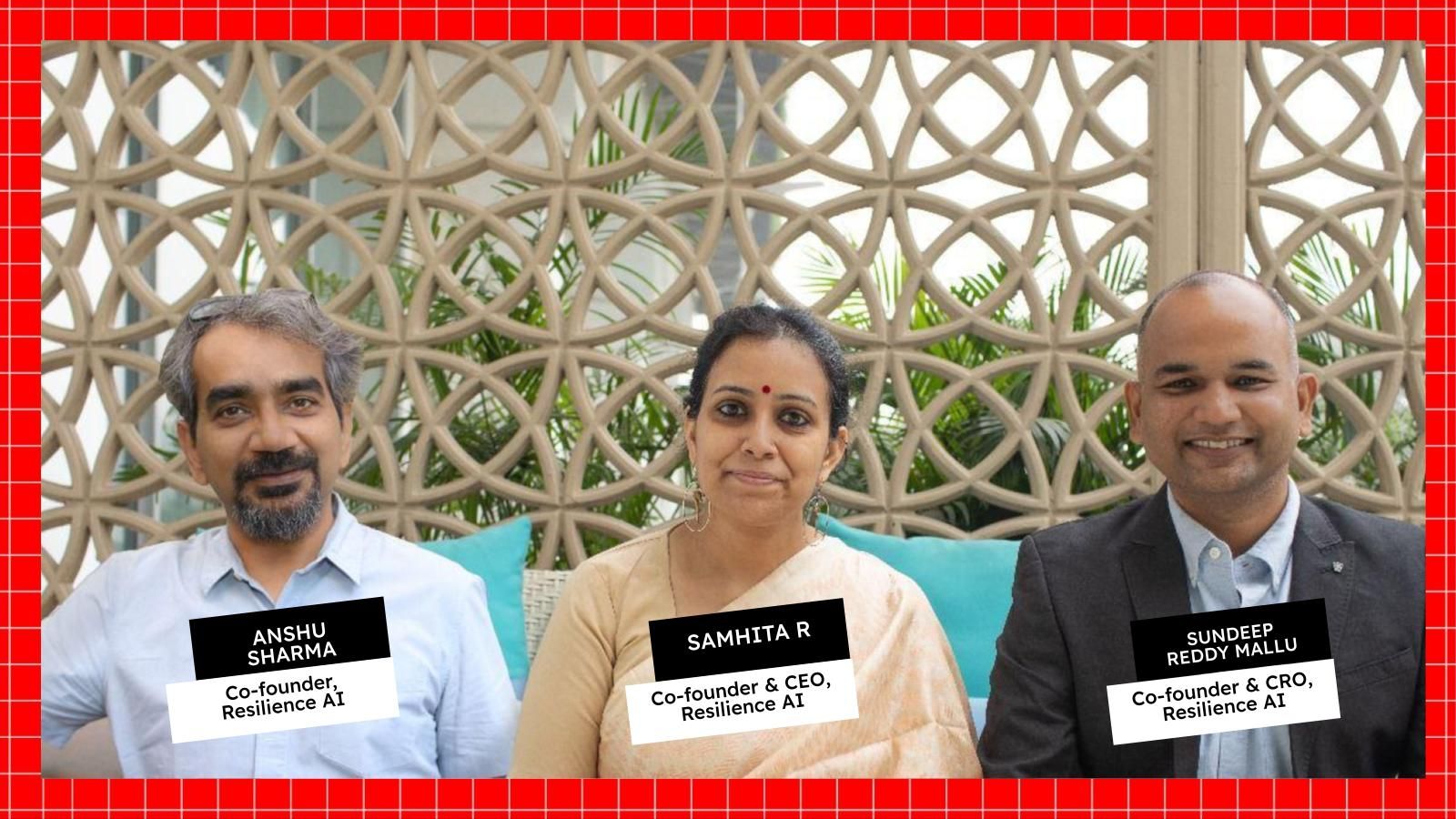

Resilience AI bags $1 million in seed funding round led by Kalaari Capital

- Resilience AI, a climate risk and sustainability technology start-up, has raised $1 million in a seed funding round led by Kalaari Capital’s CXXO initiative and with participation from Java Capital.

- The funding will be utilized to develop Resilience360, a platform that offers end-to-end climate risk management solutions for private and public enterprises.

- Resilience360 combines machine learning and deep climate analytics to provide hyperlocal risk maps, automated climate risk diagnostics, and institutionalized climate action plans.

- The company aims to enhance its solutions in supply chain resilience, ESG compliance, and physical risk baseline for banking and financial services, as well as co-develop solutions, expand market access, and drive research-based innovation.

HinduBusinessLine | 18 Dec, 2024

Climate risk and sustainability technology startup Resilience AI raises $1 million

- Climate risk and sustainability technology startup Resilience AI raises $1 million

- Resilience AI secures $1 million in a seed funding round led by Kalaari Capital’s CXXO initiative and Java Capital.

- Resilience AI plans to use the funding to advance its flagship platform, Resilience360, which offers climate risk management solutions for enterprises.

- Using AI and advanced analytics, Resilience360 helps businesses and governments prepare for extreme weather events and mitigate climate risks.

ISN | 18 Dec, 2024

Resilience AI bags $1M seed funding led by Kalaari Capital

- Resilience AI, a climate risk and sustainability technology firm, has raised $1 million in seed funding led by Kalaari Capital's CXXO initiative.

- The funding will be used to develop Resilience AI's flagship product Resilience360, which offers climate risk management solutions for enterprises.

- Resilience AI also aims to strengthen its technology portfolio and expand its market reach, focusing on areas like supply chain resilience and ESG compliance.

- The company provides proactive tools and solutions to manage and adapt to climate challenges, helping organizations prepare for severe climatic occurrences.

Yourstory | 18 Dec, 2024

Powered by

Kalaari Capital Offices

Compare Kalaari Capital with

Lightspeed Venture Partners

1.8

Chiratae Ventures

2.6

India Quotient

4.2

Wise Finserv

3.0

STP Investment Services

3.6

Faircent.com

3.2

Goodwill Commodities

3.4

Asit C Mehta Investment Interrmediates

2.9

Chatrapati Multistate Co-Operative Credit Society

3.8

Instant Systems

3.5

Smallcase Technologies

4.3

CapitalAim Financial Advisor

2.3

KOTRA

2.9

DreamGains Financials India

3.7

Jainam Share Consultants

3.9

Zephyr

2.5

APT Research Private Limited

3.7

The Nest Group

2.9

Unifi Capital

4.3

Robinhood Capital Services

2.7

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to Kalaari Capital

Sequoia Capital

Financial Services, Investment Banking / Venture Capital / Private Equity

3.4

• 6 reviews

3.0

• 1 reviews

Matrix Partners

Investment Banking / Venture Capital / Private Equity

2.8

• 3 reviews

Lightspeed Venture Partners

Investment Banking / Venture Capital / Private Equity

1.8

• 3 reviews

Chiratae Ventures

Financial Services, Investment Banking / Venture Capital / Private Equity

2.6

• 2 reviews

4.2

• 2 reviews

Wise Finserv

Financial Services, Investment Banking / Venture Capital / Private Equity

3.0

• 67 reviews

STP Investment Services

Investment Banking / Venture Capital / Private Equity, IT Services & Consulting

3.6

• 76 reviews

Faircent.com

Financial Services, Internet, Investment Banking / Venture Capital / Private Equity

3.2

• 70 reviews

Goodwill Commodities

Investment Banking / Venture Capital / Private Equity

3.4

• 70 reviews

Asit C Mehta Investment Interrmediates

Financial Services, Investment Banking / Venture Capital / Private Equity

2.9

• 66 reviews

Chatrapati Multistate Co-Operative Credit Society

Investment Banking / Venture Capital / Private Equity

3.8

• 61 reviews

Kalaari Capital FAQs

When was Kalaari Capital founded?

Kalaari Capital was founded in 2011. The company has been operating for 14 years primarily in the Investment Banking / Venture Capital / Private Equity sector.

Where is the Kalaari Capital headquarters located?

Kalaari Capital is headquartered in Bangalore/Bengaluru, Karnataka.

How many employees does Kalaari Capital have in India?

Kalaari Capital currently has approximately 30+ employees in India.

What are the pros and cons of working in Kalaari Capital?

Working at Kalaari Capital comes with several advantages and disadvantages. It is highly rated for work life balance and company culture. However, it is poorly rated for promotions / appraisal, salary & benefits and job security, based on 3 employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app