Add office photos

Employer?

Claim Account for FREE

National Bank Agriculture Rural Development

4.4

based on 71 Reviews

Company Overview

Company Locations

Working at National Bank Agriculture Rural Development

Company Summary

Development bank established to enhance institutional credit and support rural economic growth, contributing significantly to agriculture financing in India.

Overall Rating

4.4/5

based on 71 reviews

16% above

industry average

Highly rated for

Company culture, Job security, Salary

Work Policy

Monday to Friday

71% employees reported

Strict timing

56% employees reported

Within country

44% employees reported

Day shift

100% employees reported

View detailed work policy

Top Employees Benefits

Job/Soft skill training

6 employees reported

Cafeteria

3 employees reported

Professional degree assistance

3 employees reported

Health insurance

3 employees reported

View all benefits

About National Bank Agriculture Rural Development

Founded in1982 (43 yrs old)

India Employee Count1k-5k

Global Employee Count1k-5k

India HeadquartersMumbai, India

Office Locations

--

Websitenabard.org

Primary Industry

Other Industries

--

Are you managing National Bank Agriculture Rural Development's employer brand? To edit company information,

claim this page for free

The importance of institutional credit in boosting the rural economy has been clear to the Government of India right from its early stages of planning. Therefore, the Reserve Bank of India (RBI) at the insistence of the Government of India, constituted a Committee to Review the Arrangements For Institutional Credit for Agriculture and Rural Development (CRAFICARD) to look into these very critical aspects. The Committee was formed on 30 March 1979, under the Chairmanship of Shri B. Sivaraman, a former member of the Planning Commission, Government of India.

The Committee’s interim report, submitted on 28 November 1979, outlined the need for a new organizational device for providing undivided attention, forceful direction, and pointed focus to credit-related issues linked with rural development. Its recommendation was the formation of a unique development financial institution which would address these aspirations and formation of National Bank for Agriculture and Rural Development (NABARD) was approved by the Parliament through Act 61 of 1981.

NABARD came into existence on 12 July 1982 by transferring the agricultural credit functions of RBI and refinance functions of the then Agricultural Refinance and Development Corporation (ARDC). It was dedicated to the service of the nation by the late Prime Minister Smt. Indira Gandhi on 05 November 1982. Set up with an initial capital of Rs.100 crore, its’ paid-up capital stood at Rs.14,080 crore as of 31 March 2020. Consequent to the revision in the composition of share capital between the Government of India and RBI, NABARD today is fully owned by the Government of India.

Managing your company's employer brand?

Claim this Company Page for FREE

National Bank Agriculture Rural Development Ratings

based on 71 reviews

Overall Rating

4.4/5

How AmbitionBox ratings work?

5

43

4

18

3

3

2

0

1

7

Category Ratings

4.4

Company culture

4.4

Job security

4.3

Salary

4.3

Promotions

4.2

Work-life balance

4.2

Skill development

4.2

Work satisfaction

National Bank Agriculture Rural Development is rated 4.4 out of 5 stars on AmbitionBox, based on 71 company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

National Bank Agriculture Rural Development Reviews

Top mentions in National Bank Agriculture Rural Development Reviews

+ 3 more

Compare National Bank Agriculture Rural Development with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 4.4/5 based on 71 reviews | 4.0/5 based on 72 reviews | 3.9/5 based on 119 reviews | 2.7/5 based on 13 reviews |

Highly Rated for | Job security Company culture Salary | Salary Work-life balance | Work-life balance | Salary |

Critically Rated for |  No critically rated category | Promotions Company culture | Promotions Job security | Skill development Company culture Work satisfaction |

Primary Work Policy | - | Work from office 100% employees reported | - | - |

Rating by Women Employees | 4.3 Good rated by 11 women | 4.3 Good rated by 14 women | 4.4 Good rated by 13 women | 4.9 Excellent rated by 2 women |

Rating by Men Employees | 4.4 Good rated by 54 men | 3.9 Good rated by 56 men | 3.8 Good rated by 99 men | 2.6 Poor rated by 10 men |

Job security | 4.4 Good | 3.7 Good | 3.3 Average | 3.1 Average |

View more

National Bank Agriculture Rural Development Salaries

National Bank Agriculture Rural Development salaries have received with an average score of 4.3 out of 5 by 71 employees.

Assistant General Manager

(6 salaries)

Unlock

₹20 L/yr - ₹40.1 L/yr

Junior Consultant

(6 salaries)

Unlock

₹2.4 L/yr - ₹6.8 L/yr

Risk Manager

(6 salaries)

Unlock

₹12.6 L/yr - ₹33 L/yr

Deputy General Manager

(5 salaries)

Unlock

₹10.5 L/yr - ₹40 L/yr

Project Manager

(5 salaries)

Unlock

₹9.3 L/yr - ₹18 L/yr

Project Consultant

(5 salaries)

Unlock

₹6 L/yr - ₹7.5 L/yr

Fire Officer

(5 salaries)

Unlock

₹3.3 L/yr - ₹5.5 L/yr

Research Intern

(4 salaries)

Unlock

₹2 L/yr - ₹6 L/yr

Technical Monitor

(4 salaries)

Unlock

₹3.6 L/yr - ₹4.8 L/yr

Senior Consultant

(4 salaries)

Unlock

₹8.5 L/yr - ₹18 L/yr

National Bank Agriculture Rural Development Interview Questions

Interview questions by designation

Top National Bank Agriculture Rural Development interview questions and answers

Get interview-ready with top interview questions

National Bank Agriculture Rural Development News

View all

3-way shared services venture in the making for providing tech support to rural credit co-ops, says NABARD Chief

- The government, NABARD and entities in the short-term Rural Co-operative Credit (RCC) ecosystem plan to collectively invest about ₹1,000 crore to float a shared services entity for providing technology support services to RCCs.

- Currently, co-operative banks in the RCC ecosystem lack certain technology capabilities, such as loan origination and management systems, credit underwriting standards, and fintech collaborations.

- The shared services entity, co-owned by the Government of India, NABARD, and co-operative banks, will invest in technology and other services to enhance the customer experience and bring their services at par with commercial banks.

- The establishment of the shared services entity is planned to improve co-operative banks' transparency, loan underwriting standards, and overall efficiency in serving farmers and rural artisans.

HinduBusinessLine | 10 Mar, 2025

NABARD projects ₹4.47 lakh cr credit potential for Karnataka in 2025-26

- NABARD projects ₹4.47 lakh cr credit potential for Karnataka in 2025-26.

- NABARD annually prepares a Potential Linked Credit Plan (PLP) for each district to facilitate credit planning and allocation for priority sector activities.

- The State Focus Paper (SFP) identifies critical infrastructure gaps and key policy issues for the holistic development of Karnataka’s agricultural and rural economy.

- Of the projected ₹4.47 lakh crore credit potential, 46% is allocated for agriculture, 42% for MSMEs, and 12% for other priority sector activities.

HinduBusinessLine | 28 Feb, 2025

NABARD Projects Rs 2,106 Crore Credit Potential For Nagaland In Priority Sector

- The National Bank for Agriculture and Rural Development (NABARD) projects a credit potential of Rs 2,106.3 crore for Nagaland in the priority sector.

- The State Focus Paper released by Advisor for Agriculture Mhathung Yanthan during a seminar organized by NABARD reveals the credit distribution.

- The projected credit amount includes Rs 712 crore for agriculture, Rs 968 crore for MSME, and Rs 425 crore for other sectors.

- NABARD emphasizes the importance of expanding credit to Farmer Producer Organisations and supporting Primary Agricultural Credit Societies.

Bloomberg Quint | 26 Feb, 2025

NABARD projects ₹2,106 cr credit potential for Nagaland in priority sector

- NABARD projects ₹2,106 cr credit potential for Nagaland in priority sector.

- The State Focus Paper (SFP) states that ₹712 crore is projected for agriculture, ₹968 crore for MSME, and ₹425 crore for other sectors.

- Banks are urged to focus on extending credit to Farmer Producer Organisations (FPOs).

- The state is advised to focus on agriculture, expanding irrigation facilities, horticulture, and food processing to revolutionize its economy.

HinduBusinessLine | 26 Feb, 2025

Nabard pegs Telangana’s credit potential at ₹3.86 lakh crore

- The National Bank for Agriculture and Rural Development (Nabard) has estimated Telangana's credit potential at ₹3.86 lakh crore.

- For the agriculture sector, the credit potential for 2025-26 is estimated at ₹1.63 lakh crore, showing a growth of 23% from last year.

- For the micro, small and medium enterprises (MSME) segment, the credit potential is estimated at ₹2.03 lakh crore, reflecting a growth of 57% from last year.

- Telangana is the fastest growing state with a per capita income 1.6 times more than the national average and has made significant progress in rice production.

HinduBusinessLine | 14 Feb, 2025

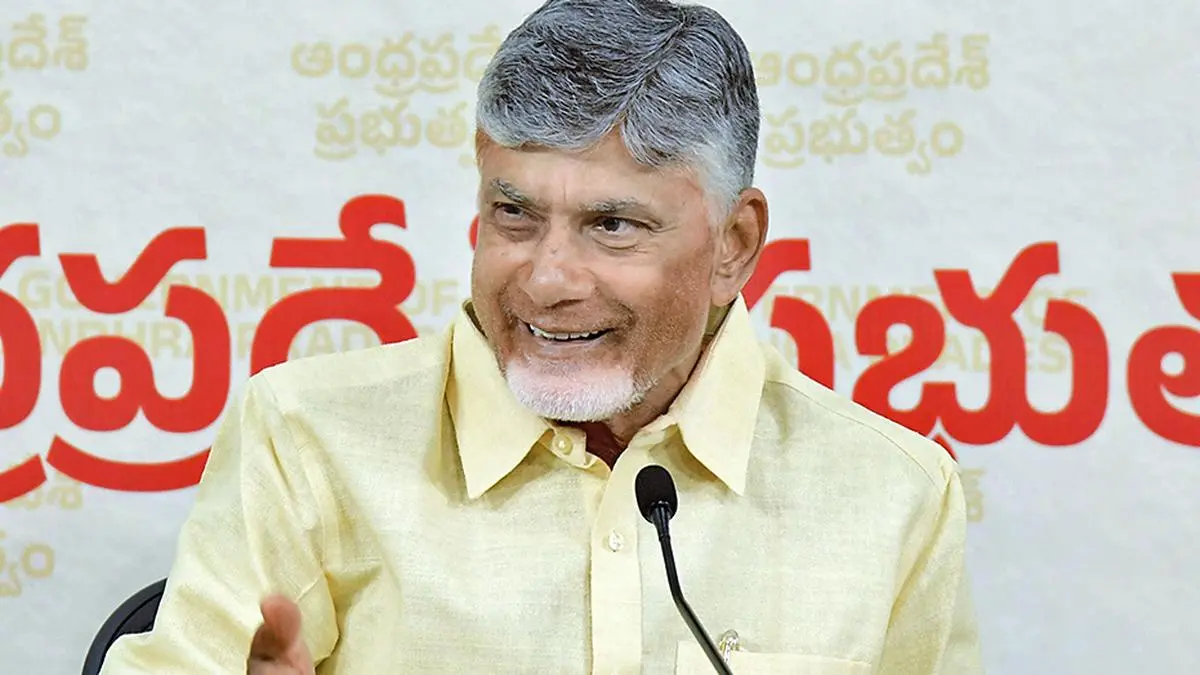

Nabard pegs total priority sector credit potential in AP at ₹4.24 lakh cr for 2025-26

- Nabard has pegged the total priority sector credit potential in Andhra Pradesh at ₹4.24 lakh crore for the year 2025-26.

- The State Focus Paper (SFP) 2025-26 of Nabard was launched by Chief Minister N Chandrababu Naidu, which focuses on sustained investments in agriculture, horticulture, allied sectors, MSMEs, and rural enterprises.

- The SFP will serve as a roadmap for credit planning, infrastructure development, and investment priorities.

- The key credit projections mentioned in the SFP include ₹2.26 lakh crore for agriculture & allied activities, ₹1.14 lakh crore for crop loans, ₹43,583 crore for animal husbandry, dairy, fisheries & farm mechanisation, ₹1.28 lakh crore for MSMEs, and ₹60,895 crore for housing, education, renewable energy & other sectors.

HinduBusinessLine | 11 Feb, 2025

NABARD, Palladium conduct workshop to help Odisha’s FPOs

- NABARD and Palladium conducted a workshop to help Odisha's FPOs.

- The workshop aimed to explore opportunities and solutions for strengthening India's agri-export ecosystem.

- The initiative included training sessions on export documentation, compliance, post-harvest management, packaging, and more.

- NABARD and Palladium outlined an action plan to foster information exchange, identify export-oriented clusters, and strengthen supply chains.

HinduBusinessLine | 10 Feb, 2025

Nabard projects ₹9.38 lakh crore credit potential for TN under priority sector in FY26

- National Bank for Agriculture and Rural Development (Nabard) projects a credit potential of ₹9.38 lakh crore for Tamil Nadu under the priority sector in FY26.

- The projection was highlighted in the 'State Focus Paper for 2025-26' unveiled during the State Credit Seminar chaired by Tamil Nadu Finance Minister Thangam Thennarasu.

- The report indicates that agriculture is expected to account for 46% of the total credit projection, while the Micro, Small, and Medium Enterprises (MSME) sector is projected to contribute about 37%.

- Nabard's Tamil Nadu Regional Office focuses on areas such as agriculture, agri-tech, financial inclusion, microfinance, and tribal welfare.

HinduBusinessLine | 5 Feb, 2025

NABARD To Launch ₹1,000 Cr Fund For Climate Solutions In Rural Finance

- NABARD is set to launch a ₹1,000 crore fund called NabVentures Fund 2.

- The fund aims to support ventures addressing climate change challenges in rural finance.

- NABARD is seeking external expertise from organizations like ADB and FAO for this project.

- The goal is to promote innovation in agriculture and develop sustainable solutions for rural India.

VIE Stories | 6 Jan, 2025

Rural boom to power agri credit to cross ₹28-lakh crore mark in FY25: NABARD

- Agri credit is expected to cross ₹28-lakh crore mark in FY25, higher than projected aim of ₹25-lakh crore.

- Rural growth is evident with higher demand in rural areas, bridging the gap with urban areas.

- Access to credit from informal sources is declining, leading to the formalization of rural credit.

- Improved productivity in agriculture is expected through innovation, supported by NABVENTURES Fund II.

HinduBusinessLine | 5 Jan, 2025

Powered by

National Bank Agriculture Rural Development Perks & Benefits

National Bank Agriculture Rural Development Offices

Compare National Bank Agriculture Rural Development with

Export-Import Bank of India

3.3

National Cooperative Development Corporation

2.3

Agriculture Insurance Company of India

4.1

National Dairy Development Board

3.9

NATIONAL SKILL DEVELOPMENT CORPORATION

3.6

National Fisheries Development Board

3.2

SBI Cards & Payment Services

3.7

Axis Direct

3.8

Kotak Securities

3.6

Aadhar Housing Finance

4.2

ICICI Home Finance

3.7

Pine Labs

3.4

Morningstar

3.9

Synchrony

4.3

Ocwen Financial Solutions

4.0

Fidelity National Financial

3.7

Franklin Templeton Investments

4.1

Vastu Housing Finance

4.2

Sun Life Financial

4.1

TIAA Global Business Services

3.9

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Write a review

Share interview

Contribute salary

Add office photos

Companies Similar to National Bank Agriculture Rural Development

Rural Electrification Corporation

Financial Services, Power

3.9

• 119 reviews

Small Industries Development Bank of India

Financial Services, NBFC

4.0

• 72 reviews

National Housing Bank

Financial Services

2.7

• 13 reviews

Export-Import Bank of India

Financial Services

3.3

• 13 reviews

2.3

• 11 reviews

Agriculture Insurance Company of India

Banking / Insurance / Accounting, Financial Services, Insurance

4.1

• 112 reviews

National Dairy Development Board

Food Processing, Federal Agencies

3.9

• 95 reviews

NATIONAL SKILL DEVELOPMENT CORPORATION

Non-Profit, Government

3.6

• 156 reviews

3.2

• 3 reviews

SBI Cards & Payment Services

Financial Services

3.7

• 4.1k reviews

Axis Direct

Financial Services, Internet

3.8

• 2.2k reviews

Kotak Securities

Financial Services

3.6

• 1.6k reviews

National Bank Agriculture Rural Development FAQs

When was National Bank Agriculture Rural Development founded?

National Bank Agriculture Rural Development was founded in 1982. The company has been operating for 43 years primarily in the Financial Services sector.

Where is the National Bank Agriculture Rural Development headquarters located?

National Bank Agriculture Rural Development is headquartered in Mumbai.

How many employees does National Bank Agriculture Rural Development have in India?

National Bank Agriculture Rural Development currently has approximately 3,700+ employees in India.

Does National Bank Agriculture Rural Development have good work-life balance?

National Bank Agriculture Rural Development has a work-life balance rating of 4.2 out of 5 based on 70+ employee reviews on AmbitionBox. 86% employees rated National Bank Agriculture Rural Development 4 or above on work-life balance. This rating reflects the company's efforts to help employees maintain a healthy balance between their personal and professional lives. We encourage you to read National Bank Agriculture Rural Development work-life balance reviews for more details

Is National Bank Agriculture Rural Development good for career growth?

Career growth at National Bank Agriculture Rural Development is highly regarded, with promotions and appraisal rating of 4.3. 86% employees rated National Bank Agriculture Rural Development 4 or above on promotions/appraisal indicating that a significant portion of employees are satisfied with career growth opportunities. We recommend reading National Bank Agriculture Rural Development promotions/appraisals reviews for more detailed insights.

What are the pros of working in National Bank Agriculture Rural Development?

Working at National Bank Agriculture Rural Development offers several advantages that make it an appealing place for employees. The company is highly rated for company culture, job security and promotions / appraisal, based on 70+ employee reviews on AmbitionBox.

Recently Viewed

INTERVIEWS

Plastic Omnium

No Interviews

INTERVIEWS

NADSOFT

No Interviews

INTERVIEWS

Amazon

No Interviews

LIST OF COMPANIES

Small Industries Development Bank of India

Overview

REVIEWS

VCC India

No Reviews

INTERVIEWS

KPIT Technologies

No Interviews

SALARIES

National Institute for Smart Government

No Salaries

SALARIES

Indian Railway Finance Corporation

No Salaries

INTERVIEWS

HCLTech

No Interviews

COMPANY BENEFITS

National Institute for Smart Government

No Benefits

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app