Add office photos

Employer?

Claim Account for FREE

KEI Industries

4.2

based on 759 Reviews

Video summary

Company Overview

Company Locations

Working at KEI Industries

Company Summary

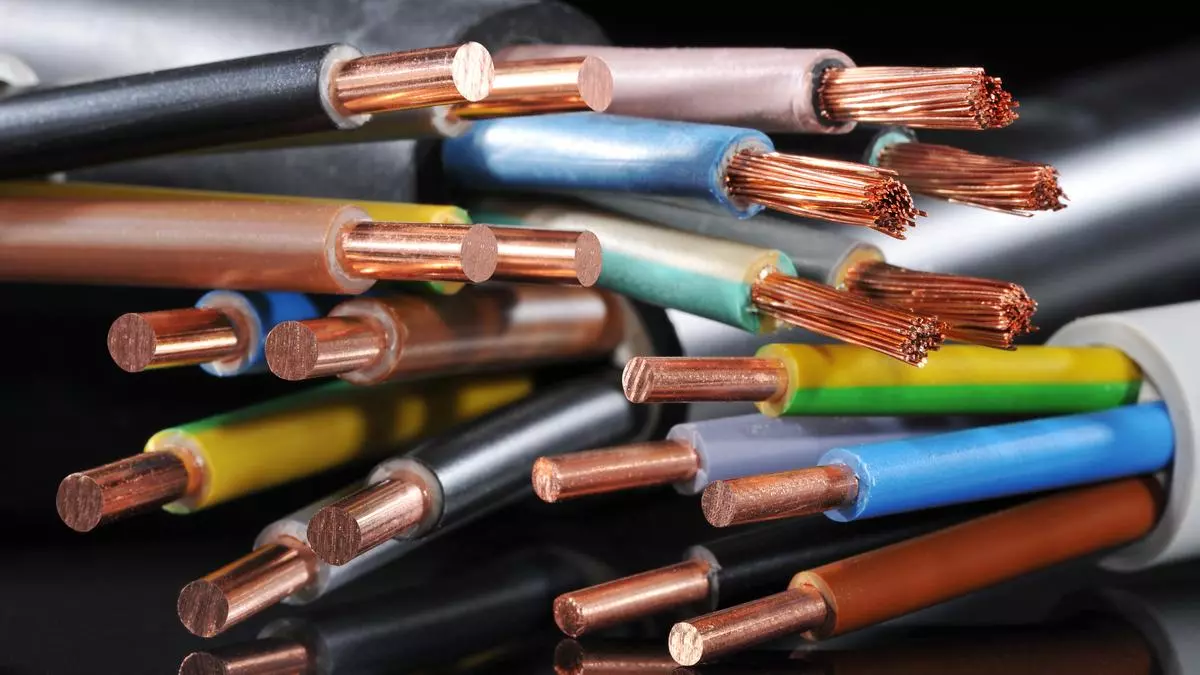

KEI Industries is one of the leading Electrical Wires & Cables Manufacturer Supplier in India offer a wide range of house wires, cable wires, flexible wires at best prices.

Overall Rating

4.2/5

based on 759 reviews

8% above

industry average

Highly rated for

Salary, Job security, Work-life balance

Work Policy

Work from office

83% employees reported

Monday to Saturday

80% employees reported

Strict timing

61% employees reported

Within city

40% employees reported

View detailed work policy

Top Employees Benefits

Health insurance

66 employees reported

Job/Soft skill training

36 employees reported

Office cab/shuttle

28 employees reported

Child care facility

14 employees reported

View all benefits

About KEI Industries

Founded in1968 (57 yrs old)

India Employee Count1k-5k

Global Employee Count1k-5k

India HeadquartersDelhi/NCR, Delhi, India

Office Locations

--

Websitekei-ind.com

Primary Industry

Other Industries

Are you managing KEI Industries's employer brand? To edit company information,

claim this page for free

View in video summary

KEI Industries Limited (KEI) was established in 1968 as a partnership firm under the name Krishna Electrical Industries, with prime business activity of manufacturing house wiring rubber cables. The firm was converted into public limited with the corporate name KEI industries Limited in December 1992. In 1996, KEI acquired Matchless, a company under same management, which was engaged in manufacture of stainless steel wires. In 2010 KEI set foot into the manufacturing of EHV cables up to 220kV in collaboration with BRUGG Kables, AG a century old Swiss company.Currently, KEI Industries Limited is engaged in the business of Manufacturing and Marketing Power Cables-Extra High Voltage(EHV), High Tension and Low Tension, Control and Instrumentation Cables, Specialty Cables, Rubber Cables, Flexible And House Wires, Submersible Cables, Pvc/Poly Wrapped Winding Wires and, Stainless Steel Wires. KEI Industries ranked amongst the top three cable manufacturing companies in India, the company addresses the cabling requirements of a wide spectrum of sectors, such as - Power, Oil Refineries, Railways, Automobiles, Cement, Steel, Fertilizers, Textile And, Real Estate etc.Through EHV Cables, KEI is geared to service Mega Power Plants, Transmission Companies, Metro Cities where underground cabling is underway, large realty projects – IT Parks, residential townships, Metro Rail Projects etc.KEI has a diversified and de-risked business model characterised by a significant presence in both the domestic and international markets, servicing both the retail and institutional segments, catering to both private and public sector clients and offering both one-stop products basket and services.

Mission: To emerge as one of the world’s leading electrical cable & wire company, offering our esteemed customers to use our electrical Wires & Cables effectively and increase industrial productivity in a sustainable way.

Vision: KEI , with its strong technology competence in Cables & Wires business, broad application know how & ability to provide customized power cable solutions shall deliver an attractive & profitable growth by providing its customers with best cable & wire products. We shall help our customers to improve their performance and productivity by minimizing power losses & lowering environmental impact. Continuous Product Innovations & R&D are the key characteristics of our product offerings and services. We believe in building long lasting & value creating partnerships with our customers and suppliers. KEI is committed to attracting & retaining dedicated & skilled professionals offering its employees an attractive work culture and developmental opportunities.

Managing your company's employer brand?

Claim this Company Page for FREE

KEI Industries Ratings

based on 759 reviews

Overall Rating

4.2/5

How AmbitionBox ratings work?

5

381

4

200

3

81

2

33

1

64

Category Ratings

4.1

Salary

3.9

Job security

3.9

Work-life balance

3.8

Company culture

3.8

Skill development

3.8

Promotions

3.8

Work satisfaction

KEI Industries is rated 4.2 out of 5 stars on AmbitionBox, based on 759 company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at KEI Industries

based on 725 reviews

3.9

Rated by 15 Women

Rated 4.4 for Job security and 4.2 for Work-life balance

4.2

Rated by 710 Men

Rated 4.1 for Salary and 4.0 for Job security

Work Policy at KEI Industries

based on 106 reviews in last 6 months

Work from office

83%

Hybrid

14%

Permanent work from home

3%

KEI Industries Reviews

Top mentions in KEI Industries Reviews

+ 5 more

Compare KEI Industries with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 4.2/5 based on 759 reviews | 3.9/5 based on 1.3k reviews | 4.0/5 based on 3.4k reviews | 4.0/5 based on 1.4k reviews |

Highly Rated for | Salary Work-life balance Job security | Job security | Work-life balance Salary | Skill development Work-life balance Salary |

Critically Rated for | No critically rated category | Promotions | No critically rated category | No critically rated category |

Primary Work Policy | Work from office 83% employees reported | Work from office 88% employees reported | Work from office 72% employees reported | Work from office 69% employees reported |

Rating by Women Employees | 3.9 Good rated by 15 women | 3.9 Good rated by 90 women | 3.6 Good rated by 143 women | 4.1 Good rated by 71 women |

Rating by Men Employees | 4.2 Good rated by 710 men | 3.9 Good rated by 1.1k men | 4.0 Good rated by 3.1k men | 4.0 Good rated by 1.3k men |

Job security | 3.9 Good | 3.8 Good | 3.7 Good | 3.7 Good |

View more

KEI Industries Salaries

KEI Industries salaries have received with an average score of 4.1 out of 5 by 759 employees.

Senior Engineer

(169 salaries)

Unlock

₹4.1 L/yr - ₹10 L/yr

Electrical Engineer

(97 salaries)

Unlock

₹3.2 L/yr - ₹6.8 L/yr

Deputy Manager

(84 salaries)

Unlock

₹7.2 L/yr - ₹15 L/yr

Sales Executive

(51 salaries)

Unlock

₹2.9 L/yr - ₹6.1 L/yr

Production Engineer

(48 salaries)

Unlock

₹1 L/yr - ₹6.2 L/yr

Assistant Project Manager

(47 salaries)

Unlock

₹5.5 L/yr - ₹11.5 L/yr

Finance Executive

(42 salaries)

Unlock

₹3 L/yr - ₹6.4 L/yr

Deputy Project Manager

(38 salaries)

Unlock

₹7.2 L/yr - ₹15 L/yr

Senior Supervisor

(38 salaries)

Unlock

₹3.1 L/yr - ₹8.4 L/yr

Project Manager

(37 salaries)

Unlock

₹7.1 L/yr - ₹24.9 L/yr

KEI Industries Interview Questions

Interview questions by designation

Top KEI Industries interview questions and answers

Get interview-ready with top interview questions

KEI Industries Jobs

Popular Designations KEI Industries Hires for

MIS Executive

Create job alerts

Front Office Executive

Create job alerts

Contract Executive

Create job alerts

Commercial Marketing Executive

Create job alerts

Popular Skills KEI Industries Hires for

KEI Industries News

View all

After paints, cable & wires, which will face the music next!

- Birla's entry intensifies competition in the decorative paints sector dominated by Asian Paints and Berger.

- Paint companies' profitability margin is expected to decrease due to increased competition and higher ad spending.

- UltraTech Cement's entry into cable and wire business causes ripples in share prices of Polycab India, Finolex Cables, KEI Industries, and RR Kabel.

- Competition in various sectors has intensified, with existing players consolidating in the cement industry.

HinduBusinessLine | 28 Mar, 2025

Havells To Polycab: Wire And Cable Shares Fall As UBS Sees Rising Competition As Negative

- Shares of Havells India Ltd., Polycab India Ltd., and KEI Industries Ltd. fell as UBS sees rising competition as negative.

- Adani Enterprises, through its subsidiary, entered the metal products, cables, and wires segment, contributing to the rising competition.

- UBS noted that the segment's competitive intensity is increasing as the second large serious player enters the market.

- Last month, cable stocks eroded Rs 30,000 crore of market cap after UltraTech Ltd.'s entry into the market.

Bloomberg Quint | 20 Mar, 2025

Stock Recommendations Today: KEI Industries, Bharti Airtel, BSE On Brokerages' Radar

- KEI Industries, Bharti Airtel, and BSE were notable stocks discussed by brokerages, alongside varied sectors.

- Jefferies, BofA, and Citi Research shared insights on India's performance, with a focus on sectors like real estate, telecom, and asset management companies.

- Foreign portfolio investment flows may improve with Dollar Index decline, boosting Indian markets as per Jefferies India Strategy.

- China is preferred over India by Jefferies Asia Pacific Quantitative Strategy, with a shift towards growth-oriented stocks.

- Goldman Sachs retained a 'neutral' rating on KEI Industries, emphasizing strong demand outlook and minimal impact from new entrants.

- CLSA maintained an 'outperform' rating on Bharti Airtel, highlighting Airtel Finance's expansion and strategic partnerships.

- Goldman Sachs retained a 'neutral' rating on BSE but revised down the target price, citing challenges in the options market share and revenue growth.

- HSBC provided insights on real estate and AMCs, adjusting target prices for key players based on macroeconomic concerns and growth pressures.

- HSBC also shared perspectives on Bharti Airtel's positive outlook, expecting free cash flow surge and no spectrum renewals for the next five years.

- BofA turned constructive on Nifty 50, foreseeing potential returns and preferring select domestic cyclicals amidst key risks like tariff wars and US slowdown.

- Citi Strategy highlighted investor sentiments towards India, focusing on sectors like banking, insurance, telecom, healthcare, and cement for investment opportunities.

Bloomberg Quint | 6 Mar, 2025

Six Stocks In News At Noon: M&M, Infosys, KEI Industries, Coal India, HDFC Bank

- Mahindra & Mahindra reported a 1% YoY rise in total auto sales, leading to a 4.29% increase in its share price on Monday.

- Infosys' share price rose over 2% as Nifty IT steadied after experiencing a sharp decline last week.

- KEI Industries witnessed a 5% surge in its shares, outperforming the benchmark Nifty 50.

- Coal India's shares declined by 4.59% due to a 0.9% drop in February production compared to the previous year.

Bloomberg Quint | 3 Mar, 2025

Polycab, KEI Industries, Havells May Face Tough Times Ahead, Say Brokerages

- The cables and wires sector, including companies such as Polycab, Havells, V-Guard, and KEI Industries, is expected to face challenging times ahead.

- Analysts predict slower growth and margin erosion for these companies, despite their historical strong performance.

- Investec has downgraded its valuation for Havells and V-Guard, while Jefferies has cut the target price for Polycab and KEI Industries.

- UltraTech Cements Ltd., a major player in the cement sector, plans to enter the cables and wires market, which adds to the competitive pressure.

Bloomberg Quint | 3 Mar, 2025

Stock Market Today: All You Need To Know Going Into Trade On March 3

- The NSE Nifty 50 and BSE Sensex closed significantly lower on Friday, with Nifty falling to its lowest level since June 5.

- Foreign portfolio investors continued selling Indian equities, while domestic institutional investors remained net buyers on Friday.

- Notable post-market earnings include International Gemmological Institute's positive Q4 CY24 highlights.

- Stocks to watch include IIFL Finance, Piramal Enterprises, and Aditya Birla Real Estate, among others.

- Bulk deals featured Coforge, Home First Fin, IndusInd Bank, KEI Industries, Mufin Green Finance, and Teamlease Services.

- Block deals involved ITC, WHILE Wells Fargo Emerging Markets Equity, among others.

- Companies like Hitachi Energy India, Ventive Hospitality, and SBI are scheduled to meet analysts and investors on specific dates.

- Insider trades included transactions by promoters of Nirlon, Thirumalai Chemicals, and Shakti Pumps (India).

- Trading tweaks included price band changes for Optiemus Infracom and Jubilant Agri, along with stocks moving in and out of the ASM framework.

- Currency update showcased the rupee closing lower at 87.52 against the US dollar due to tariff outlook uncertainty.

Bloomberg Quint | 3 Mar, 2025

Polycab, RR Kabel, Finolex, KEI Industries, Havells: How UltraTech short circuited cable stocks

- The announcement of UltraTech Cement's entry into the cables and wires space caused a significant decline in the market value of cable stocks.

- Investors reacted negatively due to overall market weakness, high valuations of the sector, and learnings from the paints industry experience.

- Wire stocks have high price-to-earnings ratios despite a 21% correction in the past year, which made the negative news more impactful.

- Havells India, with its diversified portfolio, is better positioned to absorb the competition in the cable and wires segment.

HinduBusinessLine | 1 Mar, 2025

Six Stocks In News At Noon: Patanjali Foods, Coal India, Ireda, KEI Industries

- Shares of Patanjali Foods plunged over 13% after its inclusion in Futures and Options contracts.

- Coal India saw its share price rise over 3% after announcing an additional charge of Rs 300 per tonne across all mines starting May 1.

- Ireda shares fell over 7% as the stock entered the Futures & Options segment.

- Shares of KEI Industries rose over 7% following a notable recovery in the wire and cable sector.

Bloomberg Quint | 28 Feb, 2025

.jpg?rect=0%2C0%2C3871%2C2032&w=1200&auto=format%2Ccompress&ogImage=true)

Wires and cable stocks plunge as UltraTech Cement announces entry into the sector

- Wires and cable stocks plunged as UltraTech Cement announced its entry into the sector.

- KEI Industries and RR Kabel were the most affected, with significant declines in their stock prices.

- UltraTech Cement plans to set up a manufacturing plant in Gujarat by late 2026.

- While the market reaction might be overdone, there are concerns about the long-term impact and consolidation in the industry.

HinduBusinessLine | 27 Feb, 2025

Cable Stocks Erode Rs 30,000 Crore In Market Cap On UltraTech's Foray Into The Sector

- UltraTech Cement Ltd.'s announcement of its entry into the wires and cables segment caused a market cap erosion of around Rs 30,000 crore for listed wires and cable players.

- Stocks like KEI Industries Ltd., Polycab India Ltd., and RR Kabel Ltd. witnessed significant declines following UltraTech's announcement.

- The negative stock reactions may also be linked to the Aditya Birla Group's foray into the paints sector with Birla Opus, impacting valuations across companies.

- UltraTech plans a capital expenditure of Rs 1,800 crore for its market entry, aiming to establish a plant in Bharuch, Gujarat by December 2026.

- With a current market size of Rs 80,000 crore, UltraTech targets addressing the building wire market first, which is around Rs 25,000 crore.

- Ambit estimates UltraTech could generate annual revenue of Rs 5,000–7,000 crore and EBITDA of Rs 400–800 crore from the cable venture in three–five years.

- The entry poses financial strain for UltraTech amidst existing investments; stock prices of cable companies, including Polycab and KEI, may see de-rating.

- Analysts foresee challenges in building a dedicated distribution network for the wires and cables business, impacting UltraTech's leverage and market positioning.

- Concerns arise about UltraTech's strategy to integrate building solutions with cements, paints, wires, and cables; potential overlaps and operational challenges are discussed.

- Expectations of revenue potential, competitive landscape shifts, and market reactions suggest a period of adjustment and valuation corrections for the cable industry.

Bloomberg Quint | 27 Feb, 2025

Powered by

KEI Industries Offices

Compare KEI Industries with

C&S Electric

4.0

Medha Servo Drives

4.2

Finolex Cables

3.8

RR kabel

4.1

Raychem RPG

3.9

Amber Enterprises India

3.9

Okaya Power

3.7

HBL Power Systems

4.0

Voltech

3.5

Hpl Electric & Power

3.5

Legrand

3.7

Bharat Bijlee

4.3

Landis+Gyr

3.3

Mettler-Toledo

3.6

Eastman Auto and Power Limited

3.6

Elecon Engineering

4.1

Toshiba Transmission & Distribution Systems

3.9

Laser Power & Infra

3.7

Kirloskar Electric Company

3.4

Li & Fung

4.0

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to KEI Industries

Havells

Manufacturing, Electronics, Electrical Equipment

4.0

• 3.4k reviews

Polycab Wires

Industrial Machinery, Manufacturing, Electronics, Electrical Equipment

4.0

• 1.4k reviews

CG Power and Industrial Solutions

Consumer goods, Manufacturing, Education & Training, Electrical Equipment

3.9

• 1.3k reviews

C&S Electric

Manufacturing, Electronics, Engineering & Construction, Electrical Equipment

4.0

• 810 reviews

Medha Servo Drives

Manufacturing, Roads/Railways, Electronics, Electrical Equipment

4.2

• 739 reviews

Finolex Cables

Plastics / Rubber, Electrical Equipment

3.8

• 640 reviews

RR kabel

Industrial Machinery, Manufacturing, Electrical Equipment

4.1

• 601 reviews

Raychem RPG

Import & Export, Oil / Gas / Petro Chemicals, Power, Electrical Equipment

3.9

• 582 reviews

Amber Enterprises India

Internet, Electrical Equipment

3.9

• 555 reviews

Okaya Power

Consumer goods, Manufacturing, Electrical Equipment

3.7

• 517 reviews

HBL Power Systems

Manufacturing, Electronics, Electrical Equipment

4.0

• 506 reviews

Voltech

Industrial Machinery, Manufacturing, Electronics, Electrical Equipment

3.5

• 455 reviews

KEI Industries FAQs

When was KEI Industries founded?

KEI Industries was founded in 1968. The company has been operating for 57 years primarily in the Electrical Equipment sector.

Where is the KEI Industries headquarters located?

KEI Industries is headquartered in Delhi/NCR, Delhi.

How many employees does KEI Industries have in India?

KEI Industries currently has more than 1,700+ employees in India. Construction & Site Engineering department appears to have the highest employee count in KEI Industries based on the number of reviews submitted on AmbitionBox.

Does KEI Industries have good work-life balance?

KEI Industries has a Work-Life Balance Rating of 3.9 out of 5 based on 700+ employee reviews on AmbitionBox. 77% employees rated KEI Industries 4 or above, while 23% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read KEI Industries work-life balance reviews for more details

Is KEI Industries good for career growth?

Career growth at KEI Industries is rated fairly well, with a promotions and appraisal rating of 3.8. 77% employees rated KEI Industries 4 or above, while 23% employees rated it 3 or below on promotions/appraisal. Though the sentiment is mixed for career growth, majority employees have rated it positively. We recommend reading KEI Industries promotions/appraisals reviews for more detailed insights.

What are the pros of working in KEI Industries?

Working at KEI Industries offers several advantages that make it an appealing place for employees. The company is highly rated for salary & benefits, job security and work life balance, based on 700+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app