Add office photos

Employer?

Claim Account for FREE

Havells

4.0

based on 3.4k Reviews

Video summary

Company Overview

Associated Companies

Company Locations

Working at Havells

Company Summary

Rediscover the joy of fresh living & eating with Havells Domestic Appliances Fans, Home & Kitchen Appliances, Led Lights, Personal Grooming etc.

Overall Rating

4.0/5

based on 3.4k reviews

3% above

industry average

Highly rated for

Salary, Work-life balance

Work Policy

Work from office

72% employees reported

Monday to Saturday

50% employees reported

Strict timing

57% employees reported

Within city

42% employees reported

View detailed work policy

Top Employees Benefits

Health insurance

182 employees reported

Job/Soft skill training

171 employees reported

Cafeteria

70 employees reported

Office cab/shuttle

57 employees reported

View all benefits

About Havells

Founded in1983 (42 yrs old)

India Employee Count5k-10k

Global Employee Count5k-10k

India HeadquartersNoida, Uttar Pradesh, India

Office Locations

Websitehavells.com

Primary Industry

Other Industries

Are you managing Havells's employer brand? To edit company information,

claim this page for free

View in video summary

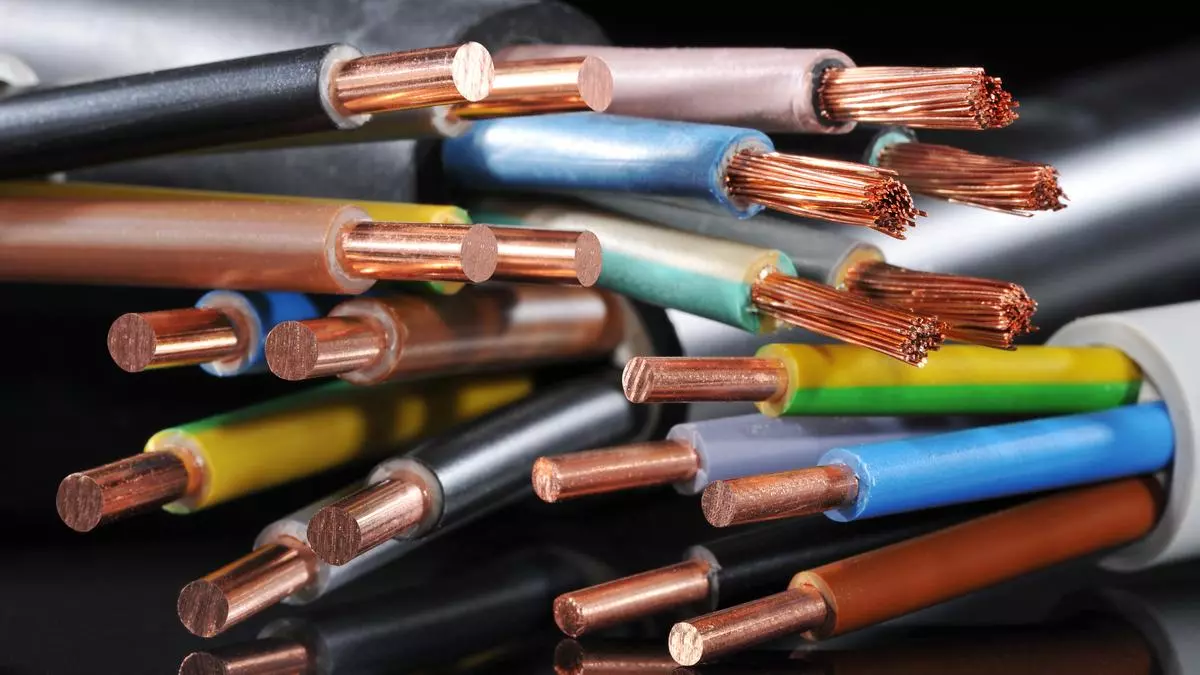

Havells India Limited is a leading Fast Moving Electrical Goods (FMEG) Company and a major power distribution equipment manufacturer with a strong global presence. Havells enjoys enviable market dominance across a wide spectrum of products, including Industrial & Domestic Circuit Protection Devices, Cables & Wires, Motors, Fans, Modular Switches, Home Appliances, Air Conditioners, Electric Water Heaters, Power Capacitors, Luminaires for Domestic, Commercial and Industrial Applications.

Mission: To achieve our vision through business ethics, global reach, technological expertise, building long-term relationships with all our associates, customers, partners and employees.

Vision: To be a globally recognised corporation for excellence, governance, consumer delight and fairness to each stakeholder including the society and environment we operate in.

Managing your company's employer brand?

Claim this Company Page for FREE

Brands of Havells

Crabtree

-

• No Reviews

Havells Ratings

based on 3.4k reviews

Overall Rating

4.0/5

How AmbitionBox ratings work?

5

1.7k

4

909

3

448

2

162

1

260

Category Ratings

3.8

Salary

3.8

Work-life balance

3.7

Company culture

3.7

Job security

3.7

Skill development

3.6

Work satisfaction

3.4

Promotions

Havells is rated 4.0 out of 5 stars on AmbitionBox, based on 3.4k company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at Havells

based on 3.3k reviews

3.6

Rated by 142 Women

Rated 3.7 for Job security and 3.6 for Work-life balance

4.0

Rated by 3.1k Men

Rated 3.8 for Work-life balance and 3.8 for Salary

Work Policy at Havells

based on 617 reviews in last 6 months

Work from office

72%

Hybrid

21%

Permanent work from home

7%

Havells Reviews

Top mentions in Havells Reviews

+ 5 more

Compare Havells with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 4.0/5 based on 3.4k reviews | 3.9/5 based on 1.3k reviews | 4.2/5 based on 758 reviews | 4.0/5 based on 810 reviews |

Highly Rated for | Work-life balance Salary | Job security | Salary Work-life balance Job security | Job security Work-life balance Company culture |

Critically Rated for | No critically rated category | Promotions | No critically rated category | Promotions |

Primary Work Policy | Work from office 72% employees reported | Work from office 88% employees reported | Work from office 83% employees reported | Work from office 75% employees reported |

Rating by Women Employees | 3.6 Good rated by 142 women | 3.9 Good rated by 90 women | 3.9 Good rated by 15 women | 3.6 Good rated by 39 women |

Rating by Men Employees | 4.0 Good rated by 3.1k men | 3.9 Good rated by 1.1k men | 4.2 Good rated by 709 men | 4.0 Good rated by 734 men |

Job security | 3.7 Good | 3.8 Good | 3.9 Good | 4.0 Good |

View more

Havells Salaries

Havells salaries have received with an average score of 3.8 out of 5 by 3.4k employees.

Deputy Manager

(610 salaries)

Unlock

₹6 L/yr - ₹18.8 L/yr

Senior Engineer

(409 salaries)

Unlock

₹4 L/yr - ₹13.5 L/yr

Sales Executive

(279 salaries)

Unlock

₹1.2 L/yr - ₹6.1 L/yr

Senior Sales Executive

(204 salaries)

Unlock

₹1.8 L/yr - ₹9.1 L/yr

Assistant General Manager

(198 salaries)

Unlock

₹15 L/yr - ₹45 L/yr

Area Sales Manager

(171 salaries)

Unlock

₹5 L/yr - ₹18.5 L/yr

Area Head

(149 salaries)

Unlock

₹5 L/yr - ₹15 L/yr

Sales Manager

(142 salaries)

Unlock

₹6.9 L/yr - ₹23 L/yr

Sales Officer

(126 salaries)

Unlock

₹2 L/yr - ₹6.2 L/yr

Production Engineer

(112 salaries)

Unlock

₹0.7 L/yr - ₹6.5 L/yr

Havells Jobs

Current Openings

Havells News

View all

Havells Aims To Sustain Profitability Amid Market Challenges, Says Motilal Oswal Maintaining 'Neutral' Rating

- Havells stock is trading fairly at 54x/44x FY26/27E EPS and, hence, Motilal Oswal reiterates its Neutral rating with a target price of Rs 1,650 (premised on 50x FY27E EPS).

- Motilal Oswal expects Havells' EPS to grow at a 23% CAGR over FY25-27, supported by margin expansion in Lloyd and other key segment.

- Havells continues to invest in manufacturing, brand building, distribution, talent development, premiumization, and R&D, positioning itself for long-term success. The summer season has begun on a positive note, which should drive growth for Lloyd, with profitability sustained through operating leverage and cost controls. Demand for cables & wires remains strong, with a stable long-term growth outlook. In the switches and switchgear segment, Havells aims to strengthen its retail reach and consolidate its market share, supported by new product launches.

- Havells is striving to sustain profitability in the face of market challenges, and Motilal Oswal maintains a 'Neutral' rating for the company.

Bloomberg Quint | 28 Mar, 2025

Havells To Polycab: Wire And Cable Shares Fall As UBS Sees Rising Competition As Negative

- Shares of Havells India Ltd., Polycab India Ltd., and KEI Industries Ltd. fell as UBS sees rising competition as negative.

- Adani Enterprises, through its subsidiary, entered the metal products, cables, and wires segment, contributing to the rising competition.

- UBS noted that the segment's competitive intensity is increasing as the second large serious player enters the market.

- Last month, cable stocks eroded Rs 30,000 crore of market cap after UltraTech Ltd.'s entry into the market.

Bloomberg Quint | 20 Mar, 2025

Amber, Crompton, Voltas: Jefferies' Top Picks Set To See Big Summer Boost

- Jefferies' top summer picks include Amber Group, Voltas Ltd., and Crompton Greaves Consumer Electricals Ltd. in the air-conditioning space.

- Amber Group is a demand aggregator, with 70% domestic market share in AC contract manufacturing and 25% overall value share.

- Jefferies maintains a 'hold' rating on Havells India Ltd., Whirlpool, and Bluestar due to relatively rich valuations.

- Stay updated with live TV, stock market updates, business news, IPO, and more on NDTV Profit.

Bloomberg Quint | 11 Mar, 2025

Stock Recommendations Today: Titan, Info Edge, Zinka Logistics, Havells India On Brokerages' Radar

- Stock recommendations for Titan, Info Edge, Zinka Logistics, and Havells India are highlighted by brokerages on Tuesday.

- JPMorgan emphasized the importance of demand revival for the paint sector's performance and noted a stabilizing margin outlook.

- Macquarie retained an 'outperform' rating on Titan but lowered the target price, addressing investor concerns.

- Macquarie also maintained an 'underperform' rating on Info Edge and raised the target price due to valuation concerns.

- JPMorgan highlighted the positive factors influencing the paint sector's performance in the market.

- Morgan Stanley maintained an 'equal-weight' rating on Zinka Logistics with a target price, despite potential delays.

- BofA retained an 'underperform' rating on Havells India and adjusted the target price, considering market dynamics.

- Jefferies' Indian Strategy focused on government measures to boost consumption and savings in the market.

- Morgan Stanley's analysis of Can Fin Homes highlighted key takeaways from management meetings and growth projections.

- Analysts are closely monitoring various stocks and sectors to provide insights on market movements.

Bloomberg Quint | 4 Mar, 2025

Polycab, KEI Industries, Havells May Face Tough Times Ahead, Say Brokerages

- The cables and wires sector, including companies such as Polycab, Havells, V-Guard, and KEI Industries, is expected to face challenging times ahead.

- Analysts predict slower growth and margin erosion for these companies, despite their historical strong performance.

- Investec has downgraded its valuation for Havells and V-Guard, while Jefferies has cut the target price for Polycab and KEI Industries.

- UltraTech Cements Ltd., a major player in the cement sector, plans to enter the cables and wires market, which adds to the competitive pressure.

Bloomberg Quint | 3 Mar, 2025

Polycab, RR Kabel, Finolex, KEI Industries, Havells: How UltraTech short circuited cable stocks

- The announcement of UltraTech Cement's entry into the cables and wires space caused a significant decline in the market value of cable stocks.

- Investors reacted negatively due to overall market weakness, high valuations of the sector, and learnings from the paints industry experience.

- Wire stocks have high price-to-earnings ratios despite a 21% correction in the past year, which made the negative news more impactful.

- Havells India, with its diversified portfolio, is better positioned to absorb the competition in the cable and wires segment.

HinduBusinessLine | 1 Mar, 2025

Havells To Finolex: Wire And Cable Stocks Recover After Selling Pressure From UltraTech's Entry Plan

- The wire and cable sector experienced a recovery following selling pressure from UltraTech's entry plan.

- On Friday, the market capitalisation of the top cable and wire stocks grew by Rs 1,514 crore, partially recovering from a sharp decline of Rs 35,500 crore on Thursday.

- Finolex Cables saw a slight increase of 0.43% in its stock price, bringing its market cap to Rs 12,629.73 crore.

- Havells India saw a gain of 0.26%, with its market cap standing at Rs 90,737.28 crore.

Bloomberg Quint | 28 Feb, 2025

Polycab, KEI Industries, RR Kabel, Havells and Finolex Cables crash on UltraTech’s entry into cables & wires space

- UltraTech's entry into the cables and wires space resulted in a crash in the stock prices of Polycab, KEI Industries, RR Kabel, Havells, and Finolex Cables.

- Analysts anticipate a de-rating in valuation multiples for other players in the space. However, KEI, Polycab, and Havells are expected to remain bullish.

- Nuvama Institutional Equities states that UltraTech's entry is unlikely to impact the FY25-28 earnings of cables and wires players.

- ICICI Securities predicts a potential contraction in margins for players due to aggressive pricing by UltraTech.

HinduBusinessLine | 27 Feb, 2025

KEI Industries, Polycab, Havells Share Prices Go Haywire After UltraTech's Cables Entry Plan

- Shares of Polycab India, KEI Industries, R R Kabel, and Havells India saw a sharp decline after UltraTech Cements announced plans to enter the cables and wires business.

- The entry of UltraTech is expected to create healthy competition among organized players, according to Macquarie.

- KEI Industries shares fell by 20%, Polycab shares fell by 15%, and Havells shares fell by 9.41% on the NSE.

- Analysts have mixed recommendations for these stocks, with some suggesting a 'buy' and others recommending a 'hold' or 'sell'.

Bloomberg Quint | 27 Feb, 2025

Buy Havells India, Target Price Of Rs 1800 — ICICI Securities

- ICICI Securities recommends buying Havells India with a target price of Rs 1800.

- Focus on market share gains of Lloyd has helped outpace Havells' peers in air conditioners, but resulted in losses over FY20–24.

- ICICI Securities expects revenue/PAT CAGRs of 14.4%/19.5% over FY24–27E for Havells India.

- The brokerage maintains a Buy rating with a DCF-based target price of Rs 1,800 (implied P/E of 52x FY27E EPS).

Bloomberg Quint | 25 Feb, 2025

.jpg?rect=0%2C30%2C391%2C205&w=1200&auto=format%2Ccompress&ogImage=true)

Powered by

Havells Subsidiaries

Lloyd Electric & Engineering

4.2

• 124 reviews

Lloyd

3.9

• 70 reviews

Promptec Renewable Energy Solutions

4.7

• 12 reviews

Standard Electricals

4.4

• 9 reviews

Report error

Compare Havells with

Finolex Cables

3.8

RR kabel

4.1

Amber Enterprises India

3.9

HBL Power Systems

4.0

Bharat Bijlee

4.3

Landis+Gyr

3.4

Elecon Engineering

4.1

Lumino Industries

3.9

Servotech Power Systems

4.1

East India Udyog

4.0

Kirloskar Electric Company

3.4

SasMos HET Technologies

3.8

Schneider Electric Infrastructure

4.2

Triveni Turbines

3.7

Swelect Energy Systems

3.7

Graphite India

3.6

Salzer Electronics

3.9

Aptronix - Apple Premium Reseller

3.8

Hind Rectifiers

3.6

ECE Industries

3.3

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to Havells

CG Power and Industrial Solutions

Consumer goods, Manufacturing, Education & Training, Electrical Equipment

3.9

• 1.3k reviews

C&S Electric

Manufacturing, Electronics, Engineering & Construction, Electrical Equipment

4.0

• 810 reviews

KEI Industries

Manufacturing, Electronics, Electrical Equipment

4.2

• 758 reviews

Finolex Cables

Plastics / Rubber, Electrical Equipment

3.8

• 639 reviews

RR kabel

Industrial Machinery, Manufacturing, Electrical Equipment

4.1

• 599 reviews

Amber Enterprises India

Internet, Electrical Equipment

3.9

• 554 reviews

HBL Power Systems

Manufacturing, Electronics, Electrical Equipment

4.0

• 506 reviews

Bharat Bijlee

Manufacturing, Electronics, Engineering & Construction, Electrical Equipment

4.3

• 379 reviews

Landis+Gyr

Internet, Manufacturing, Electronics, Software Product, Electrical Equipment

3.4

• 370 reviews

Elecon Engineering

Engineering & Construction, Electrical Equipment

4.1

• 314 reviews

Lumino Industries

Manufacturing, Electronics, Electrical Equipment

3.9

• 260 reviews

Servotech Power Systems

Electrical Equipment

4.1

• 253 reviews

Havells FAQs

When was Havells founded?

Havells was founded in 1983. The company has been operating for 42 years primarily in the Electrical Equipment sector.

Where is the Havells headquarters located?

Havells is headquartered in Noida, Uttar Pradesh. It operates in 8 cities such as Noida, Lucknow, Bangalore / Bengaluru, Chennai, Ahmedabad. To explore all the office locations, visit Havells locations.

How many employees does Havells have in India?

Havells currently has more than 7,400+ employees in India. Sales & Business Development department appears to have the highest employee count in Havells based on the number of reviews submitted on AmbitionBox.

Does Havells have good work-life balance?

Havells has a Work-Life Balance Rating of 3.8 out of 5 based on 3,400+ employee reviews on AmbitionBox. 75% employees rated Havells 4 or above, while 25% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read Havells work-life balance reviews for more details

Is Havells good for career growth?

Career growth at Havells is rated as moderate, with a promotions and appraisal rating of 3.4. 25% employees rated Havells 3 or below, while 75% employees rated it 4 or above on promotions/appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading Havells promotions/appraisals reviews for more detailed insights.

What are the pros of working in Havells?

Working at Havells offers several advantages that make it an appealing place for employees. The company is highly rated for salary & benefits and work life balance, based on 3,400+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app