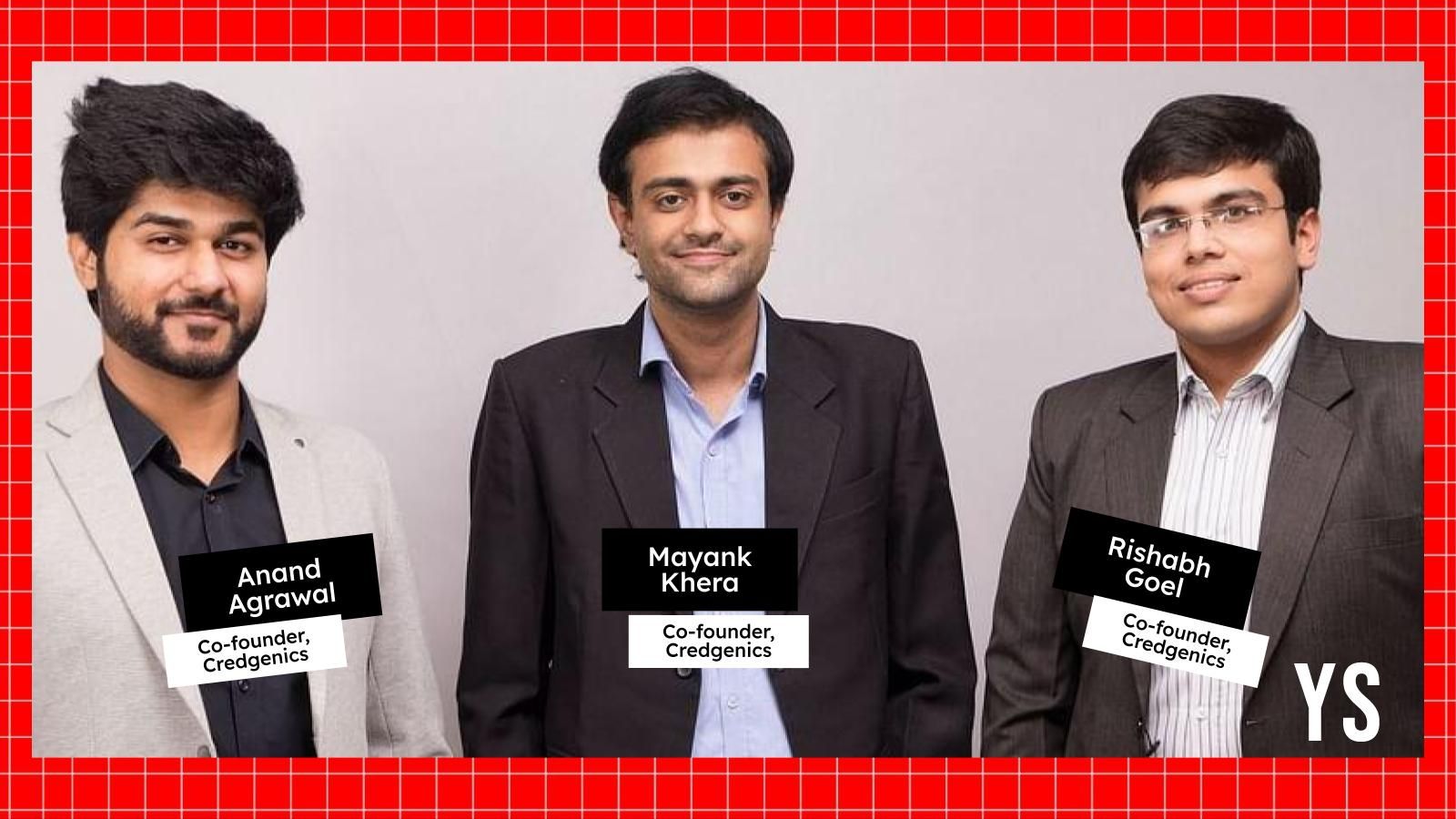

Credgenics

Working at Credgenics

Company Summary

Overall Rating

5% below

Critically rated for

Promotions, Work satisfaction, Skill development

Work Policy

Top Employees Benefits

About Credgenics

Credgenics is an innovative FinTech which provides advanced loan collections and debt resolution technology solutions to Banks, Non-banking finance companies, ARCs and Digital lending firms worldwide. The award-winning SaaS based platform covers end-to-end collections lifecycle with unique capabilities including multi-channel digital communications, AI powered predictor models for optimal collections strategy, field collections mobile app CG Collect, Billzy digital payments, litigation management system, comprehensive dashboards, analytical models insights. Credgenics platform helps lenders leverage technology to boost their resolution rates, improve collections efficiencies, increase collections, transform customer experience and reduce non performing loans. Credgenics also provides end-to-end digital solutions using the Online Dispute Resolution framework for financial disputes in BFSI sector.

Credgenics Ratings

Overall Rating

Category Ratings

Work-life balance

Company culture

Job security

Salary

Skill development

Work satisfaction

Promotions

Work Policy at Credgenics

Credgenics Reviews

Top mentions in Credgenics Reviews

Compare Credgenics with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 3.5/5 based on 116 reviews | 4.6/5 based on 11 reviews | 3.4/5 based on 6 reviews | 3.3/5 based on 6 reviews |

Highly Rated for | No highly rated category | Skill development Company culture Job security | No highly rated category | No highly rated category |

Critically Rated for | Promotions Work satisfaction Skill development | No critically rated category | Promotions Work satisfaction Job security | Promotions Job security Salary |

Primary Work Policy | Work from office 65% employees reported | - | - | - |

Rating by Women Employees | 3.4 Average rated by 30 women | - no rating available | - no rating available | 2.4 Poor rated by 2 women |

Rating by Men Employees | 3.5 Good rated by 81 men | - no rating available | - no rating available | 3.5 Good rated by 4 men |

Job security | 3.3 Average | 4.1 Good | 1.9 Bad | 2.6 Poor |

Credgenics Salaries

Data Analyst

Legal Associate

Legal Consultant

Software Engineer

Product Manager

Operations Executive

MIS Executive

Collections Executive

Senior Software Engineer

Customer Success Manager

Credgenics Interview Questions

Interview questions by designation

Top Credgenics interview questions and answers

Credgenics Jobs

Credgenics News

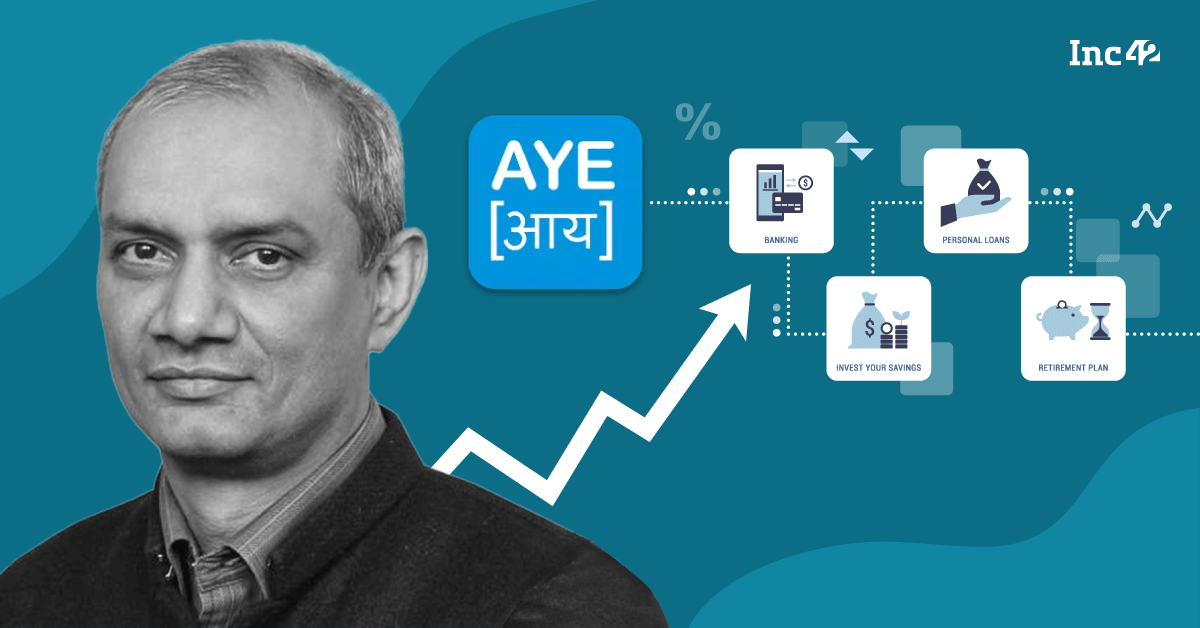

NBFC Aye Finance Partners Credgenics To Offer AI-Based Collection Solutions

- NBFC Aye Finance has partnered with Credgenics for debt collection and resolution services.

- Through this partnership, Aye Finance customers will receive personalized and insight-driven communication strategies.

- Credgenics' mobile collection platform will enable Aye Finance to generate personalized payment links for secure digital transactions.

- Aye Finance is aiming to raise INR 1,450 Cr through its upcoming IPO.

Startup news and updates: Daily roundup (February 4, 2025)

- India may have a GPU problem when it comes to its AI ambitions, as major AI powerhouses in the US and China have a far bigger muscle. OYO has plans to invest £50m in the UK over the next three years to expand its premium hotel portfolio and generate 1,000 direct and indirect jobs. Priyanka Gill, Co-founder of The Good Glamm Group, is moving on from her role at Kalaari Capital as a venture partner to launch a lab-grown diamond brand. The Global Private Capital Association (GPCA) has launched its inaugural Southeast Asia Women Investors Directory. Beacon, a super app purpose-built for immigrants to Canada, has introduced India Bill Pay, allowing users to pay Indian bills directly in Canadian dollars. Eli Lilly and Company has appointed Winselow Tucker as the President and General Manager of Lilly India, effective immediately. The partnership between NBFC Aye Finance and AI-powered debt collections platform Credgenics aims to enhance Aye Finance's digital debt resolution processes. New Relic has introduced the industry's first AI monitoring solution for DeepSeek, designed to streamline the development, deployment, and monitoring of generative AI (GenAI) applications while reducing complexity and costs.

- Earlier this month, Union Minister of Electronics and IT Ashwini Vaishnaw announced plans to develop India's own foundational AI model. Kalaari Capital's Priyanka Gill has launched lab-grown diamond brand COLUXE to make fine jewellery an everyday luxury for aspirational consumers. The Global Private Capital Association's inaugural Southeast Asia Women Investors Directory features 365 women investment professionals deploying private capital across various sectors. Eli Lilly expects Winselow Tucker's experience will be pivotal in driving growth and positioning Lilly for long-term success in India. The partnership between Aye Finance and Credgenics aims to enable personalised, insights-driven borrower communication and collection strategies. Beacon's India Bill Pay allows users in Canada to pay Indian bills directly in Canadian dollars.

- India needs to catch up fast in the global GPU race if it wants a place in the AI race. Kalaari Capital's Priyanka Gill will leave her venture partner role to launch lab-grown diamond brand COLUXE. OYO emphasises long-term leasehold and management contracts to pursue the premiumisation of its UK portfolio. The Southeast Asia Women Investors Directory is aimed at increasing the visibility of women investors in the region. Beacon's India Bill Pay aims to offer an independent solution through the company's super app. Lilly India's president and general manager Winselow Tucker will oversee the company's commercial operations in India and lead the Lilly Capability Centre India.

- New Relic has introduced the industry's first AI monitoring solution for DeepSeek, which streamlines the development, deployment, and monitoring of generative AI applications. The partnership between Aye Finance and Credgenics aims to enhance personalised communication and collection strategies. The Global Private Capital Association represents over 300 members managing over $2tn in assets across 130 countries.

What's popular during festive season sales; What IPO valuation means to Swiggy

- India Inc has upped the gifting budgets, and corporates are tying up with online portals to curate customised gifts for employees on Diwali.

- Tiger Global-backed digital lender MoneyView's revenue rose sharply 75% YoY to Rs 1,012 crore.

- Fintech Credgenics turned profitable with its parent boosting revenue by 72% YoY.

- EV enabler BatterySmart nearly tripled its revenue but its losses also more than doubled.

- Elcid Investments has dethroned MRF to become the most expensive stock.

- Flipkart managed to clock 33 crore user visits during early access and day 1 of its Big Billion Days festive sale.

- Swiggy expects Instamart to outpace its core food delivery business.

- Meesho reported a 33% growth in revenue and narrowed its adjusted losses by 97% to Rs 53 crore in FY24.

- Chinese electric vehicle manufacturer BYD overtook Tesla in quarterly revenue for the first time.

- Reddit just turned a profit for the first time, reporting a profit of $29.9 million, along with $348.4 million in revenue—a 68% increase YoY.

Credgenics parent posts Rs 8.38 Cr profit in FY24

- Analog Legalhub, parent of Credgenics, recorded a net profit of Rs 8.38 crore in FY24, marking a reversal from the loss of Rs 12.62 crore in FY23.

- Total revenue increased by 72.38% year-on-year to Rs 155.58 crore in FY24, driven by the growing adoption of digital debt collection and resolution tools.

- Employee benefit expenses rose by 49.86% year-on-year to Rs 61.10 crore in FY24, while other expenses increased by 42.54% to Rs 85.64 crore.

- Credgenics, founded in 2018, offers a SaaS-based platform for efficient loan collections and debt recovery. It raised $50 million in a Series B funding round last year.

Compare Credgenics with

Contribute & help others!

Companies Similar to Credgenics

Credgenics FAQs

Reviews

Interviews

Salaries

Users/Month