Indus Towers

Working at Indus Towers

Company Summary

Overall Rating

3% above

Critically rated for

Promotions

Work Policy

Top Employees Benefits

Rate your company

🤫 100% anonymous

How was your last interview experience?

About Indus Towers

Indus Towers Limited is formed by the merger of Bharti Infratel Limited and Indus Towers. This combined strength makes Indus one of the largest telecom tower companies in the world. Enabling communication for millions of people daily, Indus will continue to provide affordable, high-quality and reliable services for the growing network connectivity needs of India.

Indus Towers Limited has over 225,910 towers and 374,928 co-locations (30th June 2024) and a nationwide presence covering all 22 telecom circles. Indus’ leading customers are Bharti Airtel (together with Bharti Hexacom), Vodafone Idea Limited and Reliance Jio Infocomm Limited, which are the leading wireless telecommunications service providers in India by revenue.

Indus Towers Ratings

Overall Rating

Category Ratings

Salary

Company culture

Skill development

Job security

Work-life balance

Work satisfaction

Promotions

Work Policy at Indus Towers

Indus Towers Reviews

Top mentions in Indus Towers Reviews

Compare Indus Towers with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.8/5 based on 2.2k reviews | 4.5/5 based on 521 reviews | 4.5/5 based on 356 reviews | 3.9/5 based on 214 reviews |

Highly Rated for |  No highly rated category | Company culture Skill development Work-life balance | Work-life balance Company culture Salary | Work-life balance Salary |

Critically Rated for | Promotions |  No critically rated category |  No critically rated category | Promotions |

Primary Work Policy | Work from office 57% employees reported | Work from office 54% employees reported | Work from office 71% employees reported | Hybrid 56% employees reported |

Rating by Women Employees | 3.4 Average rated by 161 women | 3.9 Good rated by 36 women | 4.3 Good rated by 19 women | 3.8 Good rated by 28 women |

Rating by Men Employees | 3.8 Good rated by 1.9k men | 4.5 Good rated by 447 men | 4.5 Good rated by 301 men | 3.9 Good rated by 181 men |

Job security | 3.4 Average | 4.2 Good | 4.2 Good | 3.6 Good |

Indus Towers Salaries

MIS Executive

Field Support Engineer

Quality Engineer

Site Acquisition Executive

Project Manager

TOC Engineer

Area Operation Manager

Cluster Incharge

TOC Executive

Field Service Engineer

Indus Towers Interview Questions

Interview questions by designation

Top Indus Towers interview questions and answers

Indus Towers Jobs

Indus Towers News

Stock Recommendations Today: IndiGo, SBI Cards, Airtel, Coal India And Zomato On Brokerages' Radar

- Brokerages are closely observing stocks like SBI Cards, Trent, IndiGo, Bharti Airtel, Coal India, EPL, Zomato, and Prestige Estates today.

- Goldman Sachs maintains a 'sell' rating on Indus Towers and Vodafone Idea, while reiterating a 'buy' rating on Bharti Airtel with a raised target price.

- JPMorgan maintains a 'neutral' rating on Coal India, citing reasons not to buy the dip in stock prices.

- Goldman Sachs is bullish on Trent, expecting store sales ramp up and strategic growth in the business.

- Goldman Sachs also recommends buying shares of IndiGo Airlines due to strong domestic traffic and capacity expansion prospects.

- Morgan Stanley suggests an 'equal-weight' rating on SBI Cards, highlighting growth in January spend and market share.

- Nomura maintains a 'buy' rating on EPL, citing a positive stake sale to Indorama and long-term benefits for minority shareholders.

- Bernstein remains positive on Zomato, expecting continued growth and profitability in the medium term.

- Citigroup lowers the target price for Prestige Estates but maintains a 'buy' rating, anticipating delays in new launches.

- The article focuses on various stock recommendations and insights from brokerages to guide investors on the latest market trends.

ITI Share Price Target 2025, 2026 to 2030

- Indian Telephone Industries Ltd (ITI) has been listed on the stock exchange for a long time but faced declining share prices due to rising competition.

- The ITI share price targets for 2025 range between ₹499.53 and ₹515.56, with fluctuations throughout the year.

- For 2026, the ITI share price target is projected to fluctuate between ₹546.53 and ₹562.81.

- In 2027, the ITI share price is expected to range between ₹596.19 and ₹612.65, showing potential growth.

- By 2030, ITI's share price is forecasted to range between ₹761.11 and ₹777.48, with highs expected in February.

- ITI's shareholding pattern includes promoters at 90.28 percent, retail and others at 9.60 percent, foreign institutions at 0.10 percent, and mutual funds at 0.2 percent.

- The company's competitors include Shyam Telecom, Indus Towers, GTL Infra, Kavveri Telecom, and NELCO in the communications sector.

- ITI has faced recent share price declines but continues to perform well in its core business, with revenue expected to grow in the future.

- The ITI share price predictions for 2025, 2026, 2028, and 2030 are highlighted, offering investors insights into potential investment decisions.

- Stock market predictions are unpredictable, and it is advisable to seek expert advice before making investment decisions.

Stock Recommendations Today: M&M, Samvardhana Motherson, Indus Towers, Afcons On Brokerages' Radar

- Analysts have recommended buying M&M, Samvardhana Motherson, Indus Towers, and Afcons Infrastructure Ltd. on Monday.

- Nomura Research initiated a 'buy' rating on Afcons Infrastructure Ltd. with a target price of Rs 561 per share.

- Bank of America forecasts a weak 2025 for the Indian market due to short-term risks from reciprocal tariffs.

- Morgan Stanley sees positive implications for the steel industry from discussions on imposing anti-dumping and safeguard duties.

- Mahindra & Mahindra reported significant bookings for battery electric vehicles and is expected to show strong growth in 2025.

- BofA anticipates single-digit returns for the Nifty in 2025 with high volatility and various risks.

- Jefferies maintained a 'buy' rating on Amber Enterprises and IIFL Finance, with expectations for growth in their respective sectors.

- Citi retained a 'buy' rating on Indus Towers, projecting positive growth and strong free cash flow generation.

- Nomura provided insights on India-US trade dynamics and expectations for energy imports and trade balance.

- HSBC upgraded SBI Cards to 'buy' and Gujarat Pipavav to 'hold', citing positive trends in credit card issuance and container cargo performance.

.jpg?rect=0%2C0%2C870%2C457&w=1200&auto=format%2Ccompress&ogImage=true)

Stocks To Watch Today: Hero MotoCorp, Zomato, SBI, ITC, Airtel, Britannia Industries

- Hero Motocorp announced a record interim dividend of Rs 100 per share, having nominal value of Rs 2 each. Zomato approved a name change to Eternal Ltd and the stock ticker will change from ZOMATO to ETERNAL.

- SBI saw its net profit for the October-December quarter rise 84% year-on-year to Rs 16,891 crore. ITC declared an interim dividend of Rs 6.5 per equity share and the firm’s standalone net profit posted a marginal rise of 1.18% for Dec quarter.

- Bharti Airtel will transfer around 12,700 towers for up to Rs 2,174.6 crore, to Indus Towers. Consolidated net profit of the company surged over fourfold in the third quarter of the current financial year. Bharti Hexacom will sell around 3,400 towers for up to Rs 1,134.1 crore to Indus Towers.

- Indus Towers' board approved the acquisition of telecom towers from Bharti Airtel and Bharti Hexacom through slump sale for an aggregate of Rs 3,309 crore. Bajaj Allianz's subsidiary, Bajaj Allianz General Insurance Co reported a general insurance premium of Rs 1,331 crore for the month. Vedanta to consider issuance of non-convertible debentures on private placement basis on Feb 11.

- Britannia Industries posted a consolidated net profit of Rs 582 crore in the quarter ending Dec 31, 2024 recording a growth of 4.6% for the current financial year. Some of the other stocks to watch are Bharti Hexacom, Indus Towers, Bajaj Finserv and Vedanta.

Bharti Airtel, Hexacom To Sell 16,100 Telecom Towers To Indus Towers For Rs 3,309 Crore

- Bharti Airtel and Bharti Hexacom will sell 16,100 telecom towers to Indus Towers.

- Bharti Airtel to transfer around 12,700 towers for up to Rs 2,174.6 crore.

- Bharti Hexacom to sell approximately 3,400 towers for up to Rs 1,134.1 crore.

- The transaction is expected to be completed by March 31, 2025, subject to necessary approvals.

Airtel Q3FY25 net profit jumps 5-fold at ₹16,134.6 crore led by tariff hikes, consolidation of Indus Tower business

- Airtel's Q3FY25 net profit jumps 5-fold at ₹16,134.6 crore led by tariff hikes, consolidation of Indus Tower business.

- The exceptional gain from the consolidation of Indus Towers into Airtel played a major role in the significant boost in net profit.

- Airtel's average revenue per user (ARPU) rose 17.8% y-o-y to ₹245, the highest in the industry, surpassing Jio and Vodafone Idea.

- Airtel is focusing on acquiring quality customers, portfolio premiumisation, and expanding its fixed wireless access (FWA) business.

Indus towers share price target from 2025-2030

- Indus Towers ltd has been setting specific price targets as a part of its expansion plan in the future.

- The share prices have been increasing, and the company has been earning substantial profits to establish its strong market dominance.

- The Indus Towers Share Price Target 2025 ranges from INR 644.02 to INR 740.32.

- Indus Towers Share Price Target 2026 is expected to be between INR 739.02 (June) to INR 883.41 (December).

- The Indus Towers Share Price Target 2027 is expected to be between INR 847.56 (June) to INR 1,011.28 (December).

- Indus Towers Share Price Target 2028 is expected to range from INR 969.37 (June) to INR 1,157.55 (December).

- The Indus Towers Share Price Target for 2029 ranges from INR 1,109.20 (June) to INR 1,323.05 (December).

- Indus Towers Share Price Target 2030 is expected to range from INR 1,268.50 (June) to INR 1,515.82 (December).

- The shareholding pattern for Indus Towers is led by promoters, with 53.01% of shareholding.

- The stock market predictions are constantly changing and are often unpredictable, so it is always better to seek expert advice before investing.

Indus Towers acquires 26% stake in Amplus Tungabhadra for ₹27 crore

- Indus Towers has acquired a 26% stake in Amplus Tungabhadra.

- The acquisition enables Indus Towers to consume 50 MW of renewable energy from a solar PV power plant set up by Amplus Tungabhadra.

- This move supports Indus Towers' renewable energy objectives and net zero goals.

- The companies may establish a special purpose vehicle (SPV) for operating a captive power plant.

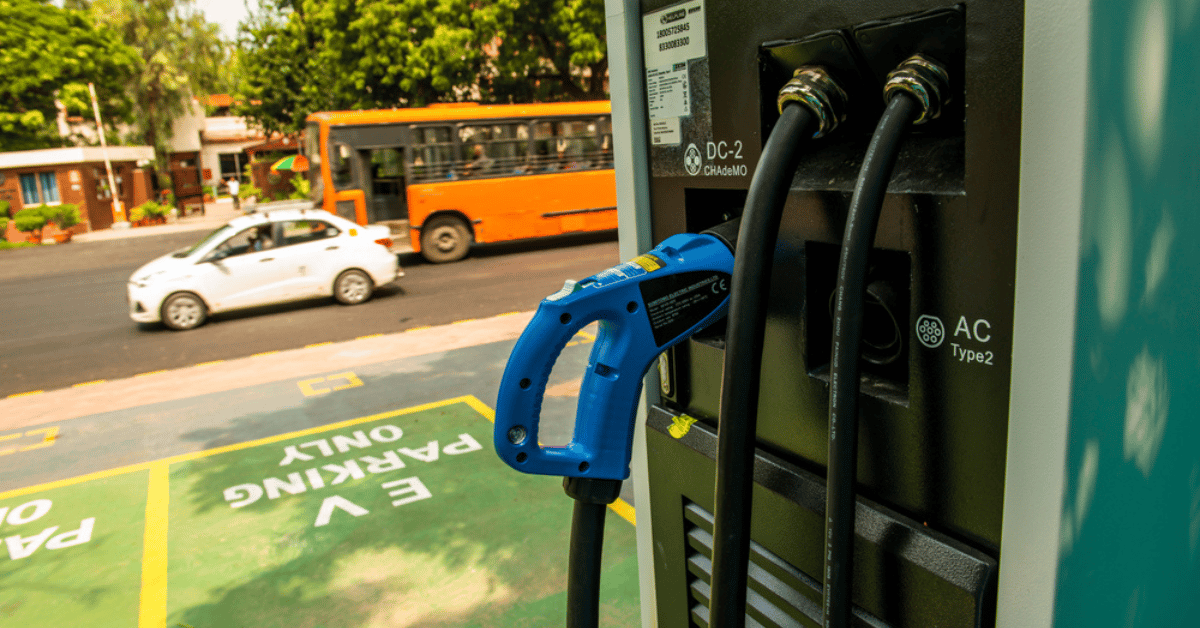

Indus Towers Sees Strong Cash Flow; Bullish On Its EV Foray

- India's largest mobile tower construction company, Indus Towers Ltd., has reported strong cash flow and is bullish on its foray into the EV charging sector.

- The company stated that its cash flow situation has significantly improved and it is conscious of the fact that it has not paid dividends for the past two years.

- Indus has launched pilot EV charging stations in Gurugram and Bengaluru and is aiming for mid- to high-double-digit returns from its EV business.

- In Q3 of FY25, Indus Towers recorded a net profit of Rs 4,003 crore, more than double compared to the same quarter previous fiscal, beating analysts' estimates.

Indus Towers Gets Board Nod to Enter EV Charging Space

- Indus Towers, one of India's largest telecom infrastructure companies, has received approval from its board of directors to enter the EV charging space.

- The company aims to align with the government's emphasis on electric vehicle adoption and infrastructure augmentation.

- Indus Towers has launched pilot EV charging stations in Gurugram and Bengaluru.

- With its extensive experience in managing telecom towers, the company is well positioned to contribute to the EV charging infrastructure sector.

Compare Indus Towers with

Contribute & help others!

Companies Similar to Indus Towers

Indus Towers FAQs

Reviews

Interviews

Salaries

Users/Month