Add office photos

Employer?

Claim Account for FREE

Tiger Global

-

No reviews yet

About Tiger Global

Founded in2001 (24 yrs old)

India Employee Count--

Global Employee Count51-200

HeadquartersNew York, New York, United States (USA)

Office Locations

--

Websitetigerglobal.com

Primary Industry

Other Industries

--

Are you managing Tiger Global's employer brand? To edit company information,

claim this page for free

Tiger Global Management, LLC is an investment firm that focuses on private and public companies in the global Internet, software, consumer, and payments industries. Our objective is to generate superior risk-adjusted returns for our investors over the long term. We have two strategies that each manage roughly the same amount of capital. The Firm’s private equity strategy was launched in 2003. This strategy has a ten-year investment horizon and targets growth-oriented private companies from early to late stages, with an emphasis on businesses based in the U.S., China and India. The Firm’s public equity business, founded in 2001, conducts deep fundamental research on our focus industries and geographies and seeks to make long-term investments in the companies we believe are best positioned to offer the highest returns. Both of our strategies have generated meaningful risk-adjusted returns since inception. Tiger Global has a relatively small investment team and seeks to hire the most talented people we can find across every function of the Firm. We pride ourselves on the quality of the work we complete and our ability to continue learning and improving. As a Firm, we value long-term thinking, intellectual honesty, continuous improvement, all-in commitment, teamwork, and self-awareness. In everything we do, we strive to be world class and to conduct ourselves with the highest integrity. Tiger Global is based in New York with affiliate offices in Hong Kong, Beijing, Singapore and Bangalore.

Managing your company's employer brand?

Claim this Company Page for FREE

Compare Tiger Global with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | - based on 0 reviews | 3.8/5 based on 532 reviews | 3.8/5 based on 458 reviews | 4.0/5 based on 345 reviews |

Highly Rated for | - | Job security Work-life balance Company culture | Company culture | Skill development Work-life balance Salary |

Critically Rated for | - | Promotions | Promotions Salary | No critically rated category |

Primary Work Policy | - | Hybrid 90% employees reported | Hybrid 80% employees reported | Work from office 88% employees reported |

Rating by Women Employees | - no rating available | 3.7 Good rated by 156 women | 3.6 Good rated by 165 women | 3.0 Average rated by 29 women |

Rating by Men Employees | - no rating available | 3.8 Good rated by 350 men | 3.9 Good rated by 261 men | 4.0 Good rated by 304 men |

Job security | - Data not available | 3.9 Good | 3.7 Good | 3.7 Good |

View more

Tiger Global Salaries

Senior Engineer

(1 salaries)

Unlock

₹5.1 L/yr - ₹6.6 L/yr

Associate

(1 salaries)

Unlock

₹12.6 L/yr - ₹16.1 L/yr

Security Guard

(1 salaries)

Unlock

₹0.2 L/yr - ₹0.2 L/yr

TIG Welder

(1 salaries)

Unlock

₹9 L/yr - ₹11.5 L/yr

Tiger Global News

View all

Hinge Health just filed to go public. It could be the healthtech IPO the market has been waiting for.

- Healthtech company Hinge Health has filed for an IPO, potentially the first healthcare delivery startup to do so in three years.

- Hinge Health aims to trade on the NYSE under the ticker 'HNGE', with a strong focus on virtual care for joint and muscle pain.

- The startup reported $390 million in revenue in 2024, showing impressive growth and strong gross margins.

- While not yet profitable by all metrics, Hinge Health is moving towards profitability, cutting its net losses significantly.

- Hinge Health's IPO price will be compared to its $6.2 billion valuation from its Series E funding round in 2021.

- The company has raised over $1 billion from investors including Tiger Global, Coatue, and Insight Partners.

- Hinge Health focuses on selling to self-insured employers and expanding its client base through virtual care tools and AI technology.

- With plans to expand globally and increase member engagement, Hinge Health aims to attract more contracts with Medicare Advantage plans and employers.

- The startup's IPO success could pave the way for other healthcare startups like Omada Health and Sword Health to consider going public.

- Hinge Health's IPO comes at a time of market volatility, but its strong financials and growth make it a promising candidate in the healthtech sector.

Insider | 11 Mar, 2025

Industrial analytics startup Infinite Uptime raises $35 million from Avataar Ventures, others

- Infinite Uptime, a startup aiding manufacturers in minimizing maintenance downtime, secured a $35 million funding round led by Avataar Ventures.

- The round included support from StepStone Group, LGVP, Tiger Global, and GSR Ventures.

- Founder Raunak Bhinge disclosed plans to expand the startup's presence in the US, taking advantage of potential market opportunities in heavy industries.

- The investment will primarily fuel the expansion and adoption of predictive maintenance solutions in the US market.

- Infinite Uptime's AI-based offerings aim to elevate plant efficiency and decrease downtime for US manufacturers.

- Competitors of Infinite Uptime include UptimeAI and Avathon, players in the predictive maintenance solutions landscape.

- Infinite Uptime deploys a subscription model where customers pay for maintenance recommendations rather than hardware.

- The startup's track record showcases substantial downtime reductions and efficiency improvements for its clients.

- Avataar Ventures' principal, Shobhit Gupta, highlights the common expansion trajectory of companies serving heavy industries.

- Infinite Uptime has witnessed rapid revenue growth and plans to sustain its doubling trend in the coming years.

Economic Times | 11 Mar, 2025

Amsterdam unicorn Mews raises €70.6M from Tiger Global, Goldman Sachs, others

- Amsterdam-based Mews, a hospitality technology company, has raised €70.6M in funding led by Tiger Global.

- Other investors, including Goldman Sachs and Battery Ventures, also participated in the funding round.

- Mews plans to use the funds to expand in the U.S. and DACH regions, drive strategic acquisitions, and accelerate platform innovation.

- Mews has experienced significant growth, with over 50% YoY growth, processing $10B in payments and generating $200M in revenue.

SiliconCanals | 5 Mar, 2025

Mews Takes in $75 Million to Boost Hospitality Management Platform

- Hospitality management platform Mews has raised $75 million in a funding round led by Tiger Global.

- The investment will fuel Mews' geographic expansion and enhance its use of AI-powered revenue management capabilities.

- Mews experienced over 50% growth in 2024, processing $10 billion in payment volume and generating $200 million in revenue.

- As travel businesses increasingly rely on AI, Mews aims to integrate AI in a way that enhances human interaction rather than replacing it entirely.

Pymnts | 5 Mar, 2025

Top 10 Investors Driving EV Dreams Into Reality For Startups

- As India becomes the third largest automobile market, the EV ecosystem accelerates with supportive policies and investments from key players in the industry.

- The country's EV market is projected to grow significantly, leading to an estimated 5 Cr job opportunities by 2030.

- Investors have poured over $3.7 Bn into EV startups, with a notable rise in unicorns and soonicorns in the sector.

- However, private funding in 2024 slowed down due to regulatory scrutiny and profitability concerns.

- Despite challenges, top investors continue to show confidence in the EV startup space, with an estimated market value of $110.74 Bn by 2029.

- Key investors driving EV dreams include Blume Ventures, Micelio Mobility, Venture Catalysts, Anicut Capital, and 3one4 Capital.

- These investors have actively supported EV startups with investments and initiatives to propel the industry forward.

- Other notable investors include AdvantEdge Founders, Green Frontier Capital, growX Ventures, Speciale Invest, and Tiger Global.

- These investors have made significant contributions to the growth of EV startups, aiming to make sustainable mobility a reality in India.

- The investments and support from these top players showcase a promising future for the EV industry in India.

Inc42 | 28 Feb, 2025

B2B sourcing startup Geniemode raises $50 million in round led by Multiples

- Geniemode, a B2B sourcing startup, raised $50 million in a Series C funding round led by Multiples Alternate Asset Management.

- The round included participation from Fundamentum, Paramark Ventures, and existing investor Info Edge Ventures.

- The funding will be used for expanding into new geographies and enhancing technology-driven supply chain solutions.

- Geniemode previously raised $28 million in a Series B round led by Tiger Global, bringing the total funds to $87 million.

- Founded in May 2021, Geniemode helps global buyers source products from India and South Asian markets.

- The platform offers end-to-end solutions, including product discovery, design collaboration, quality control, and logistics management.

- Geniemode predominantly serves retailers, wholesalers, and brands in the US, UK, and Europe, connecting them with manufacturers in India, Bangladesh, and China.

- The company collaborates with over 100 suppliers and 50 global brands, such as DKNY, Tommy Hilfiger, and Calvin Klein.

- About 60% of Geniemode's business comes from the US and UK, with Europe contributing 35%.

- Geniemode aims to achieve a gross merchandise value (GMV) of over $140 million by the end of the current financial year.

Economic Times | 24 Feb, 2025

Captain Fresh raises Rs 250 crore in a pre-IPO funding round

- Bengaluru-based meat and seafood supplier, Captain Fresh has raised Rs 250 crore ($33 million) in a pre-IPO funding round.

- Investors who participated in the round include Accel, Tiger Global Management, Prosus Ventures, co-founder of Swiggy Sriharsha Majety, and India Equity Partners’ chairman Sid Khanna amongst others.

- Captain Fresh plans to hit the stock markets in the next financial year, joining startups likebluestone, Lenskart, Boat, PhysicsWallah, Zetwerk, and Ather Energy who are preparing for an IPO.

- The seafood start-up uses a business-to-business model to supply meat and seafood to sellers across India and international markets. Over 98% of the company's demand comes from international markets, which has helped it report profitability over the past two consecutive quarters.

- The fresh funding takes its valuation to around $526m, after raising $100m at this valuation from Motilal Oswal Wealth in December 2021.

- The funding will enable the company to exceed $1bn in revenue in the next 12 months. Founder and Group CEO of Captain Fresh, Utham Gowda, said the fresh capital will strengthen the balance sheet and serve as a strong foundation for the upcoming IPO.

- According to the firm, Captain Fresh is on track to close FY25 with $550m in revenue, after reporting an operating revenue of Rs 1,395 crore ($186m), up 71% YoY.

- Before this, the company had raised $48m in February 2021 in a funding round led by SBI Investment and Evolvence Capital.

- Captain Fresh, which was founded in 2020 has been supplying seafood to international markets including the Middle East, Europe, and the US.

- The company had reported an operating revenue of RS 817 crores ($109m) in FY23, growing to Rs 1,395 crore ($186m) in FY24.

Economic Times | 19 Feb, 2025

ICON, a pioneer in 3D home printing, raises $56M led by Norwest, Tiger Global

- Austin-based 3D home printing pioneer ICON has raised $56 million in a Series C funding round.

- The funding round was co-led by Norwest Venture Partners and Tiger Global.

- The new capital infusion brings ICON's total raised to over $500 million.

- ICON plans to use the funding to develop its line of multi-story 3D printers and low-carbon building material.

TechCrunch | 14 Feb, 2025

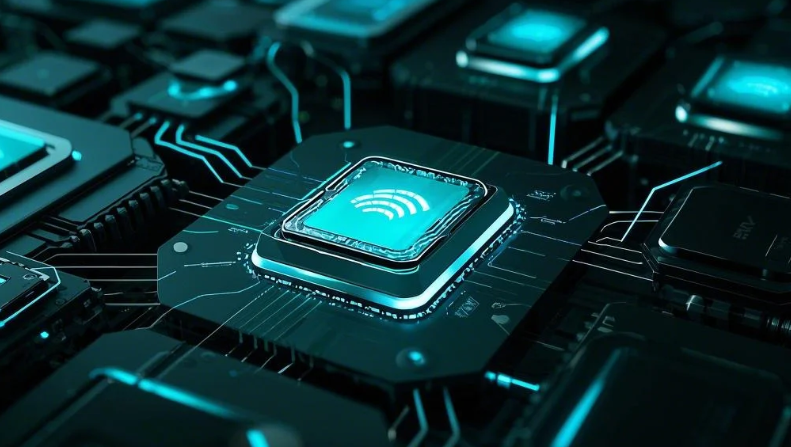

EnCharge raises $100M+ to accelerate AI using analog chips

- EnCharge AI has raised over $100 million in a Series B round led by Tiger Global to drive growth in developing analog memory chips for AI applications.

- The startup focuses on embedding analog memory chips in devices like laptops, desktops, handsets, and wearables to accelerate AI processing and reduce costs.

- Claiming that their AI accelerators consume 20 times less energy than other chips, EnCharge aims to launch its first chips later this year.

- The funding comes amidst U.S. government interest in boosting domestic innovation in hardware and infrastructure, with EnCharge potentially playing a key role.

- Investors in the Series B round include Tiger Global, Maverick Silicon, Samsung Ventures, and other strategic and financial partners.

- EnCharge collaborates with TSMC for manufacturing its chips and focuses on noise-resilient analog chip design for efficient AI processing.

- The company, co-founded by experts from Macom and IBM, aims to differentiate itself in the competitive market with its analog chip technology.

- EnCharge's approach to analog chips for AI inference at the edge sets it apart from traditional designs, with ongoing research to expand use cases.

- The startup has developed full-stack hardware and software solutions, aligning with its strategy to drive innovation in AI computing.

- EnCharge's journey from research at Princeton to the current commercialization phase showcases a deliberate approach to de-risking technology innovations.

TechCrunch | 13 Feb, 2025

EnCharge raises $100M to accelerate the rollout of its energy-efficient edge AI chips

- EnCharge AI Inc. has raised over $100 million in a Series B funding round to accelerate the commercialization of its energy-efficient edge AI chips.

- The company's AI accelerators are set to launch later this year, aiming to reduce energy consumption and improve performance for AI workloads.

- Investors in this round include Tiger Global, Maverick Silicon, Capital TEN, SIP Global Partners, and others, bringing the total funding to over $144 million.

- EnCharge aims to shift AI inference computation from energy-intensive cloud data centers to local devices for better efficiency and security.

- The startup's AI chips use charge-based memory, offering significant energy savings compared to traditional GPUs.

- EnCharge's chips consume 20 times less energy than typical GPUs and come with software tools for optimization and compatibility with various devices.

- These energy-efficient chips have gained attention from industries like defense and aerospace for their transformative potential in AI deployment under power constraints.

- EnCharge's roadmap includes transitioning to advanced technology nodes to offer a range of analog in-memory chips for different AI workloads.

- The company's innovative approach to AI runtime architectures has potential, although the performance of existing models on its silicon remains a key consideration.

- EnCharge's focus on energy efficiency and performance improvements in AI chips has garnered interest from diverse industries seeking more sustainable and powerful AI solutions.

Siliconangle | 13 Feb, 2025

Powered by

Compare Tiger Global with

Adarsh Credit Co-Operative Society

4.0

Debtcare Enterprises

4.3

MNC Group

4.3

Swastika Investmart

4.1

Belstar Investment and Finance

4.2

Cholamandalam Securities

3.6

Globe Capital Market

3.6

Silicon Valley Bank

4.2

Verity Knowledge Solutions

2.8

Link Intime

3.4

A K Capital Services

3.4

Trustline Securities

4.3

STP Investment Services

3.6

Asset Reconstruction Company (India)

3.7

Dezire Research

4.4

Faircent.com

3.2

Almajal Alarabi Holding

3.2

Goodwill Commodities

3.4

Wise Finserv

3.0

Asit C Mehta Investment Interrmediates

2.9

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to Tiger Global

Nomura Holdings

Financial Services, Investment Banking / Venture Capital / Private Equity

3.8

• 532 reviews

Blackrock

Consulting, Financial Services, Investment Banking / Venture Capital / Private Equity, IT Services & Consulting

3.8

• 458 reviews

Muthoot Homefin India

Investment Banking / Venture Capital / Private Equity

4.0

• 345 reviews

Adarsh Credit Co-Operative Society

Investment Banking / Venture Capital / Private Equity

4.0

• 340 reviews

Debtcare Enterprises

Financial Services, FinTech, Investment Banking / Venture Capital / Private Equity, NBFC

4.3

• 318 reviews

MNC Group

Investment Banking / Venture Capital / Private Equity

4.3

• 294 reviews

Swastika Investmart

Financial Services, Investment Banking / Venture Capital / Private Equity

4.1

• 283 reviews

Belstar Investment and Finance

Financial Services, Investment Banking / Venture Capital / Private Equity

4.2

• 225 reviews

Cholamandalam Securities

Investment Banking / Venture Capital / Private Equity

3.6

• 151 reviews

Globe Capital Market

Internet, Investment Banking / Venture Capital / Private Equity

3.6

• 146 reviews

Silicon Valley Bank

Financial Services, Investment Banking / Venture Capital / Private Equity

4.2

• 143 reviews

Verity Knowledge Solutions

Advertising / PR / Events, Investment Banking / Venture Capital / Private Equity

2.8

• 126 reviews

Tiger Global FAQs

When was Tiger Global founded?

Tiger Global was founded in 2001. The company has been operating for 24 years primarily in the Investment Banking / Venture Capital / Private Equity sector.

Where is the Tiger Global headquarters located?

Tiger Global is headquartered in New York, New York.

Stay ahead in your career. Get AmbitionBox app

Helping over 1 Crore job seekers every month in choosing their right fit company

75 Lakh+

Reviews

5 Lakh+

Interviews

4 Crore+

Salaries

1 Cr+

Users/Month

Contribute to help millions

Get AmbitionBox app