HRA Calculator (House Rent Allowance)

HRA is a fully/partially tax free allowance given to employees to help cover their house rent.

Amount

Amount

Amount

Amount

Quick facts about HRA

- The maximum exemption limit is 50% of the basic salary if residing in a Metro city and 40% if residing in a Non metro city.

- To claim HRA exemption, rent receipts, rental agreements, and proof of payment are required.

- Exemption will be limited to the amount of HRA received. Rent paid beyond HRA does not impact the exemption.

What is HRA?

House rent allowance (HRA) is a component of the salary paid to employees to cover their rental expenses. It is partially exempt from income tax under Section 10(13A) of the Income Tax Act. Many employees are unaware that HRA can also offer tax savings. The HRA amount is determined by factors such as your salary structure, actual earnings, and the city in which you reside. If you are a salaried employee living in rented accommodation, you can use our HRA calculator to determine your tax liability.

Part of your CTC

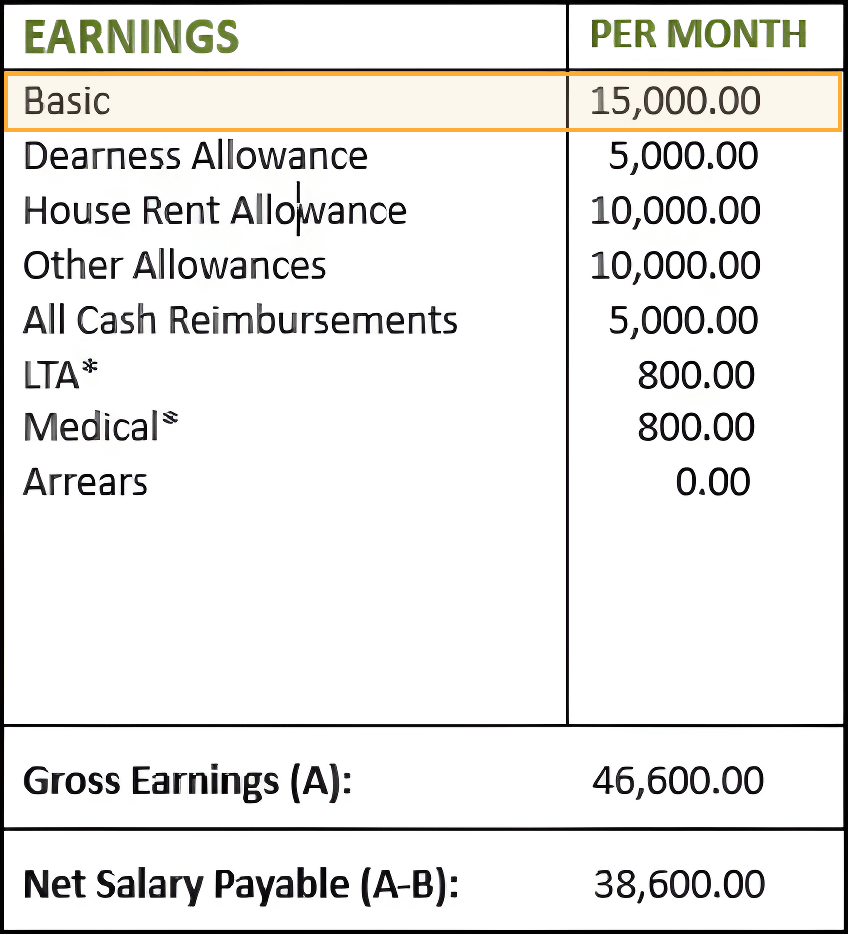

Part of your CTCWhat is basic salary?

It is the fixed amount paid to an employee before adding allowances, bonuses, and other benefits. Basic salary is usually calculated based on the employee’s role, experience, and industry standards. It is also the basis for calculating various other benefits and deductions such as Provident Fund (PF), Gratuity, and Income Tax.

Part of your CTC

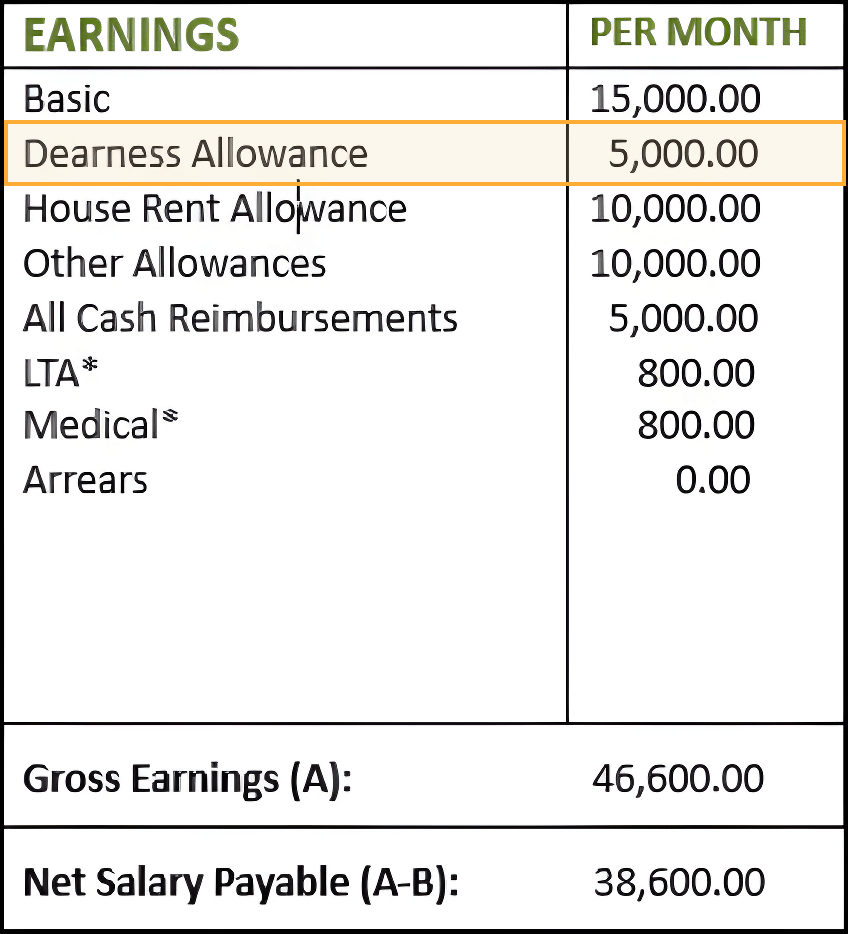

Part of your CTCWhat is dearness allowance (DA)?

This is an allowance provided to employees to help them cope with inflation and the rising cost of living. It is typically a percentage of the basic salary and is revised periodically based on changes in the Consumer Price Index (CPI) or other economic indicators. DA is particularly common in public sector jobs.

Part of your salary slip

Part of your salary slipHow is HRA Calculated?

The formula for calculating HRA exemption is: HRA = Minimum of (HRA received, rent paid−10% of salary, 40% of salary (for those living in non-metro cities))

- HRA Received: The amount of HRA provided by the employer.

- Rent paid: The actual rent paid by the employee.

- 10% of salary: The amount of salary deducted as a standard deduction for housing expenses.

- 40% of salary: For employees living in non-metro cities, 40% of the basic salary is considered (50% if living in metro cities like Delhi, Mumbai, Kolkata, and Chennai).

- Basic salary: ₹50,000

- HRA received: ₹15,000 (A)

- Rent paid: ₹20,000

- City: Mumbai (metro city)

- Calculate 10% of salary: 10% of ₹50,000 = ₹5,000

- Calculate the excess rent paid: ₹20,000 − ₹5,000 = ₹15,000 (B )

- Calculate 50% of salary (since Mumbai is a metro city): 50% of ₹50,000 = ₹25,000 (C)

- Determine the exempt HRA: Minimum of (A,B,C) i.e. Minimum of (₹15,000, ₹15,000, ₹25,000) = ₹15,000

In this example, the exempt HRA amount is ₹15,000.

How much of my HRA is exempt from tax?

Not all of the house rent allowance (HRA) you receive is necessarily tax-exempt. To determine the exempt portion of your HRA, you need to consider the least of the following three amounts:

- The HRA received from your employer.

- The actual rent paid minus 10% of your basic salary.

- 50% of your basic salary if you live in a metro city (like Delhi, Mumbai, Kolkata, or Chennai), or 40% of your basic salary if you live in a non-metro city.

The portion of your HRA that exceeds this exempt amount will be added to your taxable income. Our calculator can help you quickly determine the exempt portion of your HRA.

What is the maximum HRA exemption limit?

The maximum exemption limit is 50% of the basic salary if residing in a metro city and 40% if residing in a non-metro city, subject to other conditions.

What documents are required for HRA exemption?

Rent receipts, rental agreements, and proof of payment are typically required for claiming HRA exemption.

Can I Use the calculator for any city?

Yes, the calculator adjusts the exemption based on whether the city is classified as a metro or non-metro.

What if my rent is higher than the HRA received?

The exemption will be limited to the amount of HRA received. Rent paid beyond HRA does not impact the exemption.

Is HRA exemption available for self-occupied property?

No, HRA exemption is not available for self-occupied property. It applies only to rented accommodations.

Reviews

Interviews

Salaries

Users