Gratuity Calculator

Gratuity is a amount given to employees as a form of recognition after completing 5 years of continuous service with a company.

Amount

Amount

Years

Months

Quick facts about Gratuity

- Gratuity is tax-free up to a limit of ₹20 Lakhs for private sector employees.

- Gratuity is paid within 30 days from the date the company receives the application

- If your tenure of service is 16 years 7 months, then you receive the gratuity for 17 years. If its for 16 years 4 months then you’ll receive gratuity for 16 years

What is gratuity?

Gratuity is a payment made by a company to an employee in recognition of their services to the company. According to the Payment of Gratuity Act, 1972, this benefit is generally provided to employees who have completed at least five years of service with the company.

However, there are few exceptions to the Five-Year Rule where an employee may get gratuity before completing five years:

- Termination due to death or disablement: Employees are eligible regardless of service length under these circumstances.

- The 4 Years 240 Days Rule: Employees can qualify with just four years and seven months of service under certain conditions.

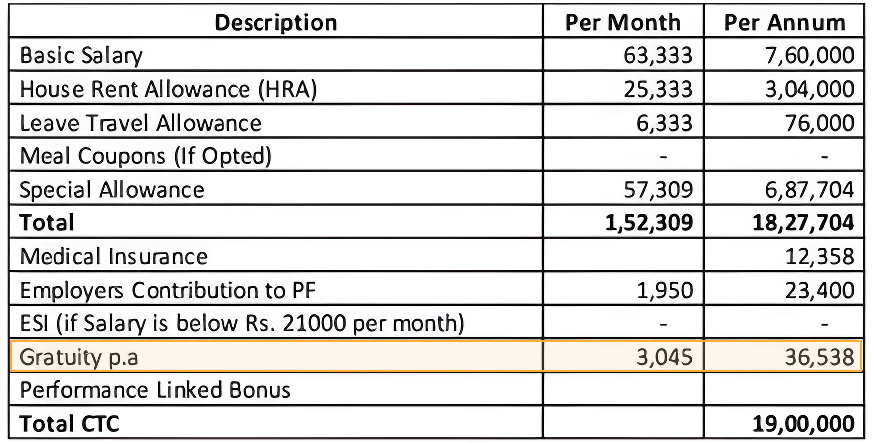

Component in your CTC

Component in your CTCWhat is basic salary?

It is the fixed amount paid to an employee before adding allowances, bonuses, and other benefits. Basic salary is usually calculated based on the employee’s role, experience, and industry standards. It is also the basis for calculating various other benefits and deductions such as Provident Fund (PF), Gratuity, and Income Tax.

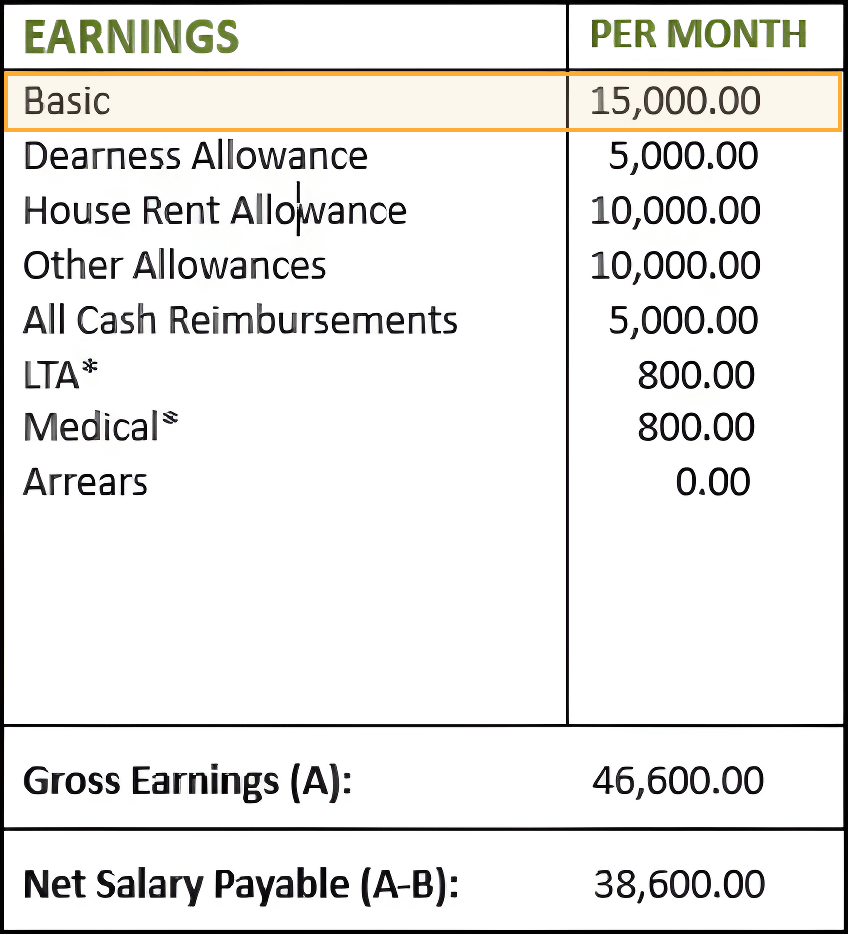

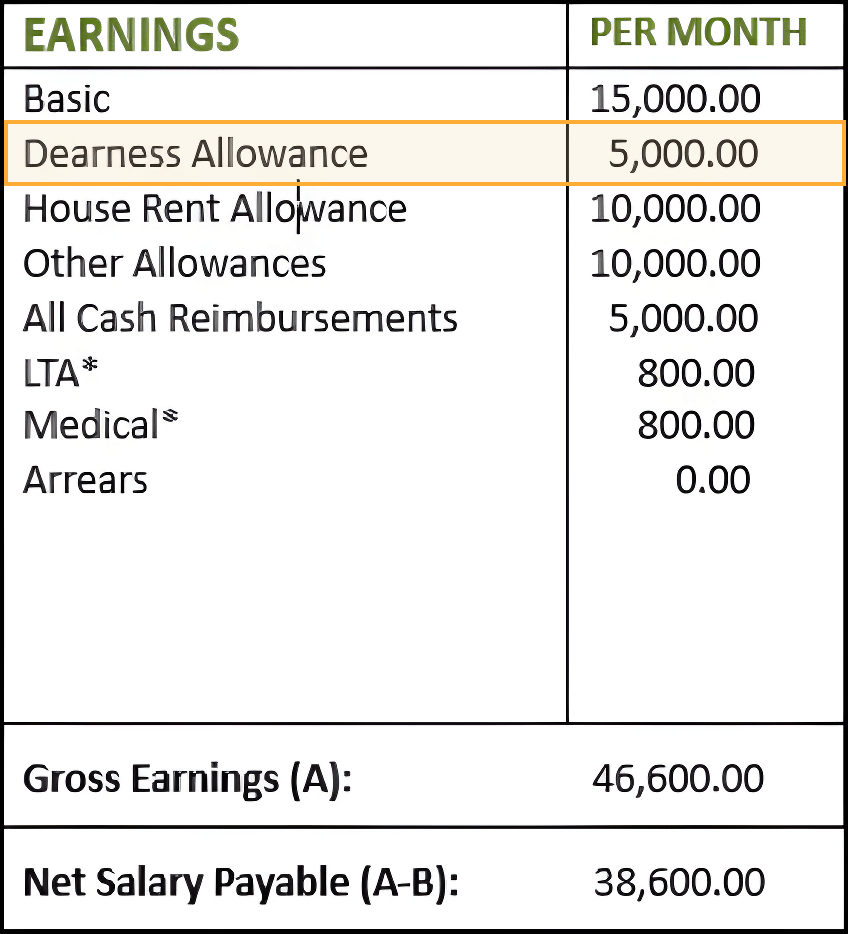

Part of your salary slip

Part of your salary slipWhat is dearness allowance (DA)?

This is an allowance provided to employees to help them cope with inflation and the rising cost of living. It is typically a percentage of the basic salary and is revised periodically based on changes in the Consumer Price Index (CPI) or other economic indicators. DA is particularly common in public sector jobs.

Part of your salary slip

Part of your salary slipHow is gratuity calculated?

The amount of gratuity for employees whose company is covered under the Gratuity Act can be calculated using the formula:

Gratuity = n x b x 15 / 26n = Tenure of service completed in the company

b = Last drawn basic salary + dearness allowance For example, you have worked with the ABC company for a period of 10 years. Your last drawn basic salary along with dearness allowance was Rs 35,000. Hence:The amount of gratuity = 10 x 35,000 x 15 / 26 = Rs 2,01,923

- As per the Gratuity Act, the amount of gratuity cannot be more than Rs 20 lakh.

- If the number of years you have worked in the last year of employment is more than six months, then it will be rounded to the nearest figure. Suppose your tenure of service is 16 years 7 months, then you receive the gratuity for 17 years. Otherwise, its for 16 years if it happens to be 16 years 4 months.

- For employees whose company is not covered under the Gratuity Act, the gratuity amount would be calculated as per the formula:

Gratuity = n x b x 15 / 30n = Tenure of service completed in the company

b = Last drawn basic salary + dearness allowance

For example, you have a basic salary of Rs 30,000. You have rendered continuous service of 7 years and the company is not covered under the Gratuity Act.

The amount of gratuity = 30,000 x 7 x 15 / 30 = Rs 1,05,000.

Taxation rules for gratuity

In India, gratuity is tax-free up to a certain limit under Section 10(10) of the Income Tax Act. Amount exceeding this limit is subject to tax. The taxes applicable to the gratuity amount depends on the type of employee:

- The gratuity amount received by any government employee is exempt from the income tax.

- For private-sector employees, the least of the following three amounts will be exempt from income tax provided that the company is covered under the Payment of Gratuity Act,

- The actual gratuity you received: This is the exact amount you got from your company when you left.

- The eligible gratuity: This is the amount you're entitled to based on your salary and the time you worked.

- Rs 20 lakh: This is the maximum amount you can claim as tax-free gratuity in your entire career.

Note: Your employer can willingly pay you more than your eligible gratuity amount, as a token of appreciation for your service.

- Your actual gratuity is less than the eligible gratuity and Rs 20 lakh, you'll pay no tax on the entire amount.

- The eligible gratuity is less than the actual gratuity and Rs 20 lakh, you'll pay no tax on the eligible gratuity but extra amount that you receive will be taxable.

- Rs 20 lakh is the least, you can only claim that amount as tax-free.

Is gratuity part of CTC?

CTC is the total amount spent by a corporation to hire and keep you as an employee. It covers your pay as well as all of your perks, such as EPF, HRA, medical insurance, gratuity, and other allowances.

Is gratuity cut from salary?

The Payment of Gratuity Act, 1972 governs all aspects related to gratuity. Although gratuity is part of employee’s CTC, but unlike Provident Fund, it is not deducted from salary, meaning that employees are not required to contribute to it.

Who is eligible for gratuity?

- Employees who have completed at least 5 years of continuous service with the same company & have resigned

- Employee should have retired from service

- In case of death the gratuity is paid to the nominee, or to the employee on disablement on account of a sickness or an accident.

How much time does the company take to release the gratuity amount?

An employee eligible for gratuity can submit their application within 30 days of the gratuity becoming payable. However, failing to file the application within this timeframe does not invalidate the claim.

The company is required to determine the gratuity amount within 15 days of receiving the application. The gratuity must then be paid within 30 days from the date the company receives the application. If the company fails to meet this deadline, they are obligated to pay the gratuity amount along with simple interest accrued on it.

Reviews

Interviews

Salaries

Users