Add office photos

Engaged Employer

BCG![]()

3.7

based on 434 Reviews

Video summary

Company Overview

Company Locations

Working at BCG

Company Summary

BCG is a global consulting firm that partners with leaders in business and society to tackle their most important challenges.

Overall Rating

3.7/5

based on 434 reviews

3% above

industry average

Highly rated for

Salary

Critically rated for

Promotions, Work-life balance

Work Policy

Hybrid

83% employees reported

Monday to Friday

92% employees reported

Flexible timing

75% employees reported

No travel

45% employees reported

View detailed work policy

Top Employees Benefits

Free meal

29 employees reported

Health insurance

24 employees reported

Cafeteria

21 employees reported

Job/Soft skill training

20 employees reported

View all benefits

About BCG

Founded in1963 (62 yrs old)

India Employee Count1k-5k

Global Employee Count10k-50k

HeadquartersBoston, Massachusetts, United States (USA)

Office Locations

Websitebcg.com

Primary Industry

Other Industries

View in video summary

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

Mission: "BCG is a global management consulting firm and the world's leading advisor on business strategy. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses."

Report error

BCG Ratings

based on 434 reviews

Overall Rating

3.7/5

How AmbitionBox ratings work?

5

177

4

103

3

61

2

28

1

65

Category Ratings

3.9

Salary

3.7

Skill development

3.6

Company culture

3.5

Job security

3.4

Work satisfaction

3.3

Work-life balance

3.2

Promotions

BCG is rated 3.7 out of 5 stars on AmbitionBox, based on 434 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at BCG

based on 401 reviews

3.5

Rated by 150 Women

Rated 3.7 for Salary and 3.6 for Skill development

3.8

Rated by 251 Men

Rated 3.9 for Salary and 3.8 for Skill development

Work Policy at BCG

based on 74 reviews in last 6 months

Hybrid

83%

Work from office

11%

Permanent work from home

6%

BCG Reviews

Top mentions in BCG Reviews

+ 5 more

Compare BCG with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.7/5 based on 434 reviews | 3.7/5 based on 19.8k reviews  | 3.3/5 based on 10.5k reviews | 3.4/5 based on 12.1k reviews |

Highly Rated for | Salary | Skill development Job security |  No highly rated category |  No highly rated category |

Critically Rated for | Promotions Work-life balance | Work-life balance Promotions | Promotions Work-life balance Work satisfaction | Work-life balance Promotions Work satisfaction |

Primary Work Policy | Hybrid 83% employees reported | Hybrid 83% employees reported | Hybrid 75% employees reported | Hybrid 75% employees reported |

Rating by Women Employees | 3.5 Good rated by 150 women | 3.7 Good rated by 6k women | 3.3 Average rated by 3.1k women | 3.3 Average rated by 3.8k women |

Rating by Men Employees | 3.8 Good rated by 251 men | 3.8 Good rated by 12.1k men | 3.3 Average rated by 7k men | 3.4 Average rated by 7.8k men |

Job security | 3.5 Good | 3.8 Good | 3.4 Average | 3.6 Good |

View more

BCG Salaries

BCG salaries have received with an average score of 3.9 out of 5 by 434 employees.

Senior Associate

(433 salaries)

Unlock

₹30 L/yr - ₹55 L/yr

Analyst

(176 salaries)

Unlock

₹12 L/yr - ₹20 L/yr

Project Lead

(170 salaries)

Unlock

₹65 L/yr - ₹1.2 Cr/yr

Senior Analyst

(161 salaries)

Unlock

₹17.3 L/yr - ₹28 L/yr

Senior Consultant

(135 salaries)

Unlock

₹37.3 L/yr - ₹65 L/yr

Software Engineer

(122 salaries)

Unlock

₹14 L/yr - ₹22 L/yr

Data Analyst

(107 salaries)

Unlock

₹12.5 L/yr - ₹22.2 L/yr

Management Consultant

(102 salaries)

Unlock

₹38.2 L/yr - ₹66.2 L/yr

Senior Data Analyst

(93 salaries)

Unlock

₹18.2 L/yr - ₹30 L/yr

Senior Data Engineer

(84 salaries)

Unlock

₹22.7 L/yr - ₹34.7 L/yr

BCG Interview Questions

A Consultant was asked Q. Guesstimate: Number of Ola and Uber cabs in Delhi.

A Software Engineer was asked 5mo agoQ. Tell me more about how you resolved code merge issues in Git.

An Associate Consultant was asked Q. Our client is a leading cement manufacturing firm in India looking to ...read more

An Intern was asked Q. A private bank recently received 50 branch opening licenses from the R...read more

A Data Analyst was asked 6mo agoQ. What are SQL window functions and how are they used in database querie...read more

BCG Jobs

Popular Designations BCG Hires for

Current Openings

BCG News

View all

Top Brazilian bitcoin Exchange to Tokenize $200M in Assets on XRP Ledger

- Brazil’s leading crypto exchange, Mercado Bitcoin, has started tokenizing $200 million in assets on the XRP Ledger, backed by Ripple.

- Ripple and Boston Consulting Group predict the tokenized RWA market cap could reach $19 trillion by 2033, driving increased institutional interest in asset tokenization.

- Regulatory developments and corporate actions, such as Ondo Finance's acquisition of Oasis Pro and Centrifuge's plan to tokenize the S&P 500 index, are shaping the tokenization space.

- Challenges remain, with regulatory uncertainty and concerns over shareholder rights in tokenized equities, but tokenization is seen as the future of capital markets.

Coindoo | 6 Jul, 2025

AI agents raise red flags for employees

- A Boston Consulting Group survey revealed that while employees are increasingly comfortable with AI, they express concerns about the adoption of autonomous agentic tools.

- Over 70% of respondents regularly use generative AI tools, with almost half reporting time savings of at least an hour daily. Confidence in AI adoption has grown by 19% from 2018.

- Only 13% of employees have encountered AI agents in their workflows. Key worries include lack of human oversight, unclear accountability for mistakes, and potential bias.

- Enterprises are looking to leverage agentic AI for competitive advantages, but challenges such as security gaps, integration issues, and organizational readiness remain. Major companies like Salesforce, PepsiCo, Toyota, Estée Lauder Companies, and Walmart are among early adopters of AI agent technology.

Hrdive | 30 Jun, 2025

BSNL Announces Flash Sale, Details to be Announced

- BSNL has announced a upcoming flash sale for customers with options for superfast broadband deals and massive discounts.

- The specifics of the flash sale are yet to be disclosed by BSNL, but it aims to attract customers amidst fierce competition in the Indian telecom market.

- BSNL has been making efforts to modernize its services, including rolling out 4G and progressing towards 5G, along with introducing new logo and services.

- With initiatives like roping in BCG (Boston Consulting Group) and focusing on profitability, BSNL is striving to compete and sustain in the market.

Telecomtalk | 28 Jun, 2025

Boston Consulting Group: To unlock enterprise AI value, start with the data you’ve been ignoring

- Boston Consulting Group emphasizes the importance of data quality and governance in enterprise AI projects.

- Organizations are navigating complexities related to data exposure, AI budgets, access permissions, and managing risks to unlock AI value.

- New AI solutions are leveraging previously unusable data, enabling insights that were not feasible before.

- Adopting AI-ready data is crucial for successful AI projects, as indicated by a Gartner survey highlighting the importance of AI-ready infrastructures for faster data processes.

VentureBeat | 26 Jun, 2025

XRP Ledger Adds BlackRock-Backed Treasuries In Ripple Deal

- Ondo Finance deployed its tokenized US Treasury fund, OUSG, directly on the XRP Ledger today.

- OUSG allows Qualified Purchasers to mint or redeem tokens using Ripple's stablecoin RLUSD on XRPL.

- The fund commands over $670 million in total value locked, showcasing real-world use.

- Ondo's platform typically manages $1.3 billion, marking its first non-EVM chain deployment.

- Institutional investors can create or redeem OUSG seamlessly using RLUSD on XRPL with rapid settlement.

- RLUSD's quick finality within seconds enables OUSG subscriptions around the clock without traditional limitations.

- XRPL's order book, low fees, and token-issuance capabilities streamline asset custody logic for issuers.

- Future Multi-Purpose Tokens will enhance OUSG functionalities and introduce a lending protocol on XRPL.

- Tokenized bills on XRPL offer treasury teams swift redeployment of funds for various financial activities.

- RippleX's SVP views OUSG's launch as a significant step in bringing tokenized finance to real markets with efficiency.

- Ripple and BCG project substantial tokenization of real-world assets by 2033, with Treasuries leading the trend.

- The migration of OUSG to XRPL could further boost the total tokenized-Treasury value exceeding $7 billion.

- Immediate plans include opening a secondary order book, integrating OUSG in lending markets, and expanding access.

- Ripple aims to broaden XRPL's use with additional RWAs, starting with commercial paper and municipal notes.

- XRP was trading at $2.32 at the time of reporting.

Bitcoinist | 12 Jun, 2025

India emerging as AI powerhouse with $17 billion market projected by 2027: BCG report

- India is projected to have a $17 billion AI market by 2027, according to a BCG report titled “India’s AI Leap: BCG Perspective on Emerging Challengers”.

- The report discusses Indian enterprises' shift towards creating measurable value through AI implementation, emphasizing operational efficiency, market expansion, faster decision-making, and innovation-led growth.

- Only 18% of Indians can report cybercrimes via official channels, as indicated by an NSSO survey.

- India is rapidly enhancing its supporting infrastructure with plans to add 45 new data centers by 2025, alongside a substantial investment in national AI compute capacity through the IndiaAI mission.

- The Indian startup ecosystem is thriving with over 4,500 AI startups, 40% of which were established in the last three years, focusing on innovation in areas like health-tech, agri-tech, logistics, and fintech.

- These startups are addressing unique Indian challenges with AI solutions, positioning India to influence the global economy's AI landscape.

- The report acknowledges India's public digital infrastructure and increasing enterprise investments as fostering scalable AI innovation.

- The government's focus on fortifying cybersecurity protocols for the power sector is highlighted.

- Mandeep Kohli, Managing Director and Partner at BCG India, emphasized that AI is now a business necessity for Indian companies, enabling them to compete globally by embracing change, nurturing talent, and integrating AI into their organizational structure.

- Published on June 11, 2025.

HinduBusinessLine | 11 Jun, 2025

Nuclear power is having a renaissance. Here's what consultants say about the industry's future.

- Nuclear energy is gaining popularity, however, facing growth obstacles particularly in the US construction sector.

- Consulting firms such as BCG and McKinsey have identified factors like scaling, public sentiment, and regulatory barriers as hindrances to the industry's progress.

- In the past, nuclear energy was viewed negatively due to incidents like Three Mile Island, Chernobyl, and Fukushima.

- But with new data and changing perceptions, it is now considered a clean and reliable energy source.

- US nuclear reactor construction lags behind other countries like China, prompting consulting firms to seek ways to enhance efficiency and reduce costs in the industry.

- Despite investments from tech giants like Amazon and Google in nuclear energy, public sentiment remains a challenge.

- Regulatory hurdles and concerns about nuclear waste storage also impede the sector's growth.

- Efforts to streamline construction processes and adopt modular designs are seen as essential for overcoming industry challenges.

- Modularity is a key trend, with small modular reactor companies gaining traction in the market.

- Nuclear fission is favored for its low greenhouse gas emissions, but challenges remain in scaling nuclear power economically and efficiently.

Insider | 27 May, 2025

VeChain Quietly Built the Backbone for Sustainable Capital—Here’s How

- VeChain's technology enables tracking of CO₂ emissions, supply chain security, and regulatory compliance, supporting the growth of ESG funds projected to reach $50 trillion by 2030.

- VeChain emphasizes transparency and accountability in sustainable finance by providing verifiable supply chain and emissions data to ESG managers and climate investors.

- VeChain stands out as a blockchain solution provider focused on environmental, social, and governance requirements, collaborating with firms like PwC, DNV, and Boston Consulting Group for regulatory compliance.

- VeChain's platform features real environmental impact projects like Cleanify, BetterBag, and Carbonlarity, offering tangible solutions for emissions reduction and sustainable practices, supported by public and cryptographic blockchain records.

Crypto-News-Flash | 16 May, 2025

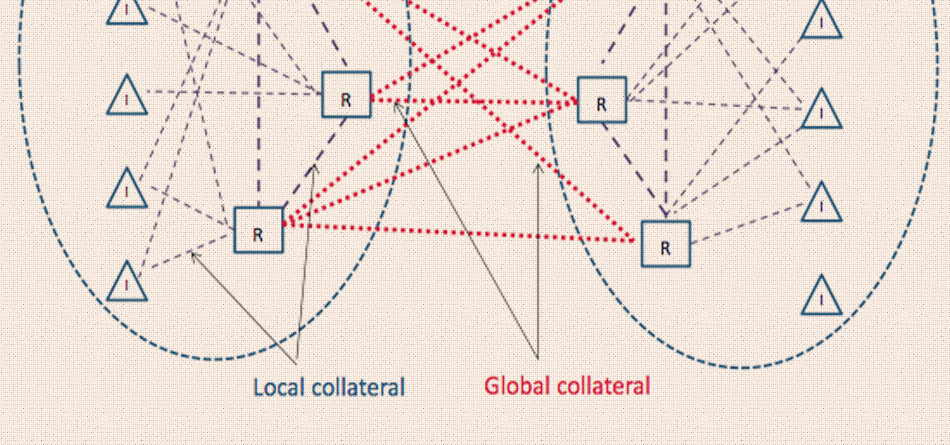

Accelerated Digital Asset Collateral is “Holy Grail”

- Depository Trust & Clearing Corporation (DTCC) has launched a unified digital collateral infrastructure for the industry, aiming to solve major challenges collaboratively.

- The platform for tokenized real-time collateral management was launched using AppChain financial infrastructure for institutional DeFi support.

- Industry challenges in collateral management include high cost due to rules and market fragmentation, impacting global repo and collateral markets.

- Report by Ripple & BCG suggests potential savings of $150-300m annually for managing $100bn in repo through enhanced collateral processes.

- DTCC's digital infrastructure combines distributed ledger tech with AI for real-time visibility, reduced settlement times, and automated reporting.

- DTCC aims to create a unified digital collateral infrastructure by collaborating with the industry and offering an open, interoperable approach.

- The Great Collateral Experiment showcased distributed ledger technology benefits in collateral management, improving efficiency and resilience.

- Blockchain enables seamless connectivity for global collateral pools and facilitates enhanced liquidity and operational efficiencies.

- Conversion orders bridge traditional finance and DeFi, allowing for real-time trading and settlement of tokenized assets across various markets.

- The industry emphasizes the importance of regulatory and legal frameworks in the adoption of tokenization and digital asset technologies.

Intelalley | 5 May, 2025

Digital real estate platform Alt DRX raises $2.7 million in new funding round

- Alt DRX, a startup focusing on 'tokenised' digital real estate, secures $2.7 million in a recent funding round with the participation of institutions like Qatar Development Bank and angel investors.

- The funds raised will be utilized for customer acquisition, technology enhancements, and corporate expenses in order to make residential real estate more accessible through blockchain technology.

- Using US-based XRPL Ripple's blockchain infrastructure, Alt DRX records custodial ledger positions securely for its KYC-whitelisted users, providing a transparent digital real estate ownership experience.

- Boston Consulting Group and Ripple estimate the RWA Tokenization market to reach $18 trillion by 2033, with Alt DRX positioned to capitalize on the growing trend as a player in the tokenized Real-World Asset marketplace.

Economic Times | 5 May, 2025

Powered by

Compare BCG with

McKinsey & Company

3.8

Bain & Company

3.9

KPMG India

3.4

ZS

3.3

Mercer

3.6

Citco

3.1

Willis Towers Watson

3.6

Guidehouse

3.7

WSP

4.2

Nexdigm

3.8

Mott MacDonald

4.1

Gartner

4.1

Protiviti

3.2

Nspira Management Services

3.7

Datamatics Business Solutions

3.4

Protiviti India Member

3.0

Huron

3.8

RSM US in India

3.4

The Smart Cube

3.5

VISTRA INTERNATIONAL EXPANSION

3.5

Contribute & help others!

You can choose to be anonymous

Companies Similar to BCG

Deloitte

IT Services & Consulting, Accounting & Auditing, Management Consulting

3.7

• 19.8k reviews

Ernst & Young

Management Consulting

3.4

• 12.1k reviews

PwC

Accounting & Auditing, Management Consulting

3.3

• 10.5k reviews

KPMG India

IT Services & Consulting, Accounting & Auditing, Management Consulting

3.4

• 6.2k reviews

Citco

Management Consulting

3.1

• 1.1k reviews

Willis Towers Watson

Consulting, Management Consulting

3.6

• 1k reviews

Guidehouse

Consulting, Management Consulting

3.7

• 767 reviews

WSP

Architecture & Interior Design, Management Consulting

4.2

• 727 reviews

Nexdigm

Consulting, Financial Services, BPO, Management Consulting

3.8

• 719 reviews

Mott MacDonald

Consulting, Management Consulting

4.1

• 666 reviews

BCG FAQs

When was BCG founded?

BCG was founded in 1963. The company has been operating for 62 years primarily in the Management Consulting sector.

Where is the BCG headquarters located?

BCG is headquartered in Boston, Massachusetts. It operates in 3 cities such as Gurgaon / Gurugram, Mumbai, Chennai. To explore all the office locations, visit BCG locations.

How many employees does BCG have in India?

BCG currently has approximately 3,700+ employees in India.

Does BCG have good work-life balance?

BCG has a work-life balance rating of 3.3 out of 5 based on 400+ employee reviews on AmbitionBox. 35% employees rated BCG 3 or below, while 65% employees rated it 4 or above for work-life balance. This rating suggests that while some employees recognize efforts towards work-life balance, there is scope for improvement based on employee feedback. We encourage you to read BCG work-life balance reviews for more details.

Is BCG good for career growth?

Career growth at BCG is rated as moderate, with a promotions and appraisal rating of 3.2. 35% employees rated BCG 3 or below, while 65% employees rated it 4 or above on promotions / appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading BCG promotions / appraisals reviews for more detailed insights.

What are the pros and cons of working in BCG?

Working at BCG comes with several advantages and disadvantages. It is highly rated for salary & benefits. However, it is poorly rated for promotions / appraisal, work life balance and work satisfaction, based on 400+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

80 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app